In the final part of our series on measurements of first-time homebuyers, we examine the sustainability of those buyers using Federal Housing Administration (FHA) and Veterans Administration loans, with an emphasis on the former.

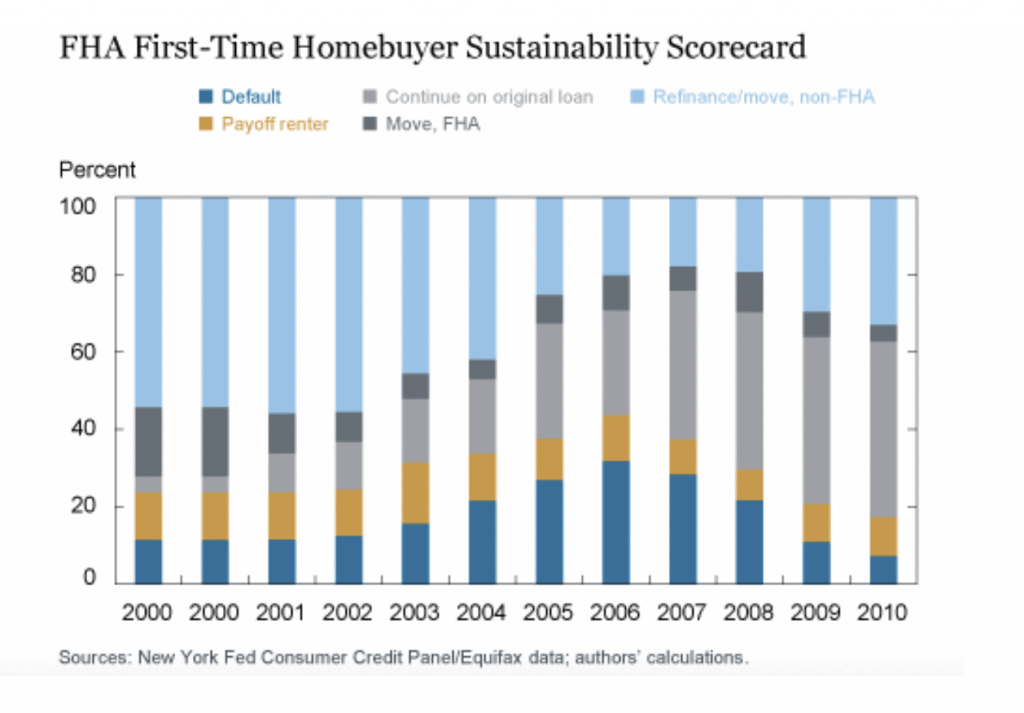

First-time buyers are a big part of FHA programs, and the Federal Reserve Bank of New York developed a first-time buyer sustainability scorecard for FHA loans. It differentiates homeowners by whether they remain with an FHA mortgage or “graduate” out of the FHA program.

This measures whether FHA programs may view more favorably those cases when first-time buyers sold their home, paid off their FHA mortgage, and purchased a new home financed with a non-FHA mortgage, than similar cases when the new home is financed again with an FHA mortgage.

The chart below illustrates an FHA first-time buyer sustainability scorecard. Between 2000 and 2002, about 11 percent of first-time FHA buyers defaulted. Including first-time buyers who return to renting without a default, about one-quarter of FHA first-time buyers were unable to sustain their homeownership.

Between 2000 and 2002, roughly 55 percent of first-time buyers paid off their FHA mortgage and graduated out of the FHA system with their trade-up purchase. The remaining cases are roughly equally divided between households that moved, but again financed their home purchase with an FHA mortgage, and households who did not move and continued to pay down their FHA mortgages.

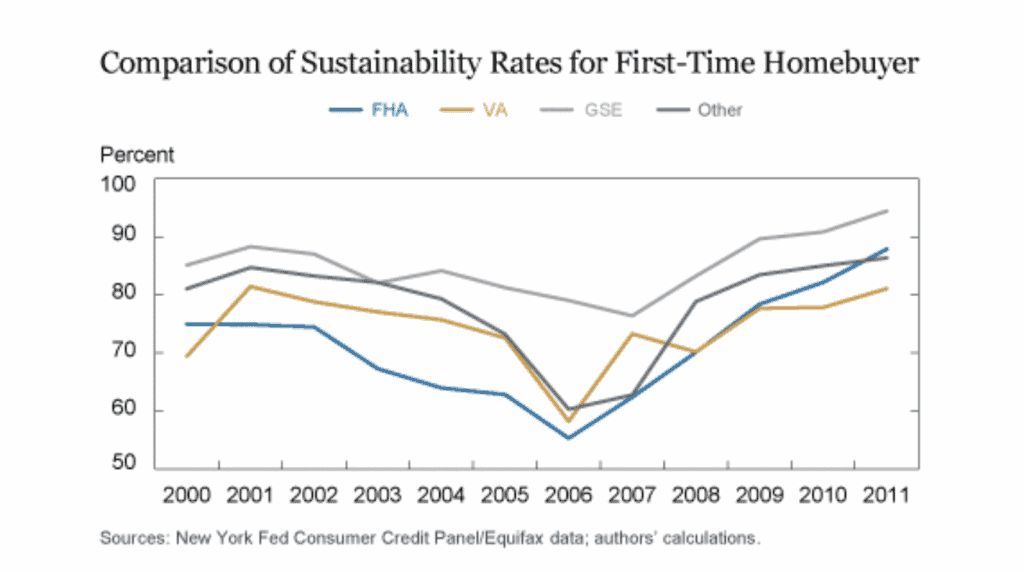

Data from the Fed shows the FHA program has a lower sustainability rate than the average for first-time buyers. In the next chart, we directly examine the sustainability record of first-time buyers broken down by the funder: FHA, Veterans Affairs (VA), Government-Sponsored Enterprise (GSE), and Other, which consists of loans in private-label securities and bank portfolios.

Again, we define the sustainability rate for any category as the fraction of the borrowers who continue to live in their first-time home or who paid off their first-time mortgage, moved, and remain homeowners. With a few exceptions, the sustainability rate of FHA first-time buyers is generally lower than the other three categories of first-time buyers. In contrast, GSE first-time buyers have the highest sustainability rate.

The outcome of the Fed’s study is that analysis indicates sustainability is higher for first-time borrowers with higher credit scores, who are older at the time of the purchase, who purchase in zip codes with higher median income, and who have a larger mortgage.

When we control for these differences across first-time buyers, we find the FHA sustainability is roughly equivalent to the VA, 5.6 percentage points below that for the GSEs, and 5.2 percentage points below Other first-time borrowers.

That is, observed differences between their borrowers explain roughly half of the observed difference in sustainability between GSE and FHA first-time borrowers. However, the FHA/VA programs produce lower sustainability rates, even controlling for these observed differences, through a higher default rate for FHA programs and a higher back to rental rate for VA programs. A likely factor is the down payment, which is typically lower in the FHA and VA programs, and could be an indicator of less liquid borrowers.

There is considerable policy focus on first-time homebuyers. In this series of posts, we have used Federal Reserve data to point out the first-time buyer share has been consistently lower than current measures. We also summarized the characteristics of first-time buyers and how they have evolved. Finally, we evaluated the effectiveness of different mortgage programs for first-time buyers.

We conclude that the FHA/VA programs, on average, produce lower sustainability rates, even accounting for the difference in borrower characteristics.

SOURCE

https://libertystreeteconomics.newyorkfed.org/2019/04/a-better-measure-of-first-time-homebuyers.html