Since the earliest days of the pandemic, we’ve been tracking how COVID has impacted various aspects of the U.S. economy.

In particular, we’ve been tracking the Federal Reserve’s ongoing series on Income Inequality and to what degree the pandemic has exacerbated inequality.

Today, we cover the first of a two-part series on what to expect when student loan forbearance ends at the end of August 2022.

OVERVIEW

The Federal government recently extended forbearance on student loan payments until the end of August 2022. This is the sixth such extension, and it was a welcome relief for the more than 41 million Americans who have availed themselves of student loans from the federal government.

Considering the likelihood that forbearance will end in August, the Fed wanted to gauge expectations as to how the program’s termination might impact consumers’ ability to meet future debt obligations.

Pulling from their Survey of Consumer Expectations, the authors of this analysis looked at a special module from May 2021, which focused on debt relief during the pandemic. In particular, the probed respondents about debt repayment, receipt of debt relief, the type of relief received, and, most importantly, their expectations that they will miss a debt payment in the coming three months.

LIKELIHOOD OF MISSING DEBT PAYMENTS

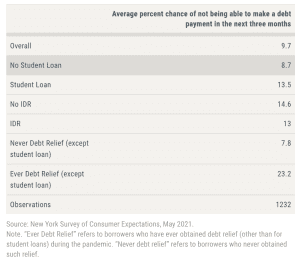

The first part of the study looked at household expectations concerning missing ANY type of debt payment (i.e., a minimum required payment on a credit card, auto loan, student loan, mortgage, or any other type of debt repayment).

Looking at the table below, here’s what we see:

- As a result of financial pressures realized because of the pandemic, 9.7% of ALL U.S. households surveyed expected to miss a required debt payment in the coming three months.

- 5% of those households carrying a student loan expected to miss a debt payment (vs. 8.7% without student debt).

- The survey also looked at those households with income-driven repayment (IDR) plans. These plans are designed to make student loan debt more manageable by reducing their monthly payment amount.

- Those with IDR plans had slightly lower expectations of missing a debt payment than non-IDR households (13% vs. 14.6% respectively).

- Finally, the survey looked at the expectations of households who had received any type of debt relief (other than student loan relief) during the pandemic: fee & interest waivers, debt forgiveness, delay/deferral on credit card, auto loan or mortgage payments). As you can see:

- Those who have “ever-received” debt relief are three times more likely to expect that they will miss a debt payment in the coming three months (23.2% vs. 7.8% respectively).

THE IMPACT OF STUDENT LOAN DEBT

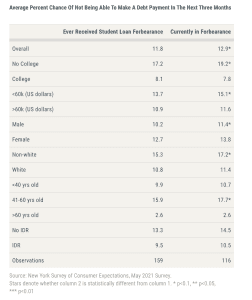

The table below focuses on borrowers who received student loan forbearance.

The first column looks at those who received student debt forbearance through the administrative forbearance of federal student loans. As we can see, these borrowers expect an 11.8 percent likelihood of missing any debt payment in the next three months. This is slightly lower than the 13.5% likelihood faced by an average student loan borrower in the table above.

As we see, among those borrowers who have ever received student loan forbearance, and expect to NOT be able to make a debt payment in the next three months, the demographic profile is:

- Less educated, lower-income, female, non-white, and middle-aged.

- Also, those without an IDR expect to miss a debt payment in the coming months.

Shifting to the second column, we look at those borrowers who (as of May 2021) remained in student loan forbearance. Overall:

- A slightly higher percentage of this group anticipate delinquency coming out of forbearance (12.9% vs. 11.8%).

- The demographic profile is similar to the borrowers who ever received student loan forbearance, but at slightly higher levels across the board.

THE IMPACT OF ENDING STUDENT DEBT RELIEF

In the final table below, the Fed posed a hypothetical question to those borrowers in the survey. Specifically, they asked respondents who continue to take advantage of student loan forbearance to consider what would happen if ALL student debt forbearance is discontinued at the end of the month.

As you can see, the prospect of discontinuation of student debt relief would have the greatest impact on borrowers who are less educated, female, racial minorities, and middle-aged.

Also, those who are not in an IDR plan have slightly higher anticipation of delinquency in the next three months than those with a plan.

Clearly, as the data above shows, discontinuation of student debt forbearance will result in increased financial stress, especially for those demographic groups already facing hardship. Those who benefit from student debt forbearance expect a 16% chance of delinquency within three months if forbearance ends abruptly.

In the next post in this series, we’ll look at what groups benefit most from student debt forbearance.

SOURCE

To learn more about Recovery Decision Science’s Master Servicing capabilities, contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261