For our next series, we turn to a report conducted by the Federal Reserve Bank of Boston on credit card debt and consumer data.

In our first part of the series, we’ll examine payment behavior and risk score.

According to the study, credit card revolvers-defined as consumers who report carrying unpaid balances on their credit cards–have lower income and are less educated than other cardholders.

They also exhibit a pattern of payment behavior different from consumers who pay their credit card balances on time. They are more likely to have and use debit cards instead of credit cards, but they also carry larger credit card balances, conditional on income and demographics. The high cost of paying off credit card debt may exacerbate existing inequalities in disposable income among consumers.

Since consumers who carry debt might be liquidity constrained, they also may lack cheaper borrowing alternatives. Their credit card utilization is much higher than that of convenience users— consumers who use credit cards for purchases and pay off their balances each month. Revolvers are more likely to be constrained by their credit card limits, and their higher use of debit cards (compared with convenience users) could be due to those supply-side restrictions rather than different preferences.

The report data came from two sources. The first is a nationally representative survey of self-reported consumer payment behavior, the Survey of Consumer Payment Choice. The SCPC is an annual survey of US consumers on their adoption and use of several common payment instruments, including cash, checks, debit cards, credit cards, prepaid cards, online banking bill payments (OBBP), and bank account number payments (BANP).

The second source, Equifax, a consumer credit reporting agency, provided administrative data. The credit report is from the exact month when those respondents took the SCPC in each of three consecutive years: 2014, 2015, and 2016.

The Equifax risk score measures the risk of default—the higher the score, the less likely the consumer is to default. Lenders use measures of default risk to decide whether to approve a loan and to determine the terms of the loan, including credit card limits. The risk score is a good predictor of whether a consumer is likely to repay his loans, including credit card debt, on schedule. Therefore, the Equifax risk score is correlated with the supply of credit.

An Equifax risk score ranges from 280 to 850, with higher scores indicating lower credit risk.

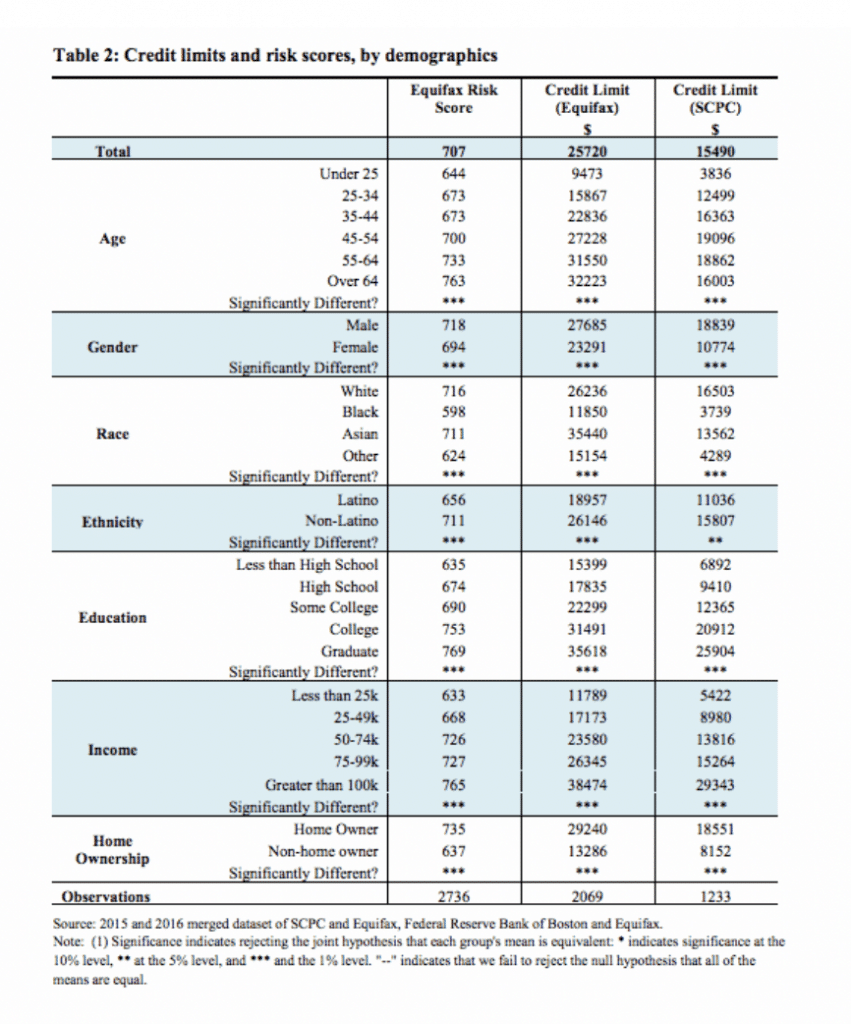

Column 1 in the table below uses the pooled 2015-2016 data to show the mean Equifax risk scores by demographic and income cohorts in the sample. The overall mean risk score is 707, but the mean scores vary by demographic and income attributes. The significance tests at the bottom of each demographic breakdown indicate that the means differ significantly by each category: age, education, income, gender, race, ethnicity, and homeownership status. The mean risk scores increase with income, education, and age. White respondents have a higher average risk score than do black respondents, and the average risk score for men is significantly higher than that for women.

Based on the Equifax data, 74 percent of consumers have at least one credit card, and the average number of cards per person is 2.26.

White respondents are more likely to have a credit card than are black respondents, and men are more likely than women to have a credit card. The youngest, lowest-educated and lowest-income consumers have rates of credit card adoption that are substantially lower than those of their older, more affluent and better-educated counterparts.

The rate of credit card adoption for the youngest consumers—those under age 25—is only 49 percent, compared with 87 percent for those 65 and over. Only 33 percent of consumers who don’t have a high school education have a credit card, compared with 92 percent of those with a graduate degree. Forty-two percent of respondents with an annual household income below $25,000 have a credit card, compared with 91 percent of those with income greater than $100,000.

The Fed study found cardholders’ balances rise with age initially but then decline after the peak for the 45–54 cohort. The pattern is similar among the revolvers, for whom the average balance increases with age until its peak for the 45–54 age cohort and then declines.

Although the amount of credit card debt varies with income, even high-income consumers carry debt: In 2015 and 2016, 43 percent of those with annual household income over $100,000 revolved on their credit cards. The percentage of revolvers increases with income until the $50,000–$75,000 annual household income cohort and then declines for each consecutive cohort above $75,000.These findings indicate that lower-income consumers are more likely to use credit cards as a source of credit, while higher-income consumers are more likely to use credit cards as a means of payment and repay the balance each month.

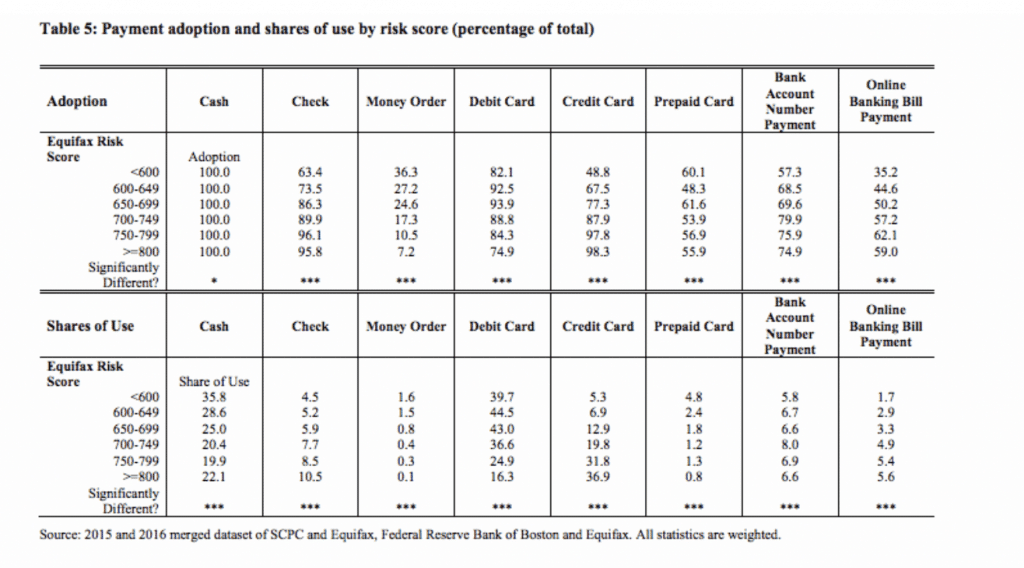

The table below shows the rates of adoption and shares of payment use for a variety of payment instruments by the Equifax risk score.

Cash is universally adopted but the use of cash, as measured by the share of transactions, declines with the risk score: Consumers with a risk score below 600 conduct 36 percent of their transactions in cash, compared with only 22 percent for those with a risk score above 800.

In our next post, we’ll return to the Boston Fed study to examine credit cards as a payment choice.

SOURCE

Error: Contact form not found.