With this post, we conclude our four-part series on mortgage forbearance and COVID, pulling from recent Federal Reserve data.

In our first three posts, we looked at who entered mortgage forbearance and the impact forbearance had on cash flow and credit. In this regard, last week’s post was a deep dive on how small business owners have used mortgage forbearance to stabilize personal finances in the wake of the economic downturn created by the pandemic.

Today, we look at the long-term profiles of those who entered forbearance: who is leaving, who is staying and how these decisions are impacting credit scores, in particular.

As a refresher, the CARES Act allowed for a six-month forbearance, with additional extensions that could last an additional 12 months.

Overall, nearly 13 percent of U.S. mortgage holders entered forbearance for at least one month during the past year. Of those who entered, a little more than a third were still in forbearance as of March, 2021.

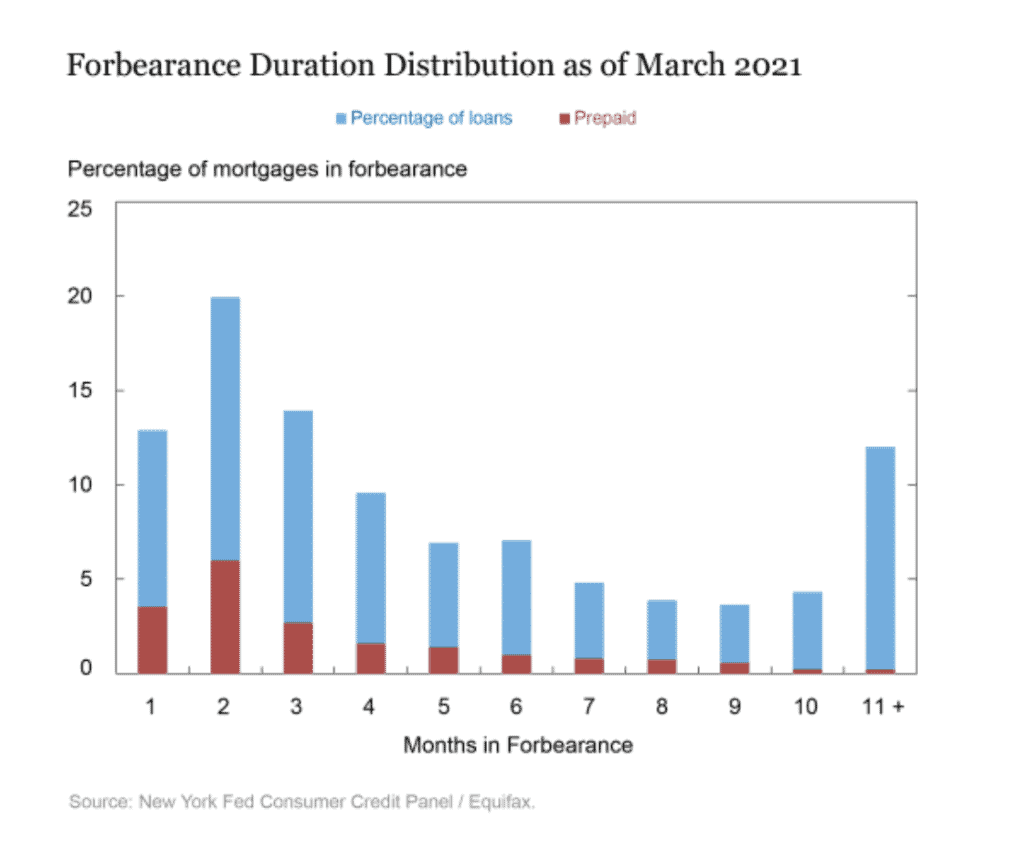

As you can see from the chart below, about a third of homeowners entered forbearance for one or two months. Looking to the right of the chart, 12 percent of those who entered forbearance have taken advantage of the maximum possible forbearance of 11-12 months.

The orange segment of the bars above show those borrowers who were in forbearance for that number of months, but have since prepaid their mortgage balance, either by selling or refinancing. Clearly, many homeowners were able to exit forbearance by selling their homes, with both demand and home prices at all-time highs.

FORBEARANCE AND LOWER-INCOME BORROWERS

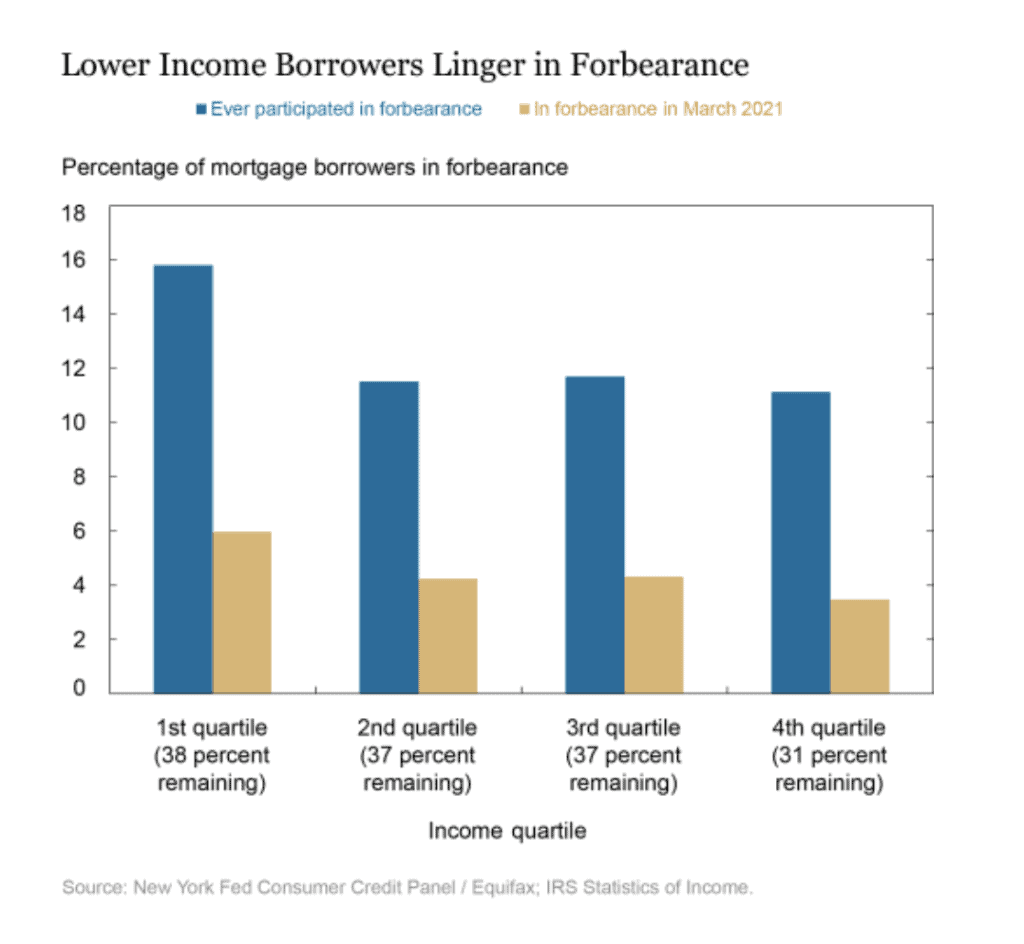

In our first post, we looked at forbearance levels by income group. We take another look in the chart below, where you’ll see several things:

- 16 percent of those borrowers in the lowest-income quartile entered forbearance, 5 percentage points more than the highest-income quartile.

- Regardless of income level, about a third of all homeowners who entered, remain in forbearance a year later.

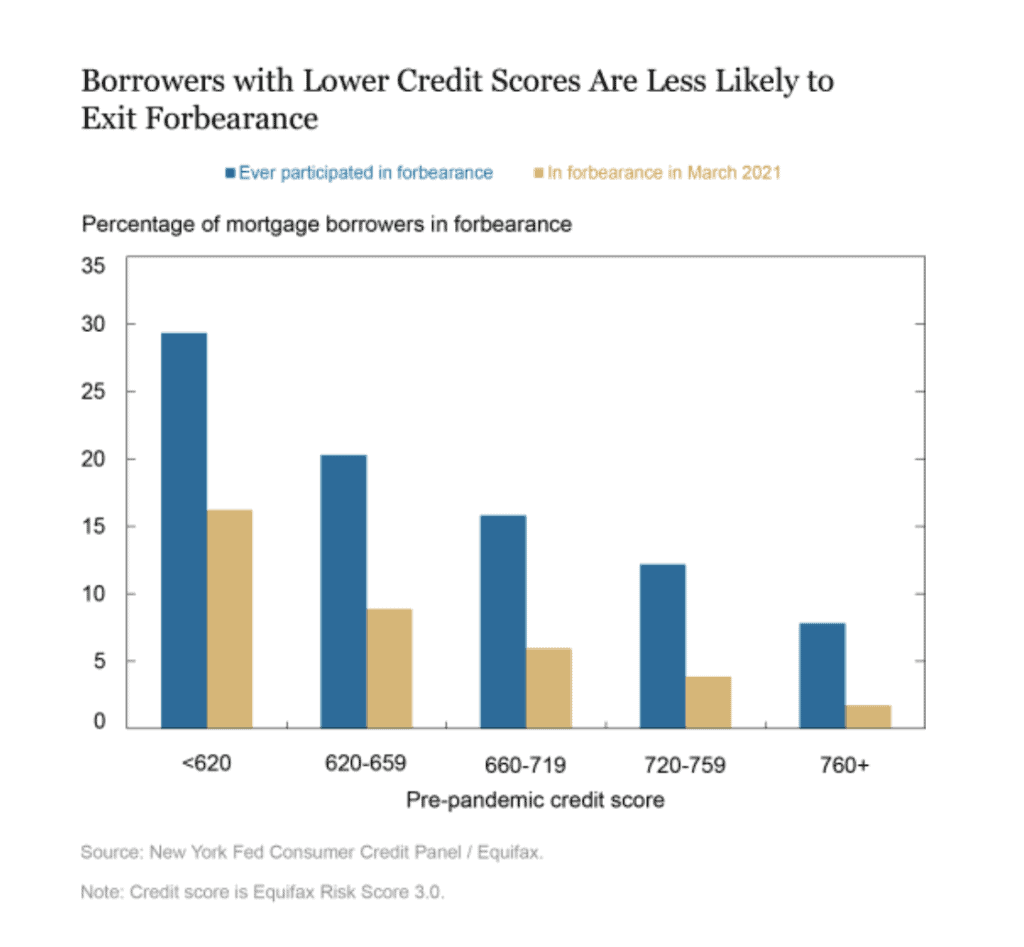

Not surprisingly, those mortgage holders with the lowest credit scores entered into forbearance at a significantly higher rate than those with higher scores. In fact, we see below that nearly 30 percent of those in the lowest credit-rating group entered forbearance, a rate nearly three-times greater than those with the highest credit scores.

CREDIT SCORES IMPROVED WITH FORBEARANCE

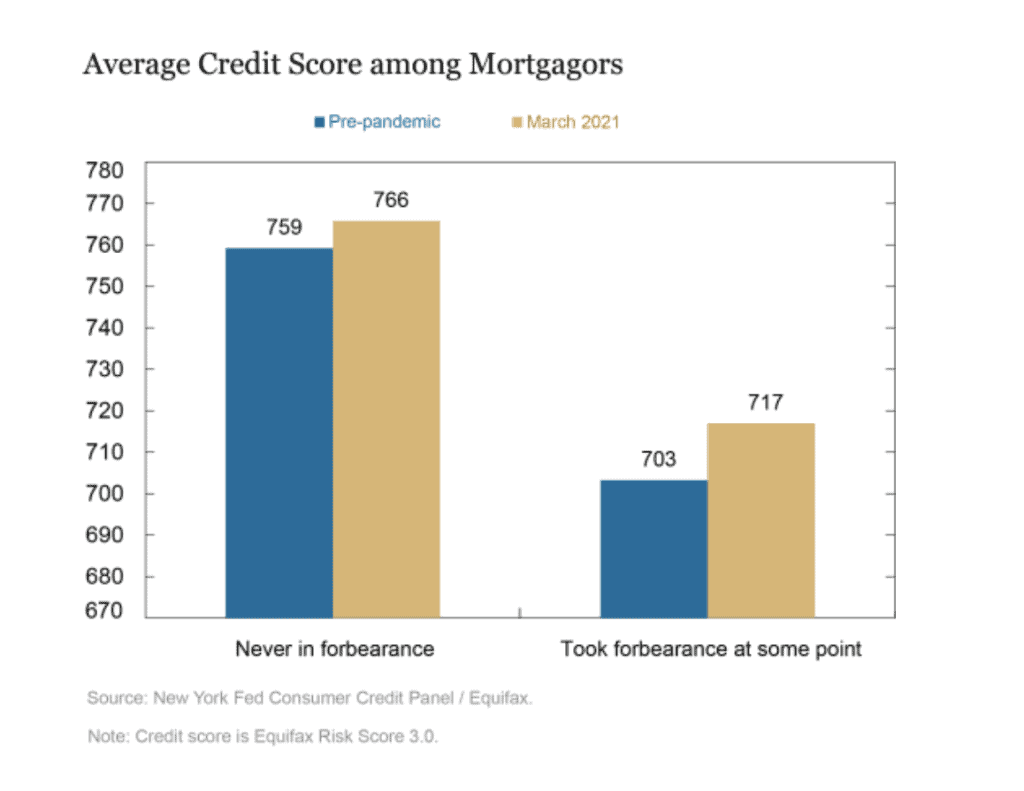

Overall, mortgage forbearance helped to improve credit scores for nearly all borrowers.

As we see below, those who took forbearance enjoyed a 14 point improvement in their credit score over the past year, compared to a 7 point increase for those who did not enter into forbearance. This 14 point improvement reflects the fact that, while they were not making payments, their credit score showed continued payments for credit scoring purposes and account history. Worth noting, and not shown visually in this report, is that those borrowers in the lowest end of the credit score groupings (620-) realized a 57-point improvement in their credit score. Again, this reflects the fact that their credit reports show continued payments during forbearance.

WHAT’S NEXT?

There’s no question that the mortgage forbearance aspects of the CARES Act proved a valuable lifeline for many Americans, especially those at the lowest rungs of the socioeconomic ladder. For example, as we saw in the previous section, those with the lowest credit ratings enjoyed a 57-point improvement in their score over the past year.

But as forbearance programs come to an end, many Americans will face the possibility of delinquency as they struggle to meet their obligations. According to the Federal Reserve, over 70 percent of borrowers in forbearance were not making payments as of March, 2021. Without the support of forbearance, this group of non-payers could translate to 2.9 percent rate of mortgage delinquency in a worse-case scenario. That’s dramatically higher than the current delinquency rate of 0.9 percent, and the pre-pandemic rate of 1.3 percent. But still well below the rate of 6.0 percent, 90+ days delinquent seen in the period following the Great Recession.

SOURCE

https://libertystreeteconomics.newyorkfed.org/2021/05/whats-next-for-forborne-borrowers.html

To learn more about Recovery Decision Science contact:

Kacey Rask : Vice President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261

Error: Contact form not found.