The prime benchmark of The American Dream is homeownership, but, increasingly, the transition from renting to owning is difficult.

First-time home buyers often struggle to meet down-payment requirements while also paying rent, while repeat buyers can trade on the equity in their current house to trade up on a purchase. Repeaters also have an easier time qualifying for a mortgage if they’ve already successfully made payments on a prior mortgage.

With this post, we embark on a multi-part series on first-time home buyers using data from the Federal Reserve Bank of New York. First, we discuss the Fed’s measure of first-time buyers and review trends since 2000.

The Fed’s Consumer Credit Panel (CCP) is a five percent random sample of U.S. households with credit files derived from Equifax. With the CCP, the Fed follows the credit files of household members, identifying mortgage liens as Federal Housing Administration (FHA), Veterans Administration (VA), securitized by one of the government-sponsored enterprises (GSEs), or “other” (including privately securitized and bank portfolio loans).

For each mortgage, the data indicate the current balance and the payment status as of the end of that quarter.

Use of the CCP creates a clean identification of first-time home buyers as it looks at the entire history of a household’s credit file back to 1999 in conjunction with information indicating the age of the oldest mortgage—both open and closed mortgages—on the credit report.

A first-time buyer is defined as the first appearance of an active mortgage since 1999 with no indication of any prior closed mortgages on the borrower’s credit report. The analysis begins with the 2000 cohort of first-time buyers and ends with the 2016 cohort.

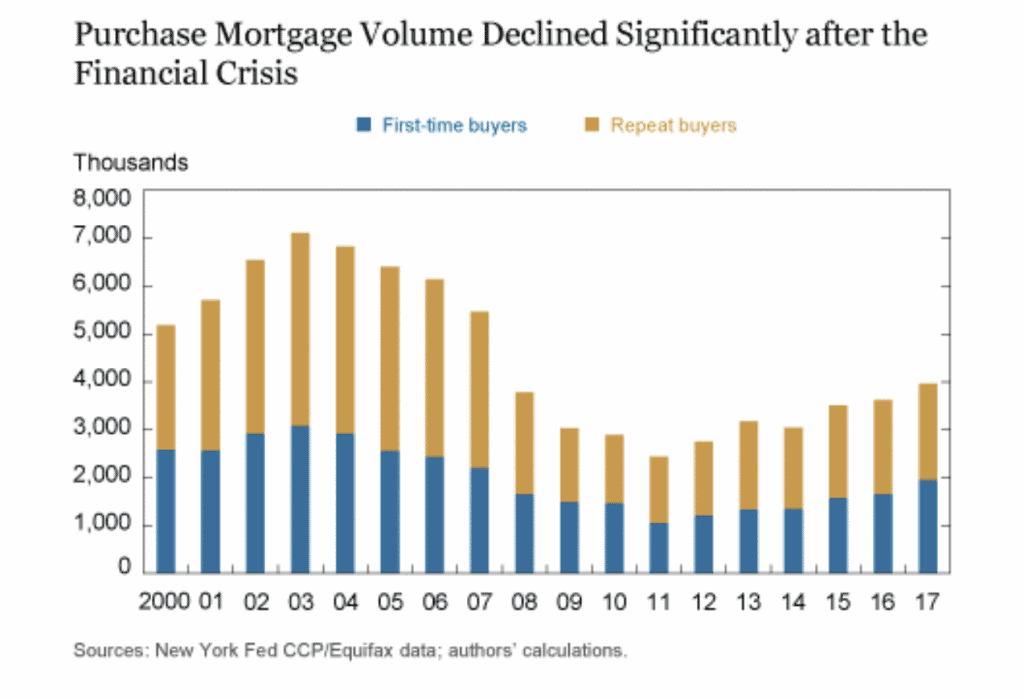

We focus only on first-time buyers as a percentage of new purchase mortgages since refinance mortgages are not associated with new housing transactions. The chart below shows the annual flow of purchase mortgages, broken down by first-time and repeat buyers.

As is evident, the volume of purchase mortgages peaked in 2003 at more than seven million. Note that this peak volume was three years before the peak in house prices. Starting in 2004 and continuing through the financial crisis, purchase mortgage volume declined, reaching a level of around 2.4 million mortgages in 2011—about a third of the peak volume. Since 2011, there has been a slow recovery in purchase mortgage transactions, with the volume exceeding 3.5 million in 2015 and 2016.

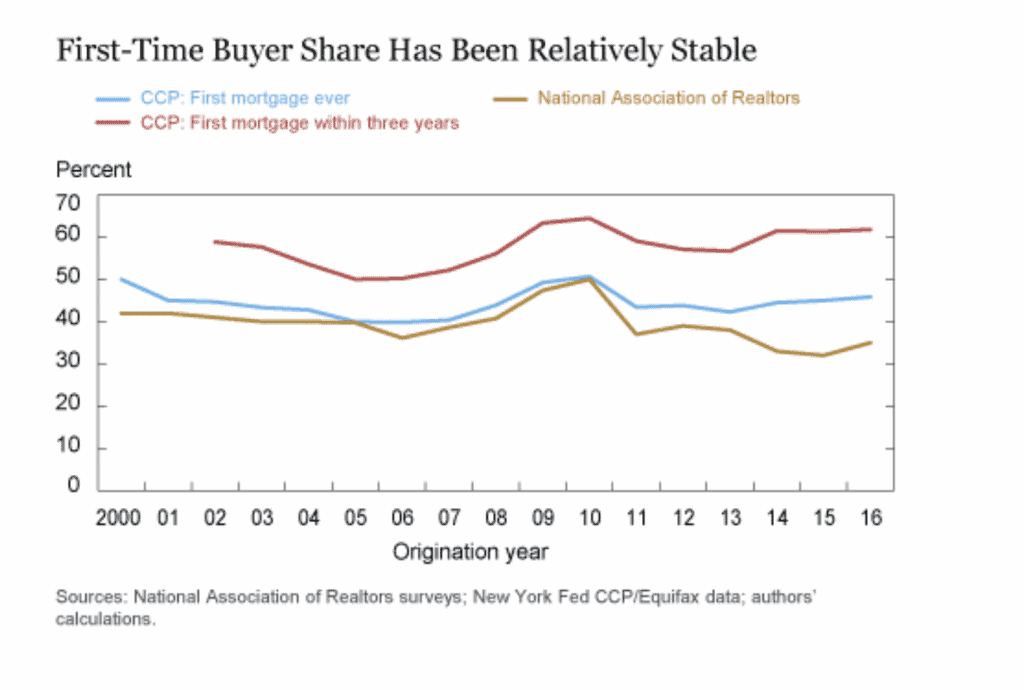

The chart below shows first-time buyers as a share of overall purchase mortgages by year using data from the CCP and the National Association of Realtors (NAR). Despite the rapid increase in house prices in the early 2000s, according to the CCP data, the first-time share declined only slightly, from 44 percent in 2001 to 40 percent in 2005.

As house prices declined during the housing bust, the first-time share increased and exceeded 50 percent in 2010. Over the next three years, the first-time share trended back down into the mid-40s. Since 2013, the first-time share edged higher, reaching 46 percent in 2016. Note that when we recalculate the first-time share using the official three-year look back, we consistently get a higher share, by around ten percentage points.

The NAR survey measure of the first-time share closely tracked the CCP share from 2001 to 2010. Since then, however, the NAR first-time share has fallen below the CCP share, with an 11-percentage point gap emerging in 2016. The recent NAR data could convey concern about credit availability for first-time buyers, as evidenced by their apparent declining share. However, this decline is not present in the CCP data.

Using this measure from the Fed of first-time homebuyers to analyze dynamics, we can see that despite the ups and downs of the housing boom and bust, market share of first-time buyers remained similar in 2016 to the early 2000s.

In our next post, we will take a look at the changing characteristics of first-time buyers themselves over time.

SOURCE

https://libertystreeteconomics.newyorkfed.org/2019/04/a-better-measure-of-first-time-homebuyers.html