The Fed should issue the charge-off and delinquency rates for the 2nd quarter of 2019 on or about August 18th.

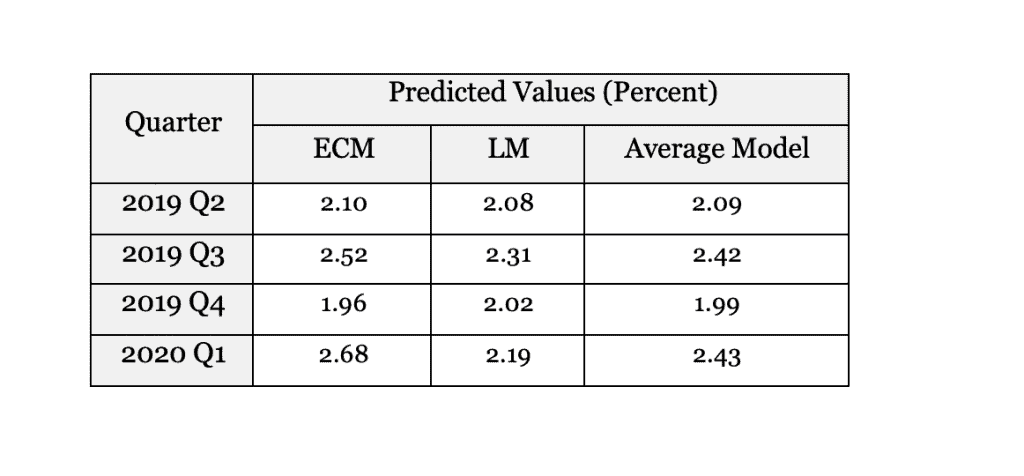

As we’ve done for each of the past 13 quarters, Recovery Decision Science has developed a predictive analysis of the soon-to-be-reported value of charge-off rates on all types of consumers loans through the 1st quarter of 2019.

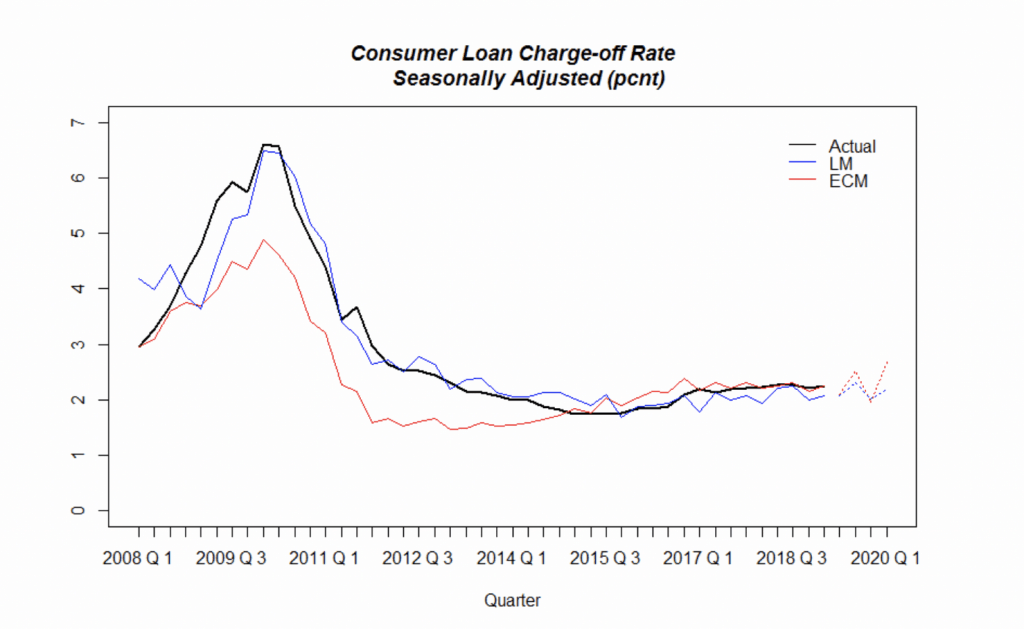

As a reference, RDS uses a proprietary Error Correction Model to predict trends in the charge-off rates. For a more in-depth understanding of the ECM, check out this earlier post.

A few notes on our new report:

- Our current prediction is that the new charge-off rate will be 2.10%. The average estimated charge-off rate based on previous predictions (using our ECM model) is 2.22%.

- Last quarter, Q12019, our predictions were, respectively, 2.31% and 2.34%. The actual charge-off rate came in at 2.25%

- Looking historically:

- The consumer loan charge-off rate bottomed off in 2015.

- The rate has been rising since 2015, but at a steady pace.

- The charge-off rate has been above 2% since Q42016.

- Our model continues to show a steady rise in the coming quarters.

- Of course, as always is the case, we continuously watch our indicators to gauge the possible impact of an economic shock (that could be caused by non-financial reasons) on our model.

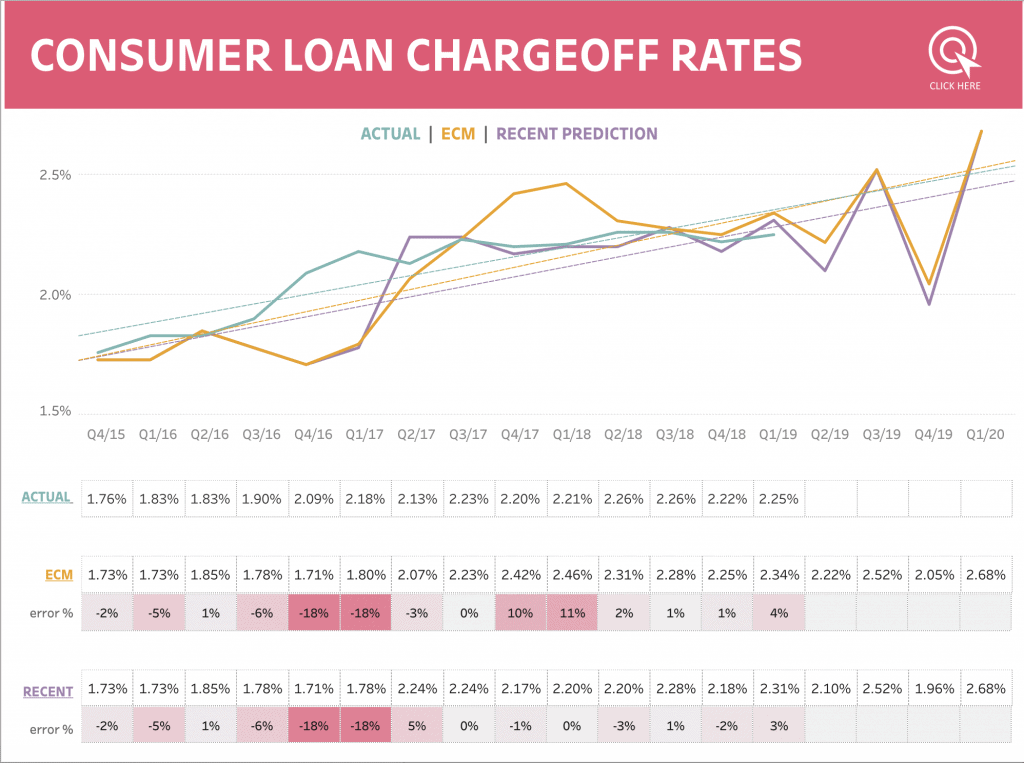

Here is also the performance of our ECM model and its projection:

The above chart is from a Tableau visualization. Here is its link