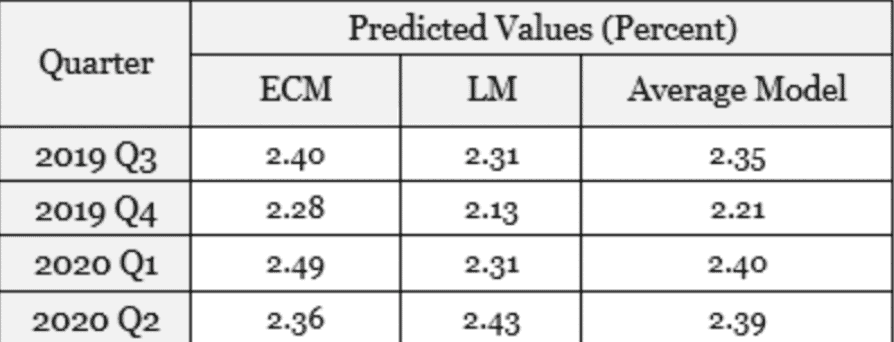

The Fed should issue the charge-off and delinquency rates for the 3rd quarter of 2019 sometime during the week of November 18.

As we’ve done for each of the past 13 quarters, Recovery Decision Science has developed a predictive analysis of the soon-to-be-reported value of charge-off rates on all types of consumers loans through the 1st quarter of 2019.

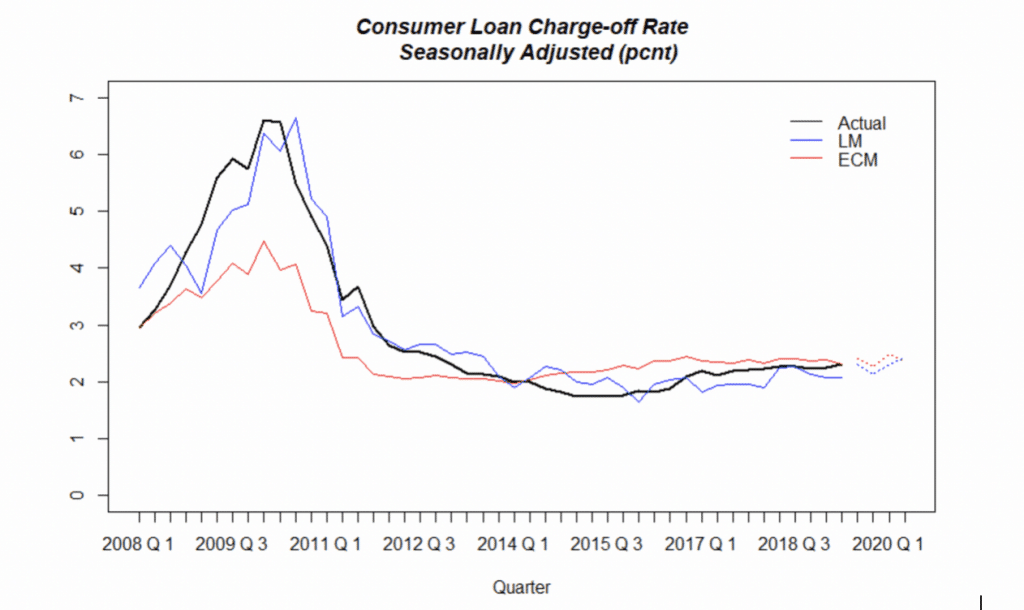

As a reference, RDS uses a proprietary Error Correction Model to predict trends in the charge-off rates. For a more in-depth understanding of the ECM, check out this earlier post.

A few notes on our new report:

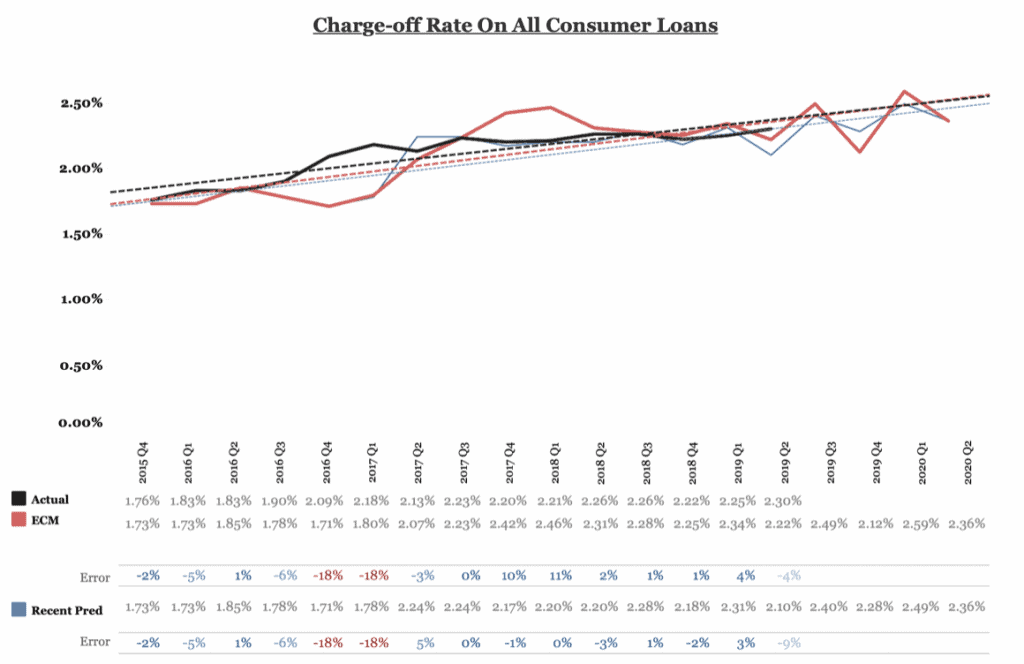

- We continue to see a steady and small upward trend, with the overall charge-off rate hovering at about 2%, with a high end of 2.5%.

- If everything stays the same, it does not seem likely to reach 3% by the end of this year

- We are seeing similar trends with regard to the delinquency rates.

- Importantly, our model does not consider exogenous factors that could influence the U.S. economy, such as: domestic political shocks or economic breakdowns, or global economic shifts that could impact confidence in the dollar.

- Looking historically:

- The consumer loan charge-off rate bottomed off in 2015.

- The rate has been rising since 2015, but at a steady pace.

- The charge-off rate has been above 2% since Q42016.

- Our model continues to show a steady rise in the coming quarters.

Here is also the performance of our ECM model and its projection:

The above chart is from a Tableau visualization. Here is its link

https://public.tableau.com/profile/hamed#!/vizhome/Charge-offRate/Chg-offRateForecast?publish=yes