A consistent theme at this fall’s industry conferences (DCS, NARCA, etc.) is the concern over a lack of volume. In fact, it’s probably fair to say this has been a consistent theme at conferences for the past five years! Portfolios are in short supply. And there continue to be tight restrictions on re-sale of existing portfolios. It’s impossible to predict if things will change with regard to new volume entering the marketplace. Some see the market loosening up, but nobody expects things to return to how they once were.

So, what to do in the absence of significant volume? That’s simple: work what you already have. What we’re finding is that there is considerable value that can be realized from existing portfolios. But it takes some digging and an acceptance that the old (i.e. low cost) way of doing things will not work to find the value within your current portfolio.

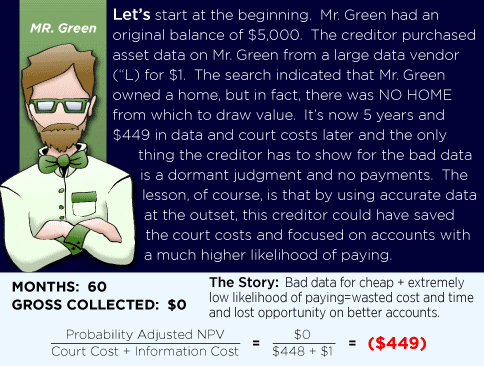

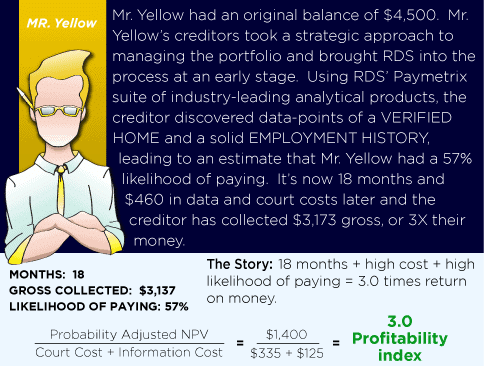

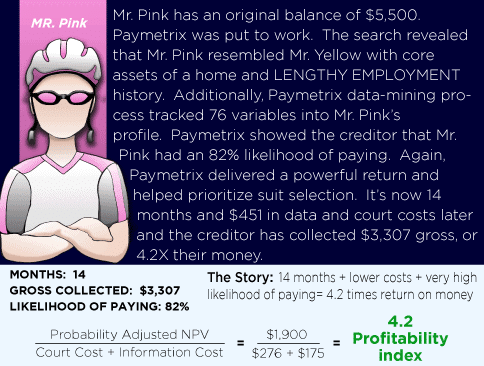

The key to success in searching for more profitable treatments lies in the value of your data. Much of what passes for “verifiable” data is old and often inaccurate. In truth, bad data had on “the cheap” often results in wasted court costs and nothing to show over time.

THREE STORIES

Perhaps the best way to illustrate our point is to share three stories that reinforce the importance of starting the process with good data. The following profiles are actually composites of treatments we’ve worked on over the years. These are real numbers that tell a story about the significance of data when it comes to uncovering value in existing treatments.

As these stories reveal, an investment in solid, verifiable data pays tremendous dividends, in a relatively short amount of time.

The volume challenge is not going away soon. But the ability to derive value and significant profits out of dormant portfolios exists today. These dormant portfolios represent billions in untapped potential that is waiting to be revealed.

Error: Contact form not found.