With this post, we continue our series predicting quarterly consumer loan charge-off rate.

PREDICTIONS FOR NEXT 4 QUARTERS

The Federal Reserve is expected to issue the charge-off and delinquency rates for the 4th quarter of 2016 on or about February 18. In this post, we’ll predict the 4th quarter rate using our proprietary model. Also, we will offer predictions for the following three-quarters.

As reported previously, charge-off rate trends declined during 2015 and 2016. But we expect this trend to reverse in the coming year as the Federal Reserve gradually increases the discount rate. We already see that mortgage rates have increased since a year ago. In general, we expect the cost of borrowing to increase in the coming year, thus forcing up the charge-off and delinquency rates.

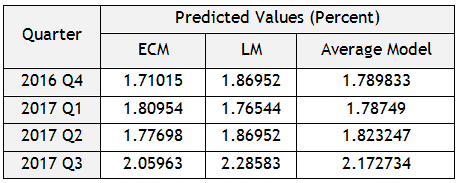

Below is a table projecting charge-off rates for the coming four quarters, followed by a graph illustrating charge-off rates from 1st quarter 2008, immediately before the start of the Great Recession:

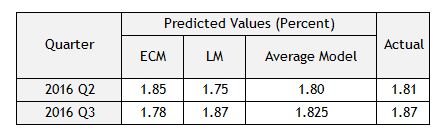

As a reference, RDS uses a proprietary Error Correction Model (ECM) to predict trends in the charge-off rates. Using Co-Integration To Predict Consumer Charge-Off Rates.

ECM focuses on short-run dynamics, while LM focuses on long-run movements. In looking at the most recent reported quarters, you can see the average of both models have showed decent performance on previous predictions:

For now, we stick by our projections for the coming year but will continue to monitor events and modify these projections accordingly.