In a recent Price Waterhouse Cooper (PWC) study, 73% of financial sector executives perceive traditional consumer banking as the one industry most likely to be disrupted by advances in fintech. New fintech entrants see opportunity in disaggregating the components of traditional banking and offering targeted solutions with both servicing to both consumers and businesses.

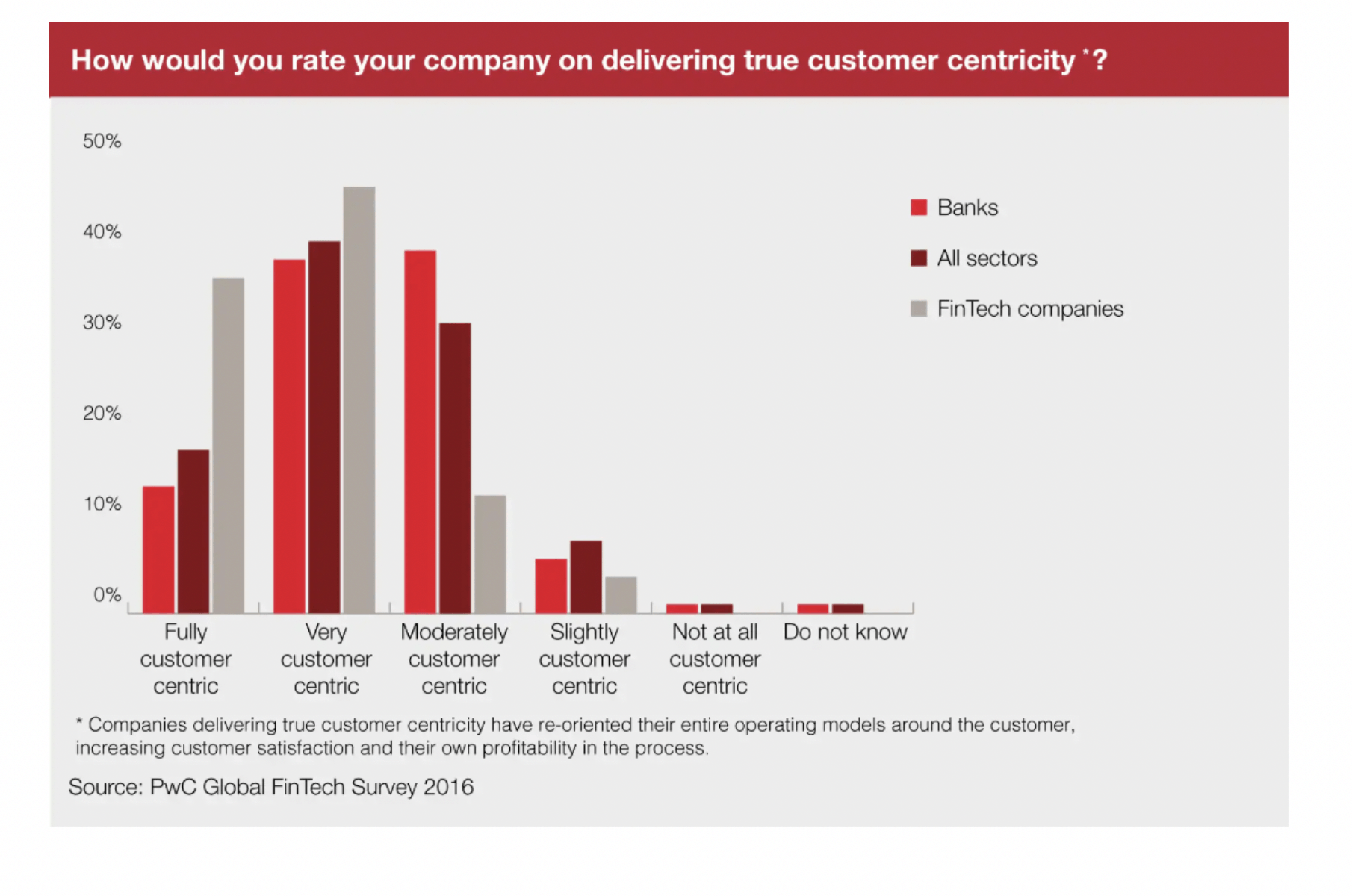

Traditional banks acknowledge they are still in the early stages of customer-centric solutions when compared to many fintech offerings. As the table below shows, 53% of banking-sector respondents believe they are consumer-centric, compared to 80% of fintech respondents.

According to the PWC survey, over the next five years, channel diversification will be the key driver in the banking sector:

- Over 90% of banks expect growth in the usage of mobile applications, much higher than any other financial sector

- 82% of respondents predict fast-paced increases in usage of web-based platforms

- More than half (53%) of respondents said they currently offer a mobile application to their customers, with another 18% having one in development.

The remainder of this post focuses on some of the significant ways in which fintech is changing how Americans approach personal finance.

ATMs

ATMs are still a popular and efficient way for Americans to handle their banking needs. Despite the fact that ATM withdraws have been flat in recent years at 5.8 billion transactions, ATM operations still are valued at over $700 billion.

Looking to the future, top banks are making major strides in redefining the ATM experience.

Chase has unveiled its new eATM in more than 1,500 branches across the country. Chase’s eATM eliminates the need to carry a debit card in two ways:

- By using the bank’s app on their phone. In using the app, customers request an access code they can then enter on the eATM. In other words, it is a temporary pin that changes with each transaction.

- By using a mobile wallet such as Apple Pay or Android Pay. Using near field communication (NFC), the customer can hold a phone to a reader and the two communicate with each other without any contact. A thumbprint verifies the customer’s ID on the mobile device and enables access to the ATM.

Both Bank of America and Wells Fargo are also launching their own NFC-enabled ATMs.

Citibank is taking NFC to another level. In partnership with ATM maker Diebold, it is testing an ATM that will confirm your identity through your eye. Diebold’s Renee Murphy said: “Iris scans are only second to DNA in security-even identical twins have different irises.”

DIGITAL WALLETS

According to Experian, digital payments grew to more than $720 billion in 2017. But because Americans still feel more comfortable with traditional financial devices such as credit cards, mobile payment methods like Apple Pay and Google Pay are lagging in their adoption rates. In fact, according to eMarketer, it’s only been in the last year that digital wallet spending surpassed $1,000 on average, per person.

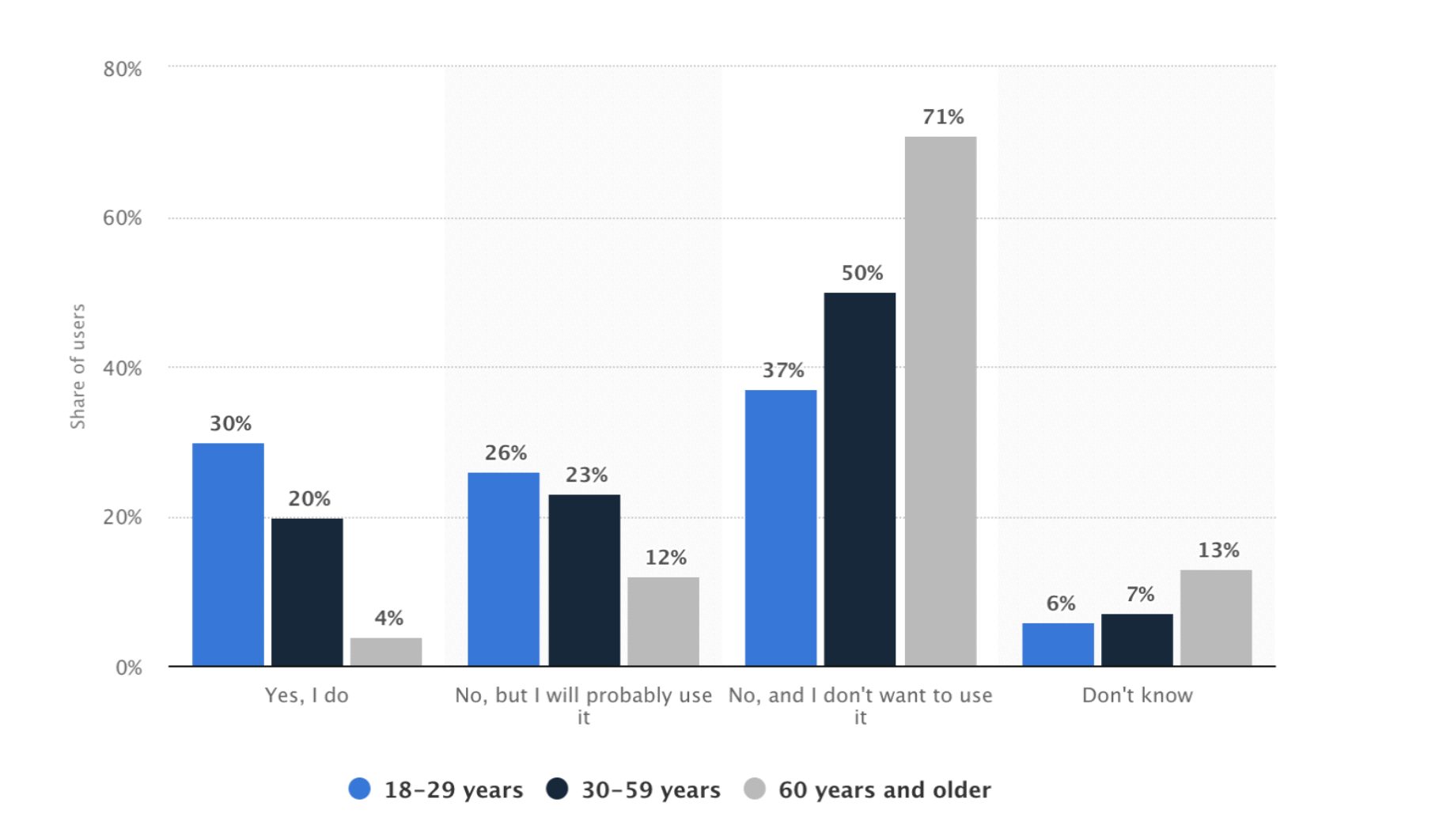

Not surprisingly, mobile-friendly millennials are adopting wallet technology at a much faster rate than older generations. The chart below from Statista shows the share of online consumers in the United States who use digital wallets as of May 2017, by age group:

More than 1 in 10 millennials use their digital wallet for EVERY purchase. By contrast, Experian reports that 55% of all consumers are sticking with traditional debit/credit cards because of safety concerns. According to the American Banking Association, only 12% of American consumers trust alternative payment providers to protect their payments.

What’s ironic, of course, is that banking on mobile devices is considered more secure than online banking. This is because mobile operating systems use “sandboxing architecture” which isolates individual apps from malicious malware.

ARTIFICIAL INTELLIGENCE (AI)

The financial services industry has been heavily invested in evolving AI capabilities and applications. Cognitive computing, chatbots, personal assistants, and machine-learning all have become standard tools in the customer service efforts of many financial institutions.

But AI is a broad-ranging term that covers myriad financial applications. Following are the most transformative uses of AI in banking and finance:

- Risk Assessment: Because the basis of AI is learning from past data, it has a natural application for assessing creditworthiness. Today, general credit scores are used to group people in broad categories, namely “haves” and “have-nots.” But through AI, data about each individual’s loan repayment habits, the number of loans currently active, the number of existing credit cards, etc., can be used to customize the interest rate of a specific card. This results in reduced credit risk while also maximizing revenue and profitability.

- Fraud Detection: AI can use past spending behaviors on different transaction instruments to point out odd behaviors, such as using a card from another country just a few hours after it has been used elsewhere. AI also can detect an attempt to withdraw a sum of money that is unusual for the account in question.

- Financial Advisory Services: According to the aforementioned PWC study, we will be dealing with more “roboadvisors” in the future. A roboadvisor is a method to automate the asset allocation of investments via a computer algorithm. In a broader sense, a roboadvisor may also include human financial advisors but only for services that require human assistance (e.g., taxes, retirement or estate planning).

- Trading: Through AI, machines can be taught to observe patterns from past data and predict how these patterns might repeat in the future. For example, depending on individual risk appetite, AI can suggest portfolio solutions to meet each person’s demand. The riskier your appetite, the more you might be willing to lean on machine learning for decisions to hold, buy or sell stocks.

- Managing Finances: PFM (personal financial management) is a recent development on the AI-based Wallet. Started by a San Francisco-based start-up, Wallet uses AI to build algorithms to make consumers make smart decisions about their money. The app accumulates all the data from your web footprint and then creates a personalized spending graph.

The PWC study concludes that competition between banks and new entrants may give way to direct collaboration across the fintech ecosystem:

“In such cases, both parties should profit. Potential opportunities span from product design and development by start-ups to distribution and infrastructure capabilities by banks.”

SOURCES

https://medium.com/the-mission/how-fintech-is-changing-banking-1d67de03b3cd

https://www.nerdwallet.com/blog/banking/this-is-the-atm-of-the-future/

https://www.cnbc.com/2018/03/02/digital-wallets-are-safe-yet-americans-remain-wary.html

https://investorjunkie.com/35919/robo-advisors/

https://www.statista.com/statistics/315961/us-digital-wallet-users-age-group/