In the fourth part of our series on first time home buyers, we look at the sustainability of homeownership for them.

While the transition from renting to owning is often a large measure of success in America, we examine how feasible retaining ownership is for first time buyers who make this move. Buyers who cannot manage the financial responsibilities of owning a home and must return to renting have made little progress in the accumulation of wealth.

One of our go-to sources, the Federal Reserve Bank of New York, has established a homebuyer sustainability scorecard, which we will examine in two parts. First, we classify the types of sustainable and non-sustainable homeownership.

The most obvious case of non-sustainable ownership is when a household defaults on its first-time mortgage. Households who go through default and foreclosure will likely not be able to transition back to homeownership for many years, as a result of the loss of home equity and deterioration of credit ratings.

At the other end of the spectrum, a first-time borrower who pays off their mortgage, moves and remains a homeowner in their new location demonstratessustainable first-time homeownership.

The next case of sustainable first-time homeownership is when the household continues to live in the same residence,paying down their initial mortgage or refinance. The longer the household has lived in the residence, the stronger is the case to classify this outcome as an example of sustainable homeownership.

An intermediate case is when the household successfully pays off its first-time mortgage but transitions back to renting. The Fed identifies those first-time buyers who return to renting for at least three years for scoring measures and classifies cases like this as examples of first-time homeownership that was not sustainable. Households like this one will face lower hurdles seeking homeownership in the future as compared to those who default.

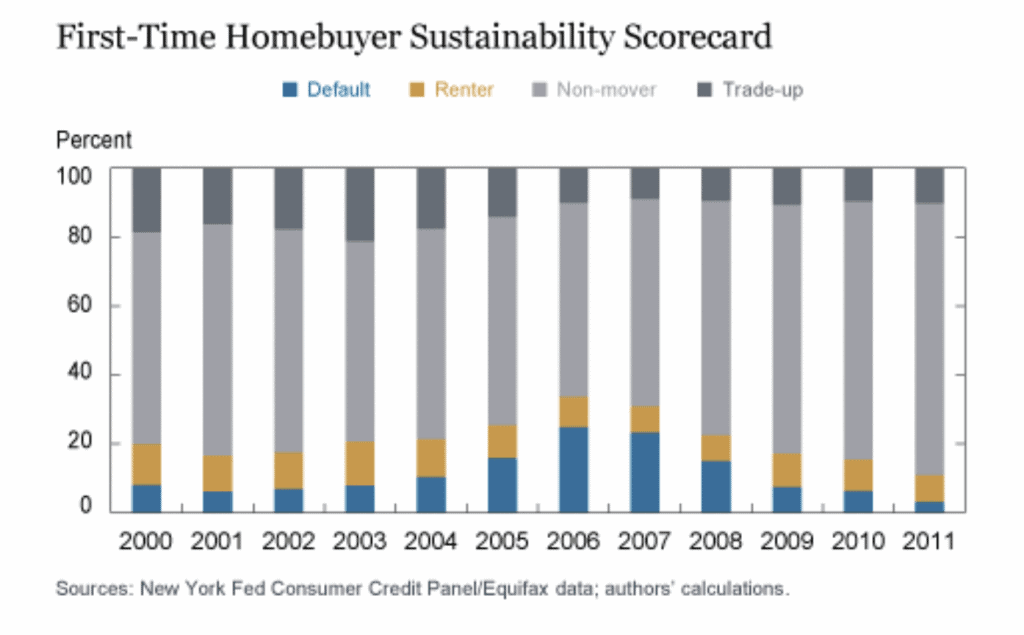

The chart below provides the Fed’s sustainability scorecard for first-time buyers.

The Fed separates each annual cohort of first-time buyers into four categories: default, renter, non-mover, and trade-up. The first two categories represent cases of non-sustainable homeownership, while the second two represent sustainable homeownership.

Each cohort uses at least six years of data to provide clear insight into the degree of homeownership sustainability, and the Fed has focused primarily on the cohorts prior to 2003 since they were the least impacted by the financial crisis.

The cohorts from 2000 to 2002 were less affected by the financial crisis. For these cohorts of first-time buyers, homeownership was sustainable for roughly 82 percent. This group consisted of around 65 percent who remain in their original home and 17 percent who successfully paid off the mortgage on their first-time purchase, moved, and remained homeowners.

As the Fed moved past the 2002 cohorts, the sustainability rate progressively declined, reaching a low of 66 percent for in 2006. Much of the decline in sustainability was due to an increase in the default rate that was only partially offset by a lower transition rate of non-defaulters back to renting.

The recovery in housing markets brought on by the economic expansion has improved sustainability and the 2011 cohort exhibits a sustainability rate of 89 percent. However, the sustainability rates of the more recent cohorts may still deteriorate going forward as the Fed continues to monitor the performance of these cohorts.

In our next post, we review the difference in the sustainability of first-time homebuyers with Federal Housing Administration (FHA) mortgages, Veterans Affairs (VA,) Government Sponsored Enterprise (GSE,) and private label banks.

SOURCE

https://libertystreeteconomics.newyorkfed.org/2019/04/a-better-measure-of-first-time-homebuyers.html