As we wrap up our series on the Federal Reserve Bank of New York’s 2017-2018 Report on the Economic Well-Being of U.S. households, it’s fitting we conclude with a look at retirement planning and savings.

Gone are the days in which Americans spent their entire careers at one company. Reaping pensions and even company-matched 401(k) funds aren’t as common as they once were, so it’s no shock to find many of the survey respondents express concern about their fiscal preparedness for retirement and old age.

More than two-fifths of survey respondents believe their retirement planning is not on track. A full quarter of respondents still in the workplace indicate they have no retirement plan at all.

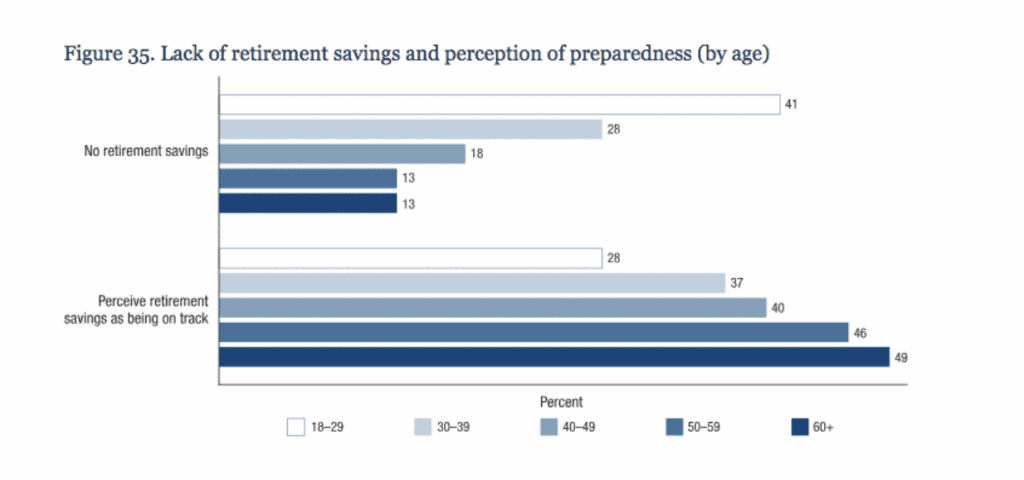

Older adults are more likely to have retirement savings and to view their savings as on track than younger adults. Nevertheless, even among non-retirees in their 50s and 60s, one in eight lacks any retirement savings and less than half think their retirement savings are on track

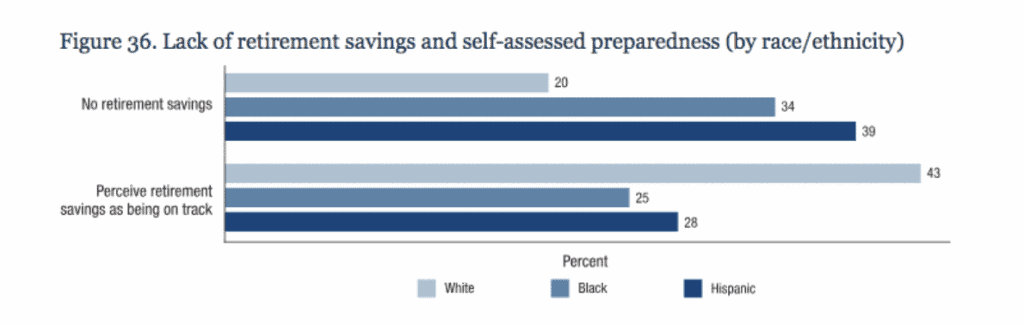

Holding true to many of the other metrics of financial well-being we’ve examined in our series, race and ethnicity plays a large factor in retirement planning as well. The chart below clearly outlines that white adults are far more prepared for retirement than blacks and Hispanics.

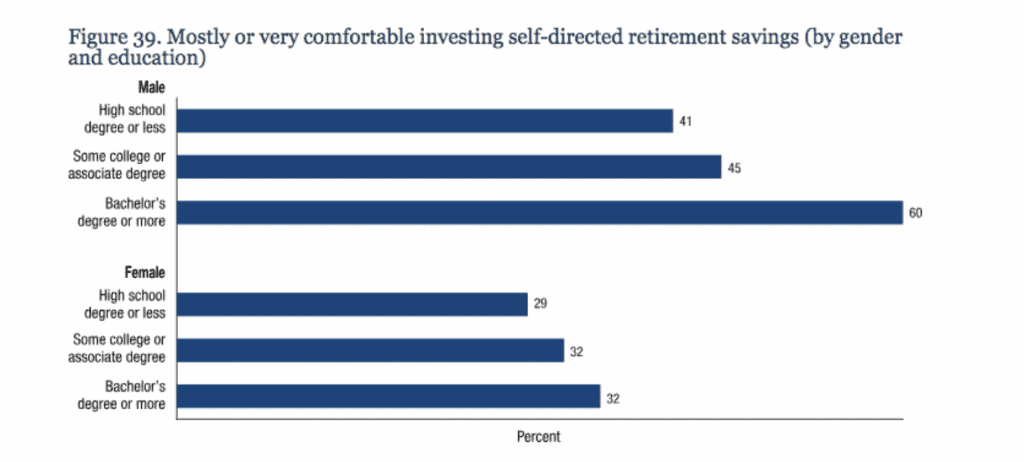

This leads into our next point: three-fifths of the non-retired survey respondents with self-directed savings accounts – think 401(k)s or IRAS – have little comfort managing their investments. Those who attained higher educational levels – again, no surprise – were vastly more comfortable managing their savings and men expressed more comfort than women.

Clearly, financial literacy is tied to overall education. As we’ve noted in earlier pieces on this study, a portion of the respondents [SA1] typically have a higher earning potential with more education and likely receive a correspondingly higher level of training on money management.

In 2017, half of retirees participating in the survey retired before age 62 and another quarter retired between 62-64. Interestingly, more black and Hispanic respondents reported retiring before age 62 (58 and 55 percent, respectively), than whites, of which 48 percent reported early retirement.

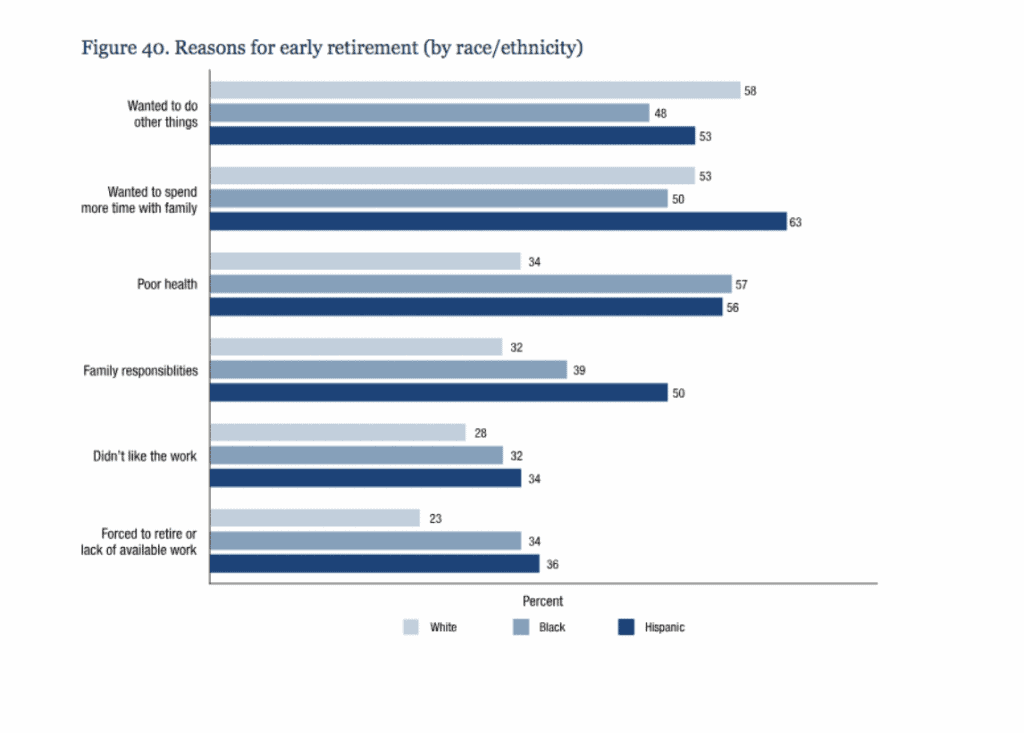

In considering the reasons for early retirement, the chart below is telling. Note the largest percentage of white respondents in early retirement reported a desire to do other things besides working. For black and Hispanic early retirees, poor health and family responsibilities – including the simple desire to spend more time with family – took precedent.

For context, we wanted to share one note on how the survey sample was drawn. Fed researchers contacted 22,355 participants over the age of 18, of which 12,246 participated. Surveyors over-sampled individuals with a household income of less than $40,000 or, in layman’s terms, drew more heavily on that group to ensure lower-income households would be represented.

SOURCE