Since the start of the COVID-19 pandemic, Recovery Decision Science has been tracking various aspects of the U.S. housing market (mortgage rates, mortgage applications, home sales) through our TABLEAU PUBLIC PAGE.

We’ve also covered COVID’s impact on both racial and income disparities in housing and household finance, including:

- Income Inequality and the Pandemic Through the Eyes of Mortgage Refinancing

- Income, Race and the COVID Commuting Gap

And, in last week’s post, we affirmed that “Americans Still See Housing as a Good Investment.”

Today, we look at the relationship between COVID and the housing market through the lens of first-time home buyers based on data from the Federal Reserve Bank.

In the early stages of the pandemic, there were marked decline in home sales. But, buoyed by historically-low mortgage rates, and a robust economic recovery in the back half of the year, the housing market rebounded, and was in a much stronger place when the second wave of the pandemic hit.

Still, because of rising home prices and stubbornly-high unemployment rates among younger Americans, many economsts feared that first-time buyers (FTBs) might be blocked in their attempts to enter the housing market.

The economists turned out to be wrong.

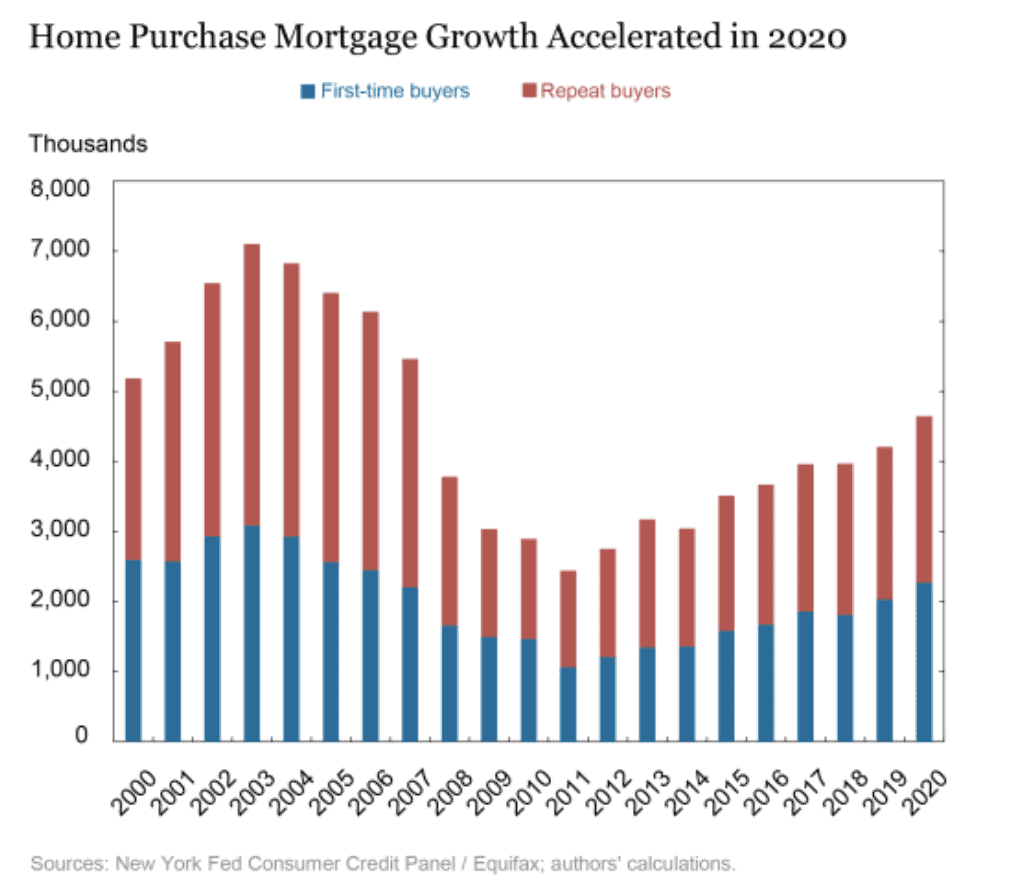

The chart below traces purchase mortgage activity since 2000. The BLUE bar represents FTBs, while the RED bar marks repeat home buyers.

As you can see, there has been a steady increase in purchase mortgages since its low point in 2011. Importantly, in 2020, we saw purchase mortgages increase by 10.5 percent overall, despite a 9.2 percent increase in home prices. This compare so 2019, where we saw a 6 percent increase in purchase mortgages against a 3.6 percent increase in home prices.

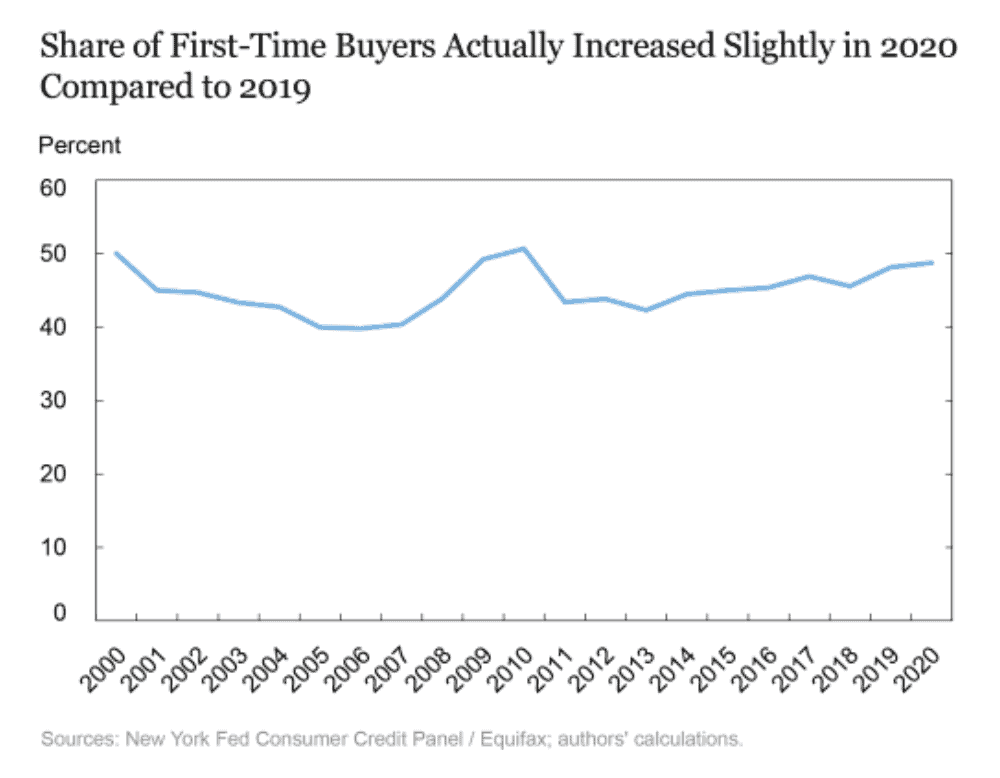

Focusing on FTBs, the chart below tracks the share of FTBs over the past 20 years. Overall, FTB share of total purchase mortgages inched up, from 48.2 percent in 2019 to 48.8 percent in 2020.

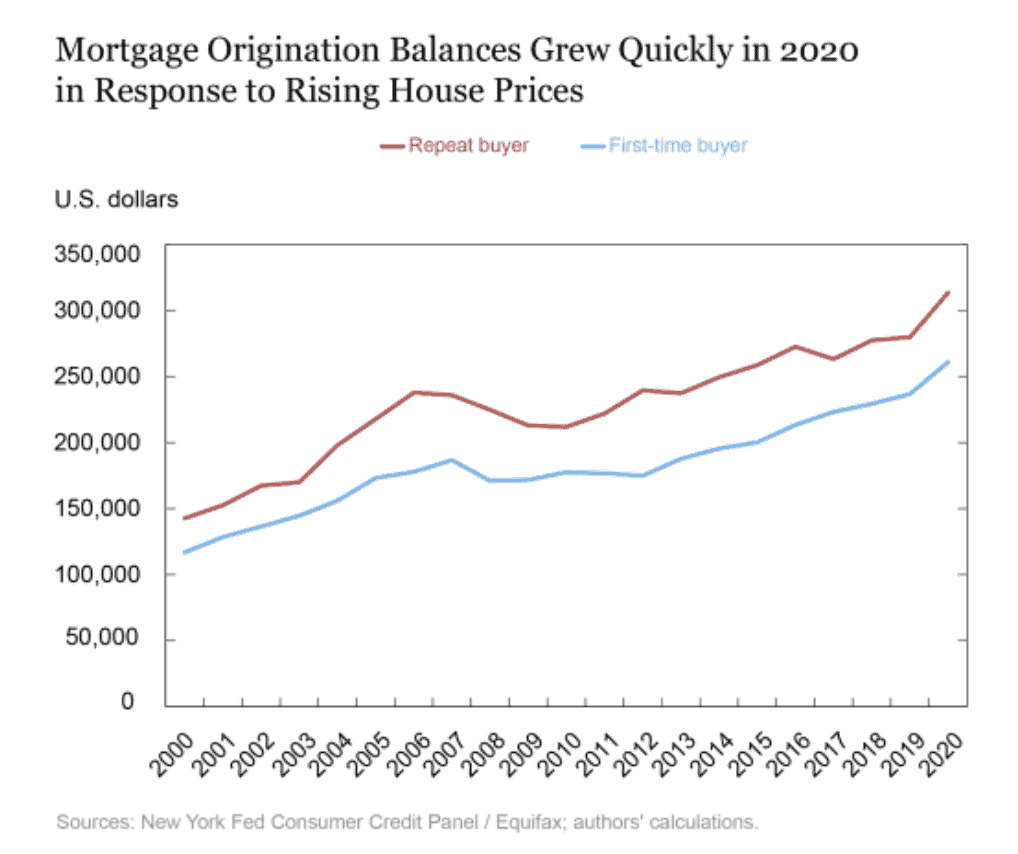

While we saw increase in purchase mortgage activity in 2020 for both repeat buyers and FTBs, the significant increase in home prices meant that both groups are now holding higher mortgage balances, see below. The mortgage balance for FTBs increase more than three-fold between 2019 and 2020, from 3.2 percent to 10.2 percent. But repeat buyers saw their balances increase to 12.1 percent in 2020, after remaining flat in the previous year.

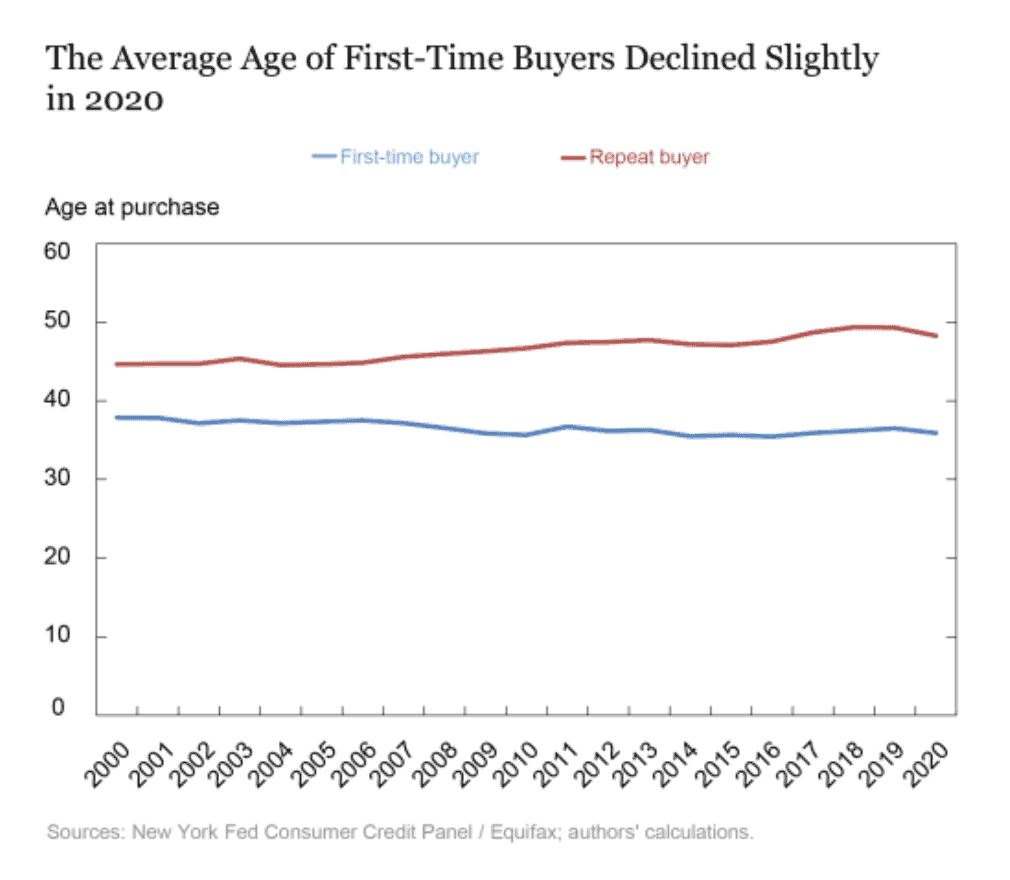

One might assume that the combination of higher home prices and higher unemployment among younger Americans would have pushed the average age of FTBs higher. But as we see below, that did not prove to be the case, as the average age for FTBs actually declined slightly in 2020 to 36.1, from 36.5 in 2019.

There were, of course, other variables that helped drive more, and younger, FTBs in 2020:

- Because of low interest rates, the average, scheduled home payments for FTBs dropped from $1,625 in 2019 to $1,590 in 2020.

- The challenge of affording a down payment for higher-priced homes was somewhat offset by healthier economy, and, in particular, a continuing bull market that drove equities (and potential down payments) higher.

- Pandemic-related stimulus checks, along with federal student loan forbearance strengthened the budgets sheets for many FTBs.

Because of widespread economic disruption and instability caused by COVID-19, it would have been safe to assume that potential first-time buyers may have opted to sit out 2020. But as we above, that was not the case. Low interest rates, a generally-robust economy (post-initial COVID shock) and various forms of government stimuli, turned out to make 2020 a great year for FTBs to jump into the housing market.

SOURCE:

To learn more about Recovery Decision Science contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261