The Federal Reserve Bank of New York’s Center for Microeconomic Data recently issued its Quarterly Report on Household Debt and Credit.

Through the first quarter of 2018, total household debt increased by $63 billion (0.5%) to $13.21 trillion. It was the 15th consecutive quarter with an increase, and the total is now $536 billion higher than the previous peak of $12.68 trillion, from the third quarter of 2008. Overall household debt is now 18.5% above the post-financial crisis trough reached during the second quarter of 2013.

Here are the key takeaways of the first quarter report, by segment:

HOUSING DEBT

- Mortgage balances, the largest component of household debt-rose by $57 billion during the first quarter, to $8.94 trillion.

- While mortgage balances increased slightly, originations declined slightly to $428 billion, versus $452 billion in the fourth quarter.

- Balances on home equity lines of credit (HELOC) continued their downward trend, declining by $8 billion, to $436 billion.

- The median credit score of newly originating mortgage borrowers increased from 755 to 761.

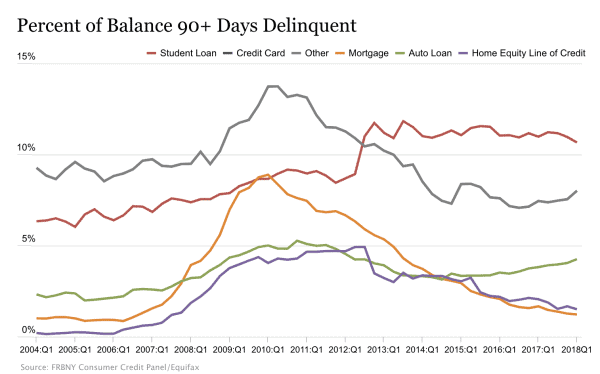

- Mortgage delinquencies continued to improve, with 1.2% of mortgage balances 90 or more days delinquent in the first quarter. The share of mortgages in early delinquency that “cured” by transitioning to current improved to 40.5%, from 35.9% in the fourth quarter.

Speaking to the overall health of the mortgage market, Andrew Haughwout, SVP at the New York Fed said:

“While housing wealth is at an all-time high, it has shifted into the hands of older and more creditworthy borrowers, in part because of tight mortgage lending standards. An increased amount of available home equity should make the household balance sheet more resilient in the event of a financial shock, though that may not be an option for lower-credit borrowers.”

NON-HOUSEHOLD DEBT

- Outstanding student loan debt grew by 2.1%, to $1.41 trillion, from $1.38 trillion at the end of 2017.

- Auto loan balances continued their six-year upward trend, increasing by $8 billion in the quarter, to $1.23 trillion

- Credit card balances declined by $19 billion, or 2.3%, which is consistent with the seasonal pattern.

DELINQUENCIES, BANKRUPTCIES, AND CREDIT INQUIRIES

- Credit card delinquency rates rose by about half a percentage point, with 8% of balances 90 or more days delinquent as of March 31.

- For student loans, 10.7% of aggregate debt was 90 or more days delinquent or in default at the end of the first quarter, a decline of three-tenths of a percentage point from the previous quarter.

- Auto loan delinquency rates edged higher, with 4.3% of auto loan balances 90 or more days delinquent as of March 31, versus 4.1% at year-end.

- About 192,000 consumers had a bankruptcy notation added to their credit reports in the first quarter, the lowest observed in the 19-year history of the data.

- The number of credit inquiries within the past six months—an indicator of consumer credit demand—declined in the first quarter to 146 million, the lowest level seen in the history of the data.

Here is a summary of the developments in household debt across each category:

https://www.newyorkfed.org/newsevents/news/research/2018/rp180517

Error: Contact form not found.