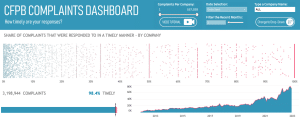

The Recovery Decision Science Business Intelligence team has updated its CFPB Complaints Dashboard on its Public Tableau page. The data is current through the end of December, 2022. The dashboard includes a company-by-company analysis of response times to complaints to the CFPB. Users can select a company from the pull-down menu. Then, using the dot-plot, you can compare that company to any of the more than 81,000 companies in the CFPB database in terms of timely response to complaints. As you work with the dot-plot, remember that blue is positive, meaning timely responses, and orange is negative. Users can also do a deep dive on a company’s performance relative to a number of factors:

- Total number of complaints

- Complaints over time

- Percent of complaints that are responded to in a timely manner (i.e. within 30 days)

- Breakdown of product type (i.e. mortgage, debt collection)

- Source of complaint

- And if the consumer disputed the response

There were 71,014 consumer complains to the CFPB in December, which was down slightly from the ALL-TIME HIGH of 77,289 reached in November.

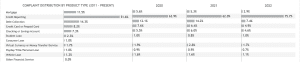

Next, we look at complaints, by product type, as outlined in the screenshot below. Here’s what we learn:

- Complaints related to credit-reporting continue to grow, now representing over 75.7% of all complaints. This is an increase of 18.5% over 2021.

It’s worth noting that the CFPB recently published its annual report on the performance of the big three credit reporting agencies: Experian, Equifax and TransUnion. The report reveals that the three most common complaints filed with NCRA (Nationwide Consumer Reporting Agencies were:

- Incorrect information on a consumer’s credit report, which can hurt their credit score and make it difficult to qualify for a mortgage.

- Problems with investigations conducted a reporting company.

- Improper use of a consumer’s credit report.

But the CFPB’s report did highlight the fact that the three credit reporting agencies had made strides in remedying various issues that were cited in the previous year’s report. These improvements included:

- Now provide more substantive and detailed reports than in past year.

- Provide more tailored complaint responses.

- Reported greater rates of relief to complains than in prior years.

To view the entire interactive CFPB complaints dashboard, along with our full compliment of financial dashboards, visit us on the RDS Tableau Public page, HERE.

To learn more about Recovery Decision Science, contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261

Error: Contact form not found.