According to a study by the Federal Reserve Bank of St. Louis, the rate of home ownership has finally stabilized post-Great Recession, but the number of Americans renting properties is at a level not seen since the late 1980s.

The St. Louis Fed’s Center for Household Financial Stability reports nearly two in five households continues to rent, up from 31.2 percent in 2006 to 36.6 in 2016.

U.S. homeownership rate peaked in 2004, with rates declining until 2016. The share of Americans renting steadily increased as many people lost their homes during the economic downturn.

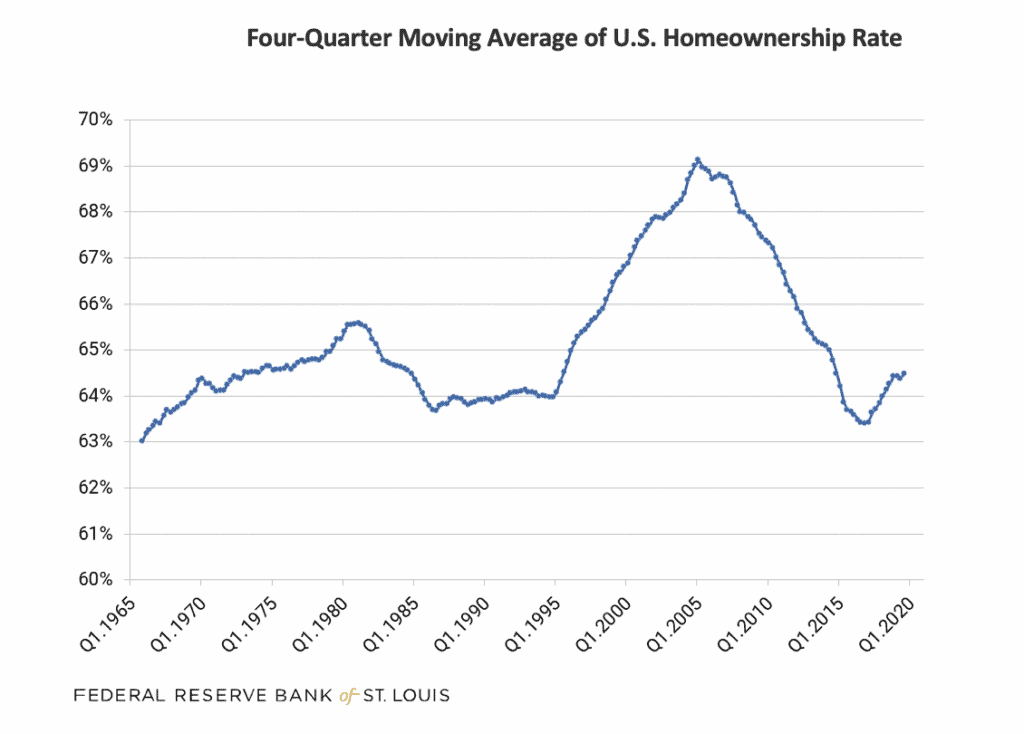

The graph below shows a moving average, or the average of the previous four quarters, of the home ownership rate, beginning in the first quarter of 1965 at 63 percent.

During the mid-1990s values were around 64 percent, climbing to a peak of about 69 percent in 2004. The rate then declined during and after the financial crisis before starting to rise again about three years ago. In the third quarter of 2019, the moving average was 64.5%.

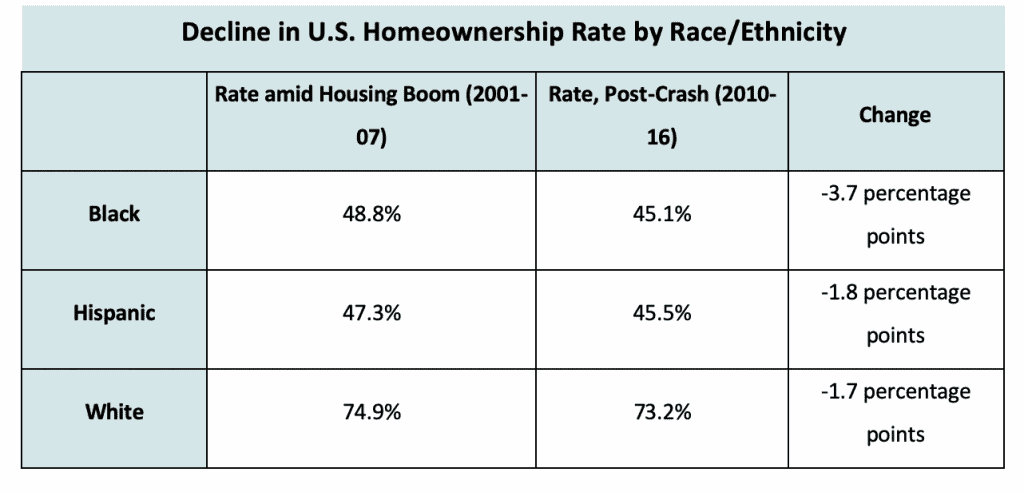

The decline in home ownership rates among black and Hispanic households between 2007 and 2016 was greater than it was for white households, dropping to the lowest averages in over 50 years.

In addition to race and ethnicity, the Fed also examined renting households across generations.

Not surprisingly, young adults, who lack financial resources to be homeowners, comprise the majority of renters. Most U.S. households headed by someone under age 35 today are renters.

The rising cost of higher education, the job-market impact of the Great Recession, and rapidly-rising house prices in some areas also may have pushed more young people into renting in recent years.

One major finding from the Fed study focuses on U.S. households that are considered “housing cost burdened,” meaning that they spend 30% or more of their income on housing costs.2

The study found that middle-income renters are increasingly housing cost burdened but mid- to higher-income homeowners are experiencing fewer housing affordability challenges.

These trends may reflect “sorting” of households between renters and homeowners, as potential homeowners and those who were foreclosed on during the financial crisis likely have been self-selected out of the homeowner pool and into the renter pool.

The Fed doesn’t predict the high percentage of Americans in rentals to last forever. Construction is tapering off for both apartments and single-family homes. An interesting twist in the market is the trend of single-family housing stock turning into rentals: Single-family rentals have been gaining attention from both renters and companies scooping up foreclosures the last 10 years. These attractively-priced homes are targeting moderate-income home hunters who are ready to get out of apartment-style living.

Nonetheless, there remain significant barriers to entering or re-entering the home ownership market. The St. Louis Fed researchers cautioned that prospective buyers should not look at a first-time home purchase as an investment to make unless they are financially stable.

While prospective first-time borrowers who have built a substantial nest egg, perhaps for a down payment, may find the dream attainable, those who were foreclosed on during the housing crisis are likely to continue to fall short.

Homeownership should be treated as a ‘capstone’ financial event, not a first step, concluded the Fed research. Families should focus on building a diversified balance sheet, lowering consumer debts and increasing liquid savings in order to be better prepared for successful homeownership.

SOURCE

https://www.stlouisfed.org/open-vault/2019/november/homeownership-rate-new-normal