Over the past few years, we’ve been blogging about the Federal Reserve’s coverage of the growing levels of economic inequality in the U.S. Of course, in many ways, the issue of economic inequality has been exacerbated by the pandemic. In today’s post, we continue our look at economic inequality based on a new three-part series published by Liberty Street Economics. Specifically, this post looks at how gender, race, and education play out in the distribution of household debt.

INTERESTING APPROACH

There is plenty of information about the volume of household debt in the aggregate. But when it comes to looking at household debt for narrower demographic segments of the population, we have little to no reliable data. So, the research tea at Liberty Street had to get creative.

To develop the data used in this series, they “linked anonymized educational and demographic data of first-time freshman students enrolled at the City University of New York (CUNY is the largest urban college system in the country) with the students’ anonymized household debt data from the New York Fed/Equifax Consumer Credit Panel. This unique data set allows analysis of debt by race and gender of CUNY students born between 1942 and 1988.”

To provide deeper context, the researchers divided the student population into those who pursued two-year associate degrees (AA) and four-year bachelor’s degrees (BA). Each chart below reflects these groupings, with AA student data on the top panel and BA below.

Finally, all data is based on debt accrued by age 30 for all the measured groups.

STUDENT DEBT

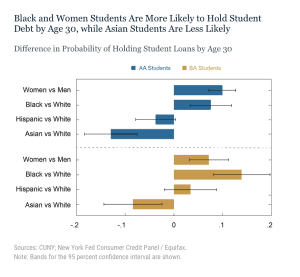

In looking at the first chart below regarding student loan debt, here’s what we learn:

- Female students pursuing AA degrees were 10 percentage points more likely to incur student loan debt than their male counterpoint.

- The gender gap narrows to 7 points for those pursuing BA degrees.

- With regard to race:

- Black AA and BA students were 8 percentage points and 14 percentage points, respectively, more likely to hold student loan debt than white students.

- For Hispanic students, there was no statistically significant difference to white students at either degree level.

- Asian AA and BA students were 13 percentage points and 8 percentage points less likely, respectively, to hold student loan debt than white students.

CREDIT CARD DEBT

CREDIT CARD DEBT

Credit card debt has become the most common form of debt for students. Here are few points for context (data not shown):

- On a national basis, 71 percent of AA students and 85 percent of BA students have taken out credit cards by the age of 30.

- Average credit card balances for AA students is $2,013 by age 30, and $2,732 for those pursuing a BA degree.

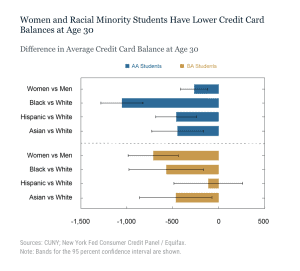

Moving to the chart below, here’s what we see with regard to demographic differences for credit card debt:

- Across the board, racial minorities have lower credit card balances by age 30, although the differences for Hispanic-white BA students is not statistically different.

- Credit card balances for female AA students were $267 less than those for their male counterparts; this gender gap grows to $712 for four-year students.

- The most notable difference was the black-white gap for two-year students, which stands at $1053.

AUTO DEBT

AUTO DEBT

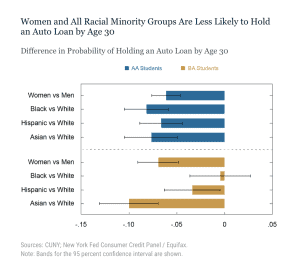

As the chart below shows, women and all minority groups are less likely to take out an auto loan by age 30 than their counterpart groups.

- The gaps are particularly notable, and consistent, for students in two-year programs.

- Interestingly, for BA students, the black-white gap almost disappears, while it expands significantly for the Hispanic-white comparison.

It’s worth noting that extrapolating the findings from CUNY students is not ideal in that New Yorkers, in general, are much more likely to rely on public transportation than those in any other part of the country. For example, only 35 percent of CUNY BA students had taken out a car loan by age 30, compared to 69 percent of BA students on a nationally-projected basis.

It’s worth noting that extrapolating the findings from CUNY students is not ideal in that New Yorkers, in general, are much more likely to rely on public transportation than those in any other part of the country. For example, only 35 percent of CUNY BA students had taken out a car loan by age 30, compared to 69 percent of BA students on a nationally-projected basis.

MORTGAGE DEBT

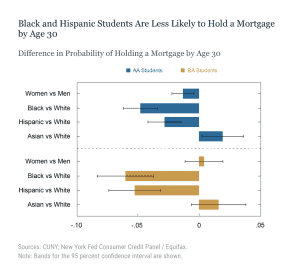

Finally, we look at mortgage debt:

- Women pursuing AA degrees are 1.3 percentage points less likely to hold mortgage debt by age 30 than their male counterparts.

- The gender gap flips slightly for BA students, but the difference is not statistically significant.

- Black and Hispanic students, whether pursuing two or four-year degrees, are considerably less likely to hold a mortgage at age 30 than their white counterparts.

- On the other hand, Asian students are actually more likely to be mortgage holders than white students.

Again, as with auto loans, a caveat is in order here as the housing market in the New York area is much different than in most of the U.S. For example, 14 percent of BA students in the CUNY sample help a mortgage by age 30. By contrast, 37 percent of BA students from a national projection hold mortgages by the same age.

Again, as with auto loans, a caveat is in order here as the housing market in the New York area is much different than in most of the U.S. For example, 14 percent of BA students in the CUNY sample help a mortgage by age 30. By contrast, 37 percent of BA students from a national projection hold mortgages by the same age.

Whether or not we agree with the methodology of basing national projects on a New York City data set, the findings, in general, suggest clear inequalities in how household debt plays out from both a gender and racial minority perspective. In next week’s post, we’ll take this story to another level by looking at credit delinquencies using the same methodology.

To learn more about Recovery Decision Science’s Business Intelligence Team, contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261

Error: Contact form not found.