In a recent post, COVID AND FIRST-TIME HOME BUYERS, we discussed how historically low interest rates have been instrumental in helping first-time buyers get into the market, despite the economic upheaval created by the pandemic. But because of the incredibly high demand, home inventory dropped and prices rose. As such, first-time home buyers saw their mortgage origination balances triple in one year, going from 3.2 percent in 2019 to 10.2 percent in 2020.

In today’s post, we take a look a concept that’s always been synonymous with first-time home buyers, and that is the “starter home.” Starter homes are typically small in rooms and square footage, with fewer amenities (e.g., gourmet kitchens, pools), and often in less desirable neighborhoods (generally defined by the quality of the school district). Historically, these factors have combined to keep starter home prices affordable for younger, first-time buyers in the early stages of their careers and, often, with little cash for a significant mortgage down payment. But they also served a valuable purpose in helping younger adults build both equity and cash assets that could lead them to their “forever home” at some point,.at which point new first-time buyers enter the market, allowing the cycle to repeat itself. Or does it?

A recent article in FreddieMac.com discussed the significant shortage in starter homes, referring to it as “one of the most important challenges” the housing industry will face. You can find a link to the complete article below.

Freddie Mac estimated that the housing shortage reached 3.8 million units by the end of 2020, a staggering 52 percent increase over the already-high shortage of 2.5 million units reported in 2018.

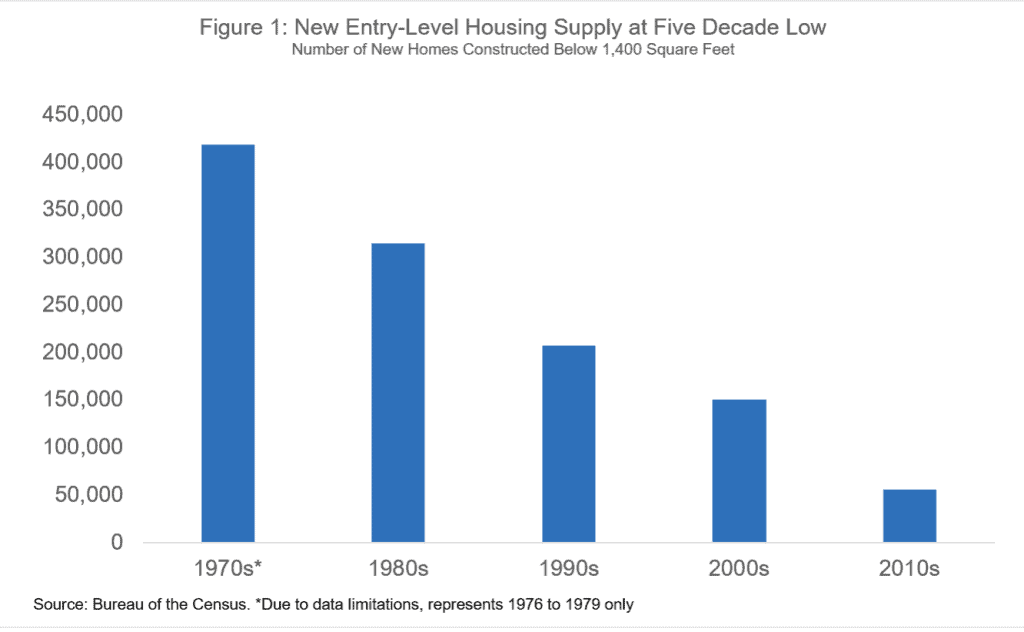

One of the key drivers of this housing shortage is the significant, long-term decline in new home construction. The chart below, from the Bureau of the Census, shows new home construction by decade, starting with the 70s, and continuing through the end of the 2010s.

We see that over the span of five decades, new home construction dropped from an average of 418,000 in the 70s to 55,000 in the 2010s. Freddie Mac reports an increase to an estimated 65,000 units in 2020, still nowhere near the level of construction needed to fill the shortage. But here’s what’s most important about this chart: the data covers new construction of homes BELOW 1,400 SQUARE FEET, which is the sweet spot when we consider traditional starter homes.

But this dramatic drop in new/small home construction is one of many factors that will continue to weigh on first-time buyers in the near future. Let’s look at a few others:

- Boomers are hanging on to their “forever homes.” According to the National Association of Realtors, in 2019, a typical seller had owned their home for 10 years. Previously, owners might sell every 6-7 years. As “empty nesters” hang on to their nests longer, there is less inventory for today’s first-time buyers to trade up tomorrow.

- Investor/landlords are holding on longer. In the aftermath of the Great Recession, millions of foreclosed homes were purchased by investors and turned into rental properties. With 35 percent of households renting (up from 31 percent in 2005, according to the Census Bureau), and housing prices rising, landlords can afford to sit tight in the near term.

- Historically low mortgage rates incentivize many homeowners to stay where they are. In fact, the lower rates drove refinancing levels to a 12-year high in March, 2020. So, if mortgage rates begin to creep up, those homeowners sitting on low rates are more likely to stay where they are, further exacerbating the housing inventory shortage.

- New home construction has primarily targeted the up-market. The Census Bureau estimates that 56 percent of newly constructed home sales in 2019 cost an average of $300,000 or more. Such prices are typically out of reach for first-time buyers.

So, despite generally positive news for the real estate market, the story is not quite as rosy for those younger Americans anxious to get their first piece of the cornerstone of the American Dream: home ownership. They’ll have to be patient, build up their savings for a reasonable down payment, maintain a strong credit score and be ready to jump in when the time is right.

SOURCE

http://www.freddiemac.com/perspectives/sam_khater/20210415_single_family_shortage.page

https://www.rocketmortgage.com/learn/starter-home-or-forever-home

https://www.businessinsider.com/millennials-ready-to-buy-houses-face-starter-home-shortage-2019-12

https://www.nerdwallet.com/article/mortgages/6-reasons-there-arent-enough-homes-for-sale

To learn more about Recovery Decision Science contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261

Error: Contact form not found.