As part of our ongoing coverage of the pandemic’s impact on the U.S. economy, we ran an earlier post on the MORTGAGE FORBEARANCE aspects of the 2020 CARES Act.

Today, we begin a four-part series on the state of forbearance as we begin to emerge from the pandemic; we will address how the forbearance program works and the benefits of the program, with a focus on whether race and income affected participation in and benefits from forbearance.

FORBEARANCE: WHO QUALIFIES AND HOW DOES IT WORK?

As a refresher, forbearance affords borrowers the option to pause mortgage payments in the face of economic hardship, without putting the loan into delinquency.

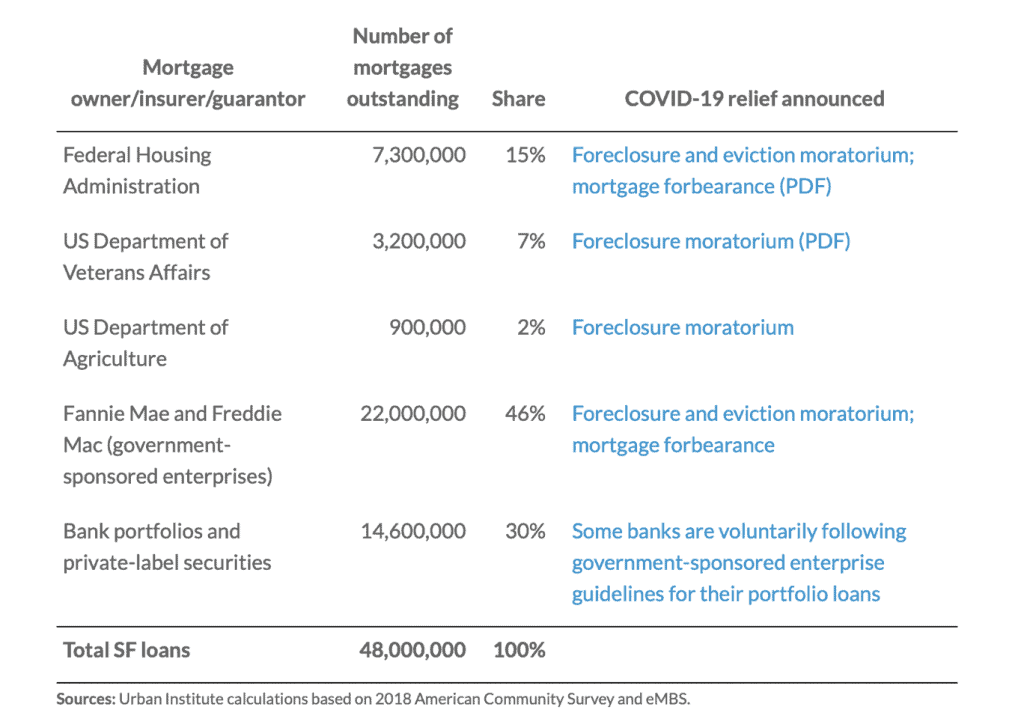

The CARES Act gave borrowers with federally-backed mortgages the ability to request up to 12 months of forbearance if they were financially impacted by the pandemic. As you can see below, 70 percent of all mortgages are backed by the federal government:

These groups ultimately extended the forbearance program to 18 months.

With forbearance, homeowners don’t have to pay back missed payments all at once. They can spread repayments over time, tack them on to the end of the loan or make a lump-sum payment at the end of the mortgage.

WHO ENTERED INTO FORBEARANCE

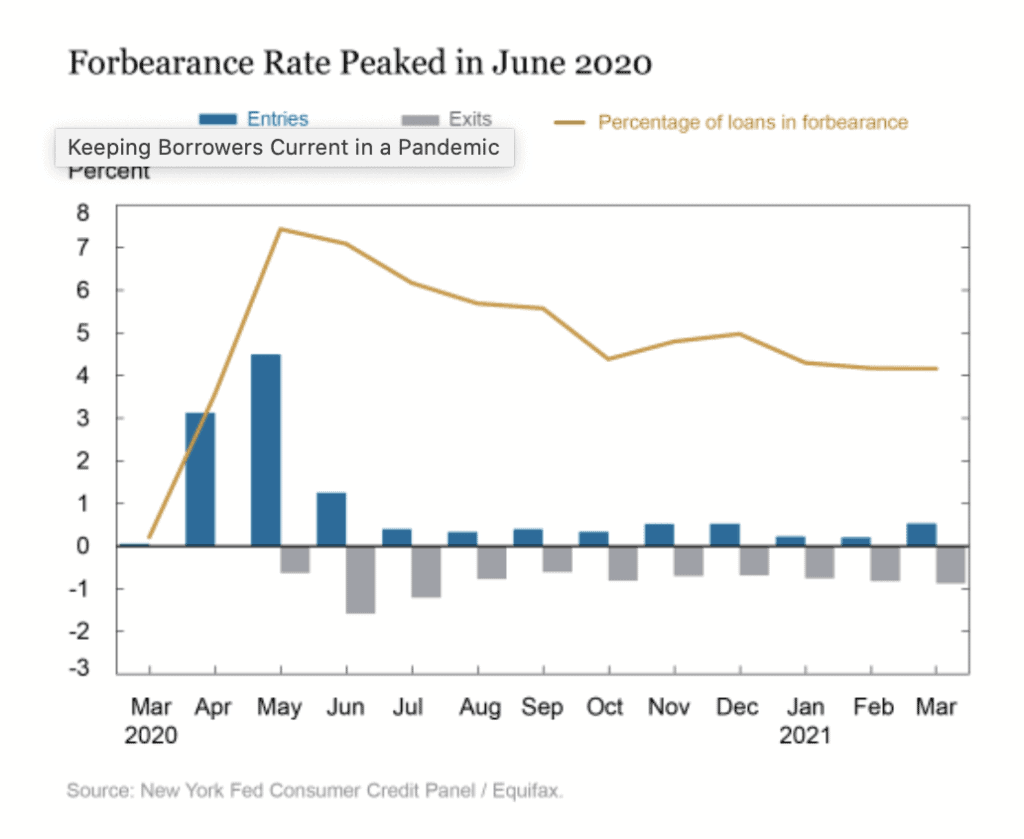

As we see in the chart below, there was a tremendous surge in mortgage forbearance in April and May, 2020, to 7 percent of all federally-backed mortgages.

After the initial shock to the economy, borrowers began to exit forbearance in June, actually outweighing entries. As of March, 2021, the forbearance rate stood at 4.2 percent, or a total of 2.2 million mortgages. Of these, a little more than half, or 1.2 million mortgages, entered forbearance in June of 2020, or earlier.

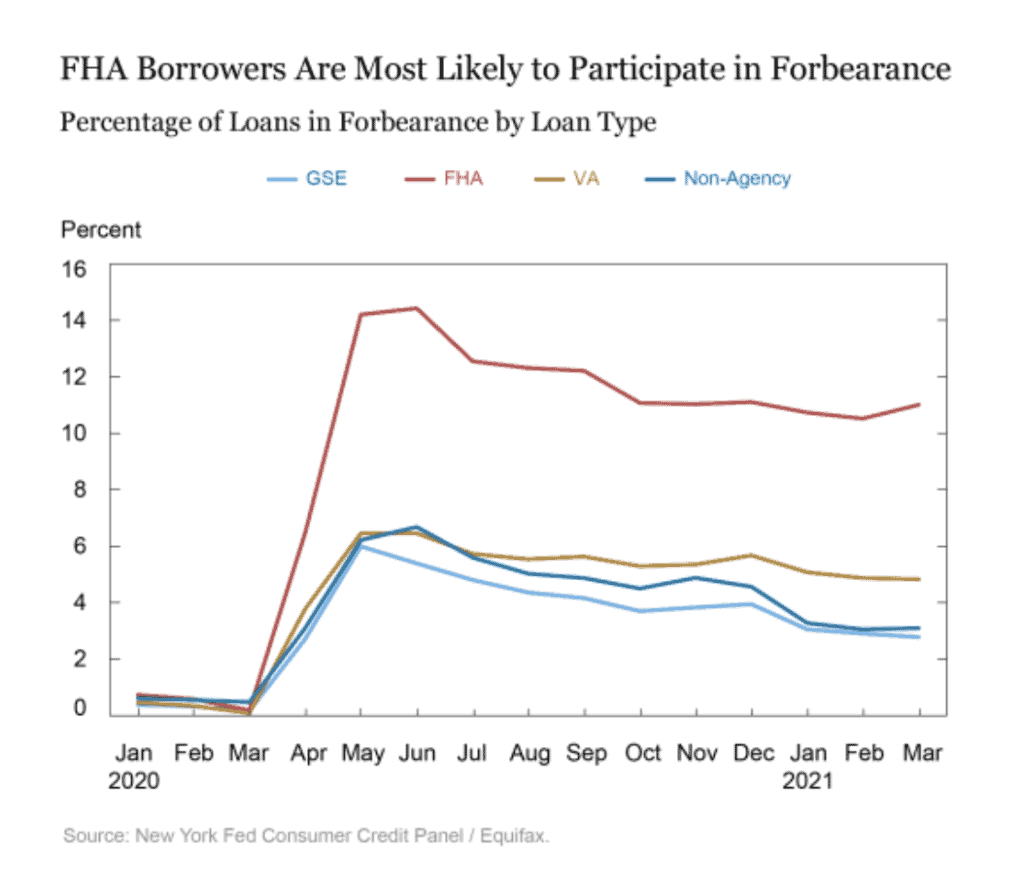

Looking at the next chart, we see that, far and away, borrowers of FHA mortgages were more likely to enter into forbearance. In fact, about 11 percent of FHA mortgages are in forbearance. Two factors explain the inordinately high forbearance rate for FHA borrowers:

- They tend to be first-time home buyers

- They are heavily concentrated in lower income areas. Specifically, 41 percent of FHA borrowers earn less than $50,000 per year, compared to 22 percent for the average GSE (Government Sponsored Enterprises) borrower.

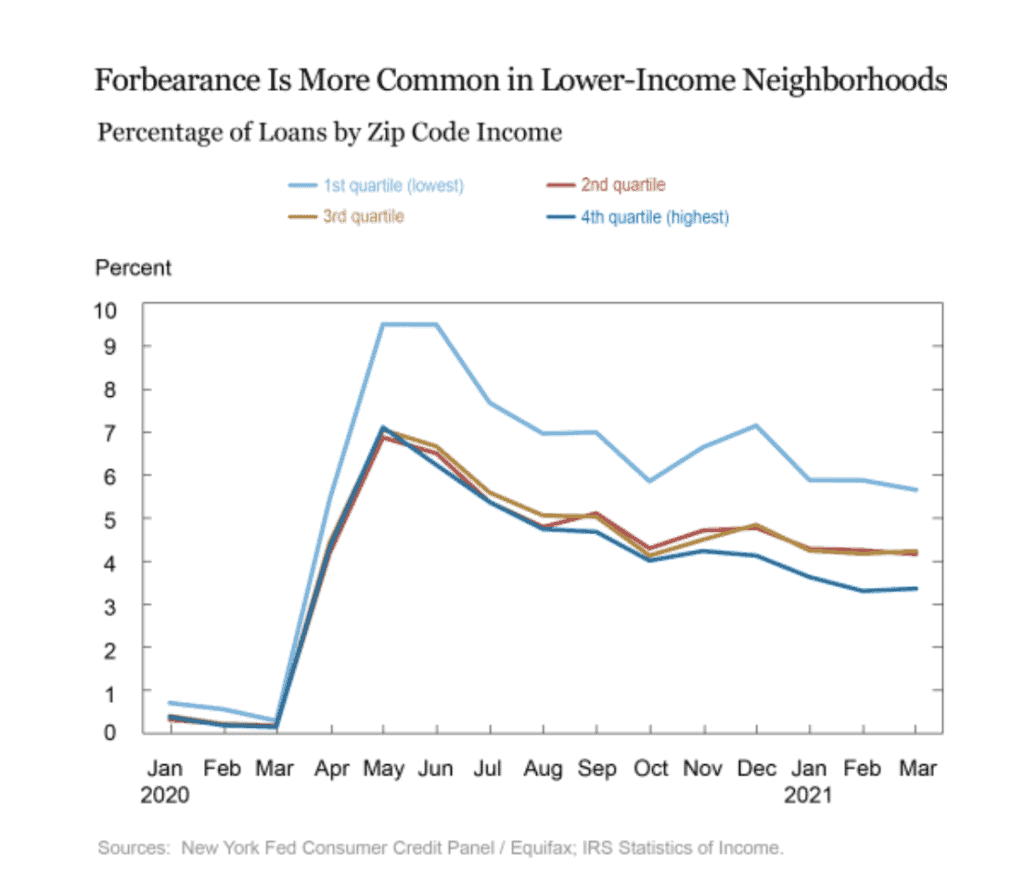

Not surprisingly, as we see below, borrowers in lower-income areas were more likely to enter into forbearance. In fact, nearly 10 percent of borrowers in the poorest zip code quartile entered forbearance during spring 2020, with 5.5 percent still in forbearance more than a year later (compared to about 3.5 percent for the highest income quartile).

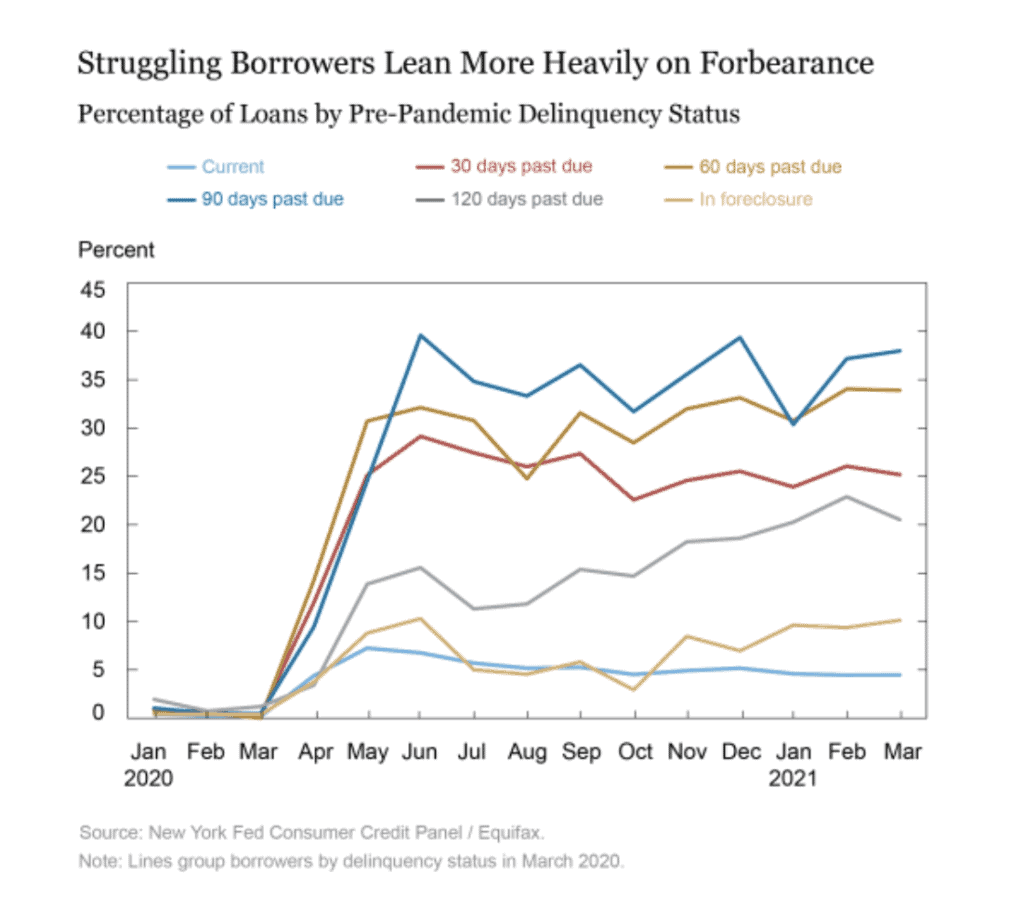

Finally, we see that those borrowers who experienced significant, pre-pandemic delinquencies were more likely to enter and remain in forbearance into 2021.

FORBEARANCE AND CASH FLOW RELIEF

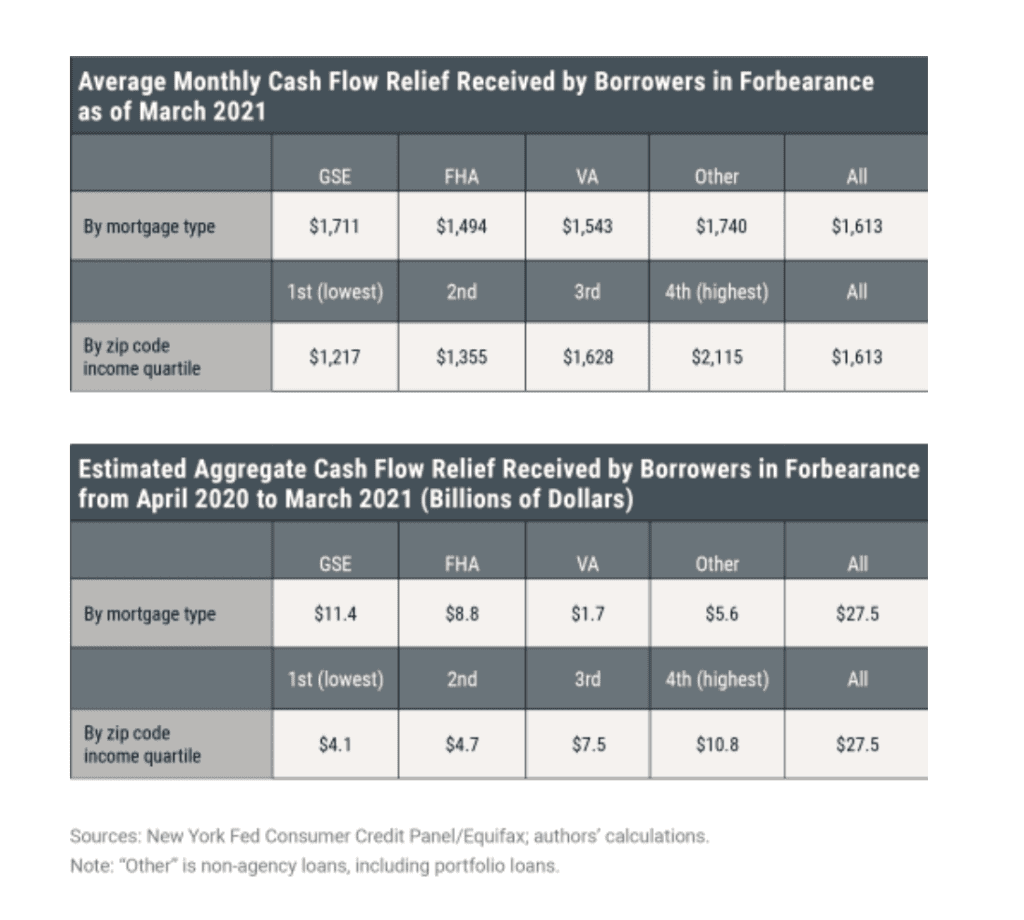

One of the biggest benefits of forbearance is, of course, the immediate cash flow relief to family budgets. On a monthly basis, average cash flow relief across all borrowers in forbearance amounted to $1,613.

However, as we see below, those families in the highest income quartile received $2,115 in cash flow improvements, 73 percent more than those families in the lowest income quartile.

The related chart looks at the cash flow story in the aggregate. Again, in total, those borrowers in the highest income quartile received about 2 ½ times more cash flow benefit than lower–income borrowers.

Still, despite the fact that higher–income borrowers enjoyed considerably more cash flow benefits in the absolute, it’s fair to assume that, on a relative basis, the improved cash flow played an outsized role in stabilizing daily finances for both FHA and lower-income borrowers.

In our next post, we’ll look at how forbearance helped to improve the financial balance sheets of those borrowers who took advantage of the program.

SOURCE

https://www.urban.org/urban-wire/price-tag-keeping-29-million-families-their-homes-162-billion

https://libertystreeteconomics.newyorkfed.org/2021/05/keeping-borrowers-current-in-a-pandemic.html

To learn more about Recovery Decision Science contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261