In the first post of this series, we introduced the idea of Financial Invisibles, those people who don’t use traditional banking tools or fully participate in the financial system.

As a brief review, Unifund and PYMNTS.com conducted a study in August 2017 and updated it in early 2018. The study surveyed more than 2,000 people and divided Financial Invisibles into four groups: No Worries, Second Chances, On the Edge, and Shut Outs. In short, the former two categories have the ability to participate in the financial system (Voluntary Invisibles) and the latter two do not (Involuntary Invisibles).

To provide better context, here is another breakdown of those considered Financial Invisibles, in comparison to the control group for the study, Financial Visibles.

In this post, we examine those who comprise the bulk of the Involuntary Invisibles, the Shut Outs and On the Edges, to assess the qualities that characterize them, why they are shut out of the financial system and what keeps them from utilizing traditional financial tools.

Although all the individuals surveyed were considered low income, both the two lowest sample groups have much lower incomes than the two top groups and are more likely to not hold jobs.

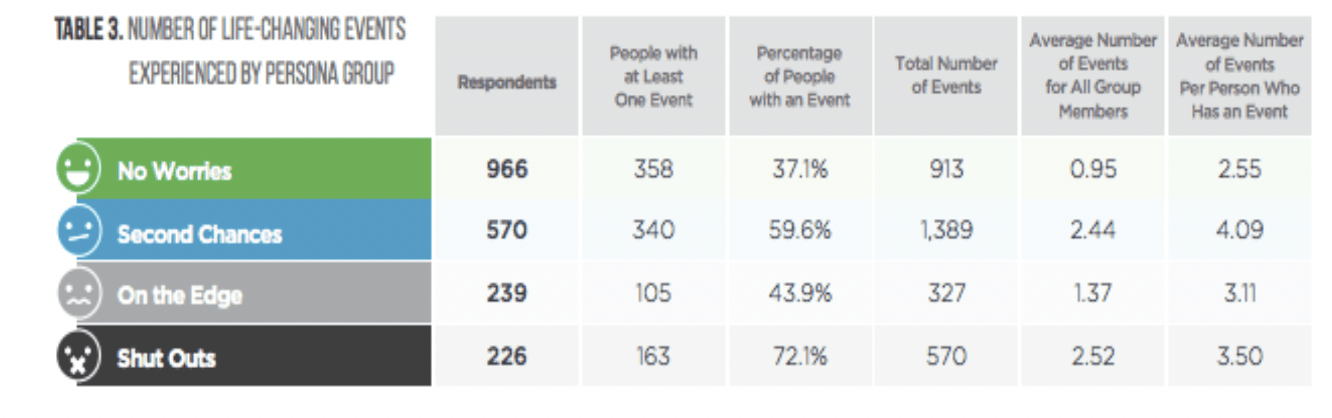

More than in any other group, personal trauma and life-altering events affect the people who comprise Shut Outs, a clear indicator that events such as divorce or a death in the family have significant financial ramifications. Shut Outs are twice as likely as the vastly more secure No Worries group to have experienced a personal crisis, by a margin of 72.1 percent to 37.1 percent. Further, most people who report having at least one life-altering event have more than one, creating a cumulatively disastrous effect on personal finances.

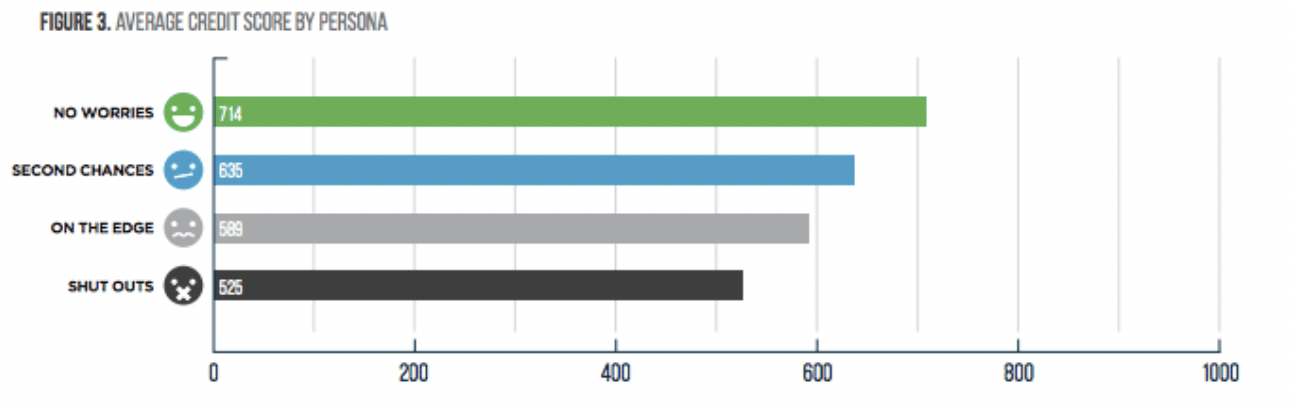

As the graph below shows, average credit score declines based on the personal challenges faced in each group. With an average credit score of 525, Shut Outs are 191 points below the 714-average posted by the No Worries Group, while On the Edge averaged 125 points lower.

A look into patterns of debt and bill-paying make it clear why credit scores are much lower for these two groups. As the figure below demonstrates, 85 percent of people characterized as Shut Outs say they live from paycheck to paycheck and 68 percent of On the Edge report they do. This is significant even given other recent studies finding that 46 percent of Americans report they would not be able to cover a $400 emergency expense.

For Shut Outs, medical expenses make up the bulk of debt at 42 percent of all incurred debt. On the Edge reported an even higher percent – 48 percent – of debt resulting from medical costs.

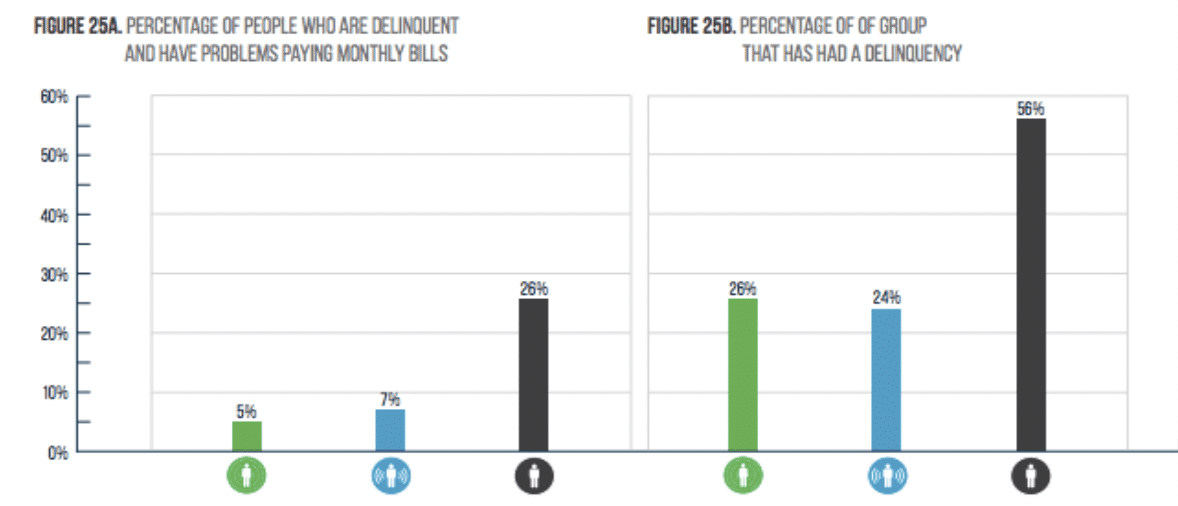

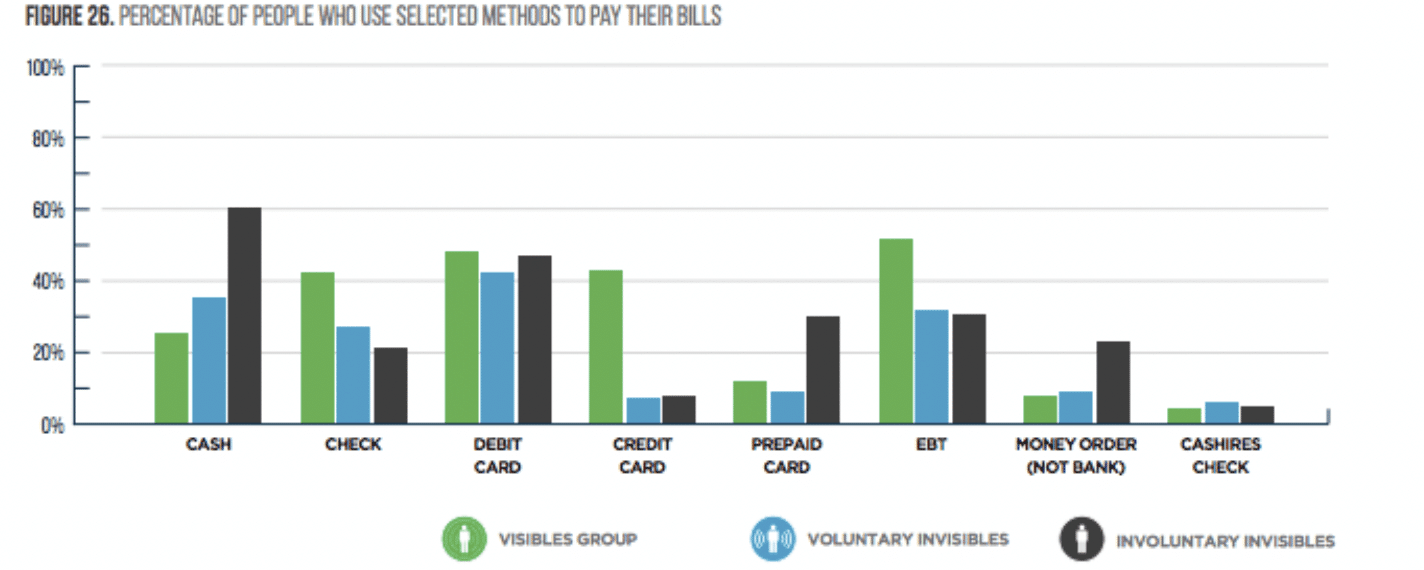

Also resulting from high debt and contributing to low credit scores for the two groups in question are delinquencies in paying bills. (Note: in the figure below, the black bar represents the Involuntary Invisibles – those who want to participate in the financial system but cannot and includes the Shut Outs; the blue bar represents the Voluntary Invisible, or those who can participate but opt not to; and the green bar represents the Visibles, or those who can and do participate in traditional banking and financial systems.)

Our final graph shows what mechanisms these three groups rely on to pay bills. As demonstrated below, Visibles are more likely to pay using credit cards or checks. The Involuntary Invisibles, who are not able to get credit cards and are less likely to have bank accounts, are more likely to pay with cash or prepaid cards.

In the next installment of our series, we will examine the top tiers of the Unifund and PYMNTS.com study to review how the comparatively better-off No Worries and Second Chances groups deal with debt and bill payment.