In our last post, we launched a series based on a serial study by the Federal Reserve Bank of New York on heterogeneity, or differences in population, and its financial effects.

Part two finds us examining the effect of merit scholarship programs on short- and long-term financial outcomes, including debt and delinquency.Eleven states have recently introduced programs to make public two-year education tuition free while 27 state offer some sort of merit aid. These programs vary in scope, but they generally provide significant reductions to in-state tuition at both public and private four- and two-year colleges to any student that clears a certain academic threshold.

The Fed analysis is the first to use a nationwide data panel that links students’ educational records with their debt outcomes to understand the effect of such merit scholarship programs on students’ short- and long-term financial outcomes. The data set used represents a merger between the New York Fed Consumer Credit Panel (CCP) and the National Student Clearinghouse (NSC). The former consists of consumer credit records from Equifax and the latter covers individual education records for 97 percent of all college enrollments.

The Fed looked at differences in access to merit aid programs to estimate their effects on college entry, student debt and repayment rates and compared the outcomes of students who were merit-eligible because of their home state and year of birth with those of students who were not merit-eligible.

Additionally, the study focused on zip codes with high shares of low-income and black residents. A separate analysis studied outcomes for students from high-Hispanic neighborhoods, the results of which are described in brief below.

First, the study found no evidence that merit-eligible individuals are more likely to go to college nor was there evidence individuals in merit-eligible cohorts coming from low-income neighborhoods or high-black or high-Hispanic neighborhoods were more likely to enter college at any age.

Second, the study found merit-eligible students show lower loan balances.

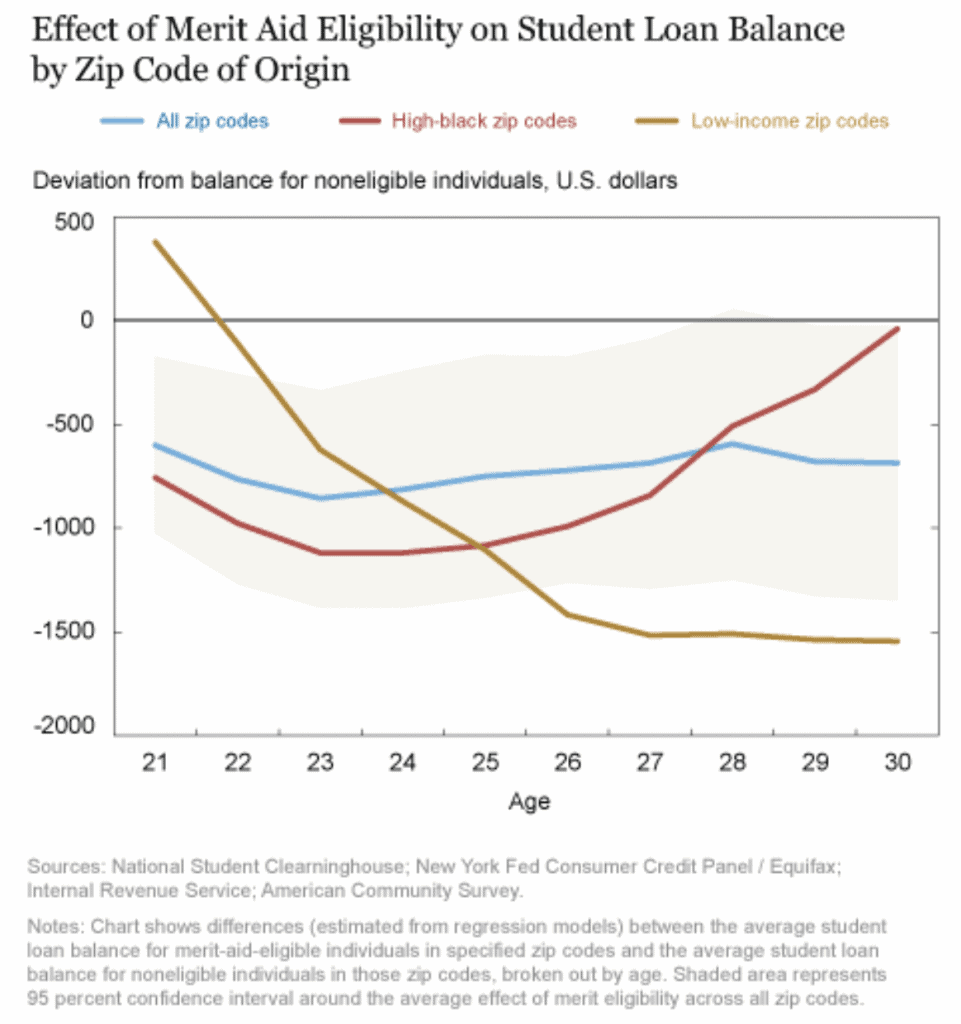

On average, student loan balances were $500 to $1,000 lower for people in their mid-to-late 20s belonging to cohorts that were eligible for merit aid programs, as shown in the blue line on the chart below. The estimate for individuals eligible for merit aid have about 14 percent less student loan debt than the average student loan balance for the overall population at age 24.

The gold line in the chart below shows the effect on debt balances is up to twice as large for merit-eligible individuals from low-income neighborhoods after their early 20s. Students from high-black neighborhoods, as represented by the red line, also have declines in student loan balances during their 20s, but there is no evidence that they had a lower balance at age 30.

The results for merit-eligible individuals from high-Hispanic neighborhoods are similar to those for students from high-black neighborhoods, but there are some important differences. Again, there is no proof merit aid eligibility has any effect on the probability of college attendance at any age, those from high-Hispanic neighborhoods have lower student loan balances and lower delinquency rates in their mid-to-late 20s than those from high-black neighborhoods.

The drop in student loan balances for merit-eligible individuals is mostly spread across individuals who would have gone to college in the absence of merit aid programs; it’s not a result of fewer individuals going to college.

Not all merit-aid-eligible high school graduates end up attending college. When scaled by an average college-attendance rates, the Fed estimates imply a 1.5 percent reduction in the average likelihood of any student loan borrowing and an average reduction of $1,052 in student debt for college-going cohorts in merit-aid states.

Finally, the study examined dynamics of student loan delinquency and default. The rate of those who become delinquent on student debt payments by age 30 is 14 percent, compared to 18 percent and 19 percent for individuals from low-income and high-black neighborhoods, respectively.

However, there are important variations between individuals from different neighborhoods. Students in merit-aid-eligible cohorts originating from low-income and high-black neighborhoods are much less likely to be delinquent on student loans until their mid-20s, likely because merit aid eases their financial constraints and helps them stay current on their payments. In contrast, by their late 20s, merit-eligible students from low-income and high-black neighborhoods are slightly more likely to be delinquent than the average merit-eligible student, although they remain statistically indistinguishable.

In summary, the Fed found no evidence lowering the cost of college through merit-aid programs increases college enrollment, but the programs show significant reductions in the magnitude of student loan balances. There aren’t, however, significant reductions in delinquency overall.

SOURCE

Error: Contact form not found.