Today’s post is the second of a two-part series on economic inequality in the COVID era, based on a recent study published by the Federal Reserve Bank of New York.

To reiterate the point we made in the first post, the Fed has two primary mandates:

- Ensure maximum employment

- Maintain price stability

In a recent post, we showed how employment rates have returned to pre-pandemic levels. More importantly, the data shows a narrowing of racial and ethnic employment rates two years following the COVID lockdowns.

Today, we look at the other Fed mandate, price stability. In particular, we’ll summarize racial and ethnic disparities concerning the rapidly increasing inflation rate.

METHODOLOGY

Unlike labor and employment data, we don’t have access to demographic-specific inflation measurements. So, the Fed created its own formula:

- The Bureau of Labor Statistics (BLS) computes separate inflation estimates (consumer price index: CPI) for different categories of goods such as food, fuel, clothing, housing, etc.

- BLS also conducts a Consumer Expenditure Study (CEX), which breaks out spending across these categories by different demographic groups.

- Assuming that pricing for goods is the same for all groups, the Fed extrapolates demographic-specific inflation rates by applying the CEX shares of demographic spending to the CPI data, referred to as the Demo-CPI.

WHAT’S HAPPENING WITH INFLATION?

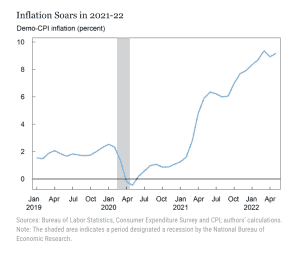

The first chart below tracks 12-month inflation for the major consumption categories dating back to 2019. Here’s what we see:

- CPI inflation was in the 2 percent rates for the year leading into the pandemic. Immediately after the COVID lockdowns began to take effect, the CPI dropped below zero.

- Over the course of 2020, the CPI slowly rose to pre-pandemic levels as demand for goods began to pick up.

- Starting in the spring of 2021, inflation began its precipitous rise, fueled by rising demand and widespread supply-chain shortages. Today the CPI sits at 9.2. percent, year-over-year.

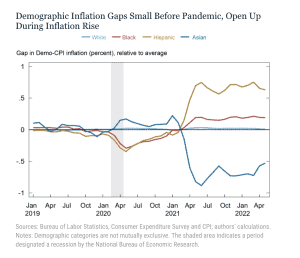

Now we focus on inflation with regard to disparities by demographic group. The chart below plots deviations from the trends shown in the previous chart for white, Black, Hispanic American, and Asian Americans dating back to 2019:

- As we see, in the lead-up to COVID, Demo-CPI rates were fairly consistent across groups. Asian Americans experienced slightly higher inflation, while the rate for Black and Hispanic Americans was slightly less than average (Note: White Americans, on average, experience inflation at the same rate as the national average).

- When COVID hit, we saw that inflation for Black and Hispanic Americans fell dramatically while rising for Asian Americans.

- As the economy began to climb back in the summer of 2020, the demographic inflation gaps narrowed again, merging to pre-pandemic levels by spring 2021.

- Then, inflation rates began to rise relative to the national average, especially for Black and Hispanic Americans. Disparities are more than double the levels seen in early 2019.

Concerning these disparities, the Fed makes an important point:

“While the measured magnitude of the inflation disparities is not very large (0.2-0.6 percentage points for Black and Hispanic-Americans) relative to the 9.2 percent overall inflation rate, they likely underestimate the actual gaps for the reasons mentioned above, with the actual gaps likely being considerably higher. The changes in the gaps relative to 2019 should be more informative, however, and suggest large changes in the magnitude of inflation inequality.”

It’s worth noting that the current dynamic between employment and inflation is the reverse of what happened following the Great Recession. Back then, employment levels plummeted (particularly for Black and Hispanic Americans), while the CPI was essentially dormant. In the COVID era, the demographic employment gap has improved. However, the rising level of inflation, as we show above, is disproportionately impacting Black and Hispanic Americans.

SOURCE

Ruchi Avtar, Rajashri Chakrabarti, and Maxim Pinkovskiy, “Was the 2021-22 Rise in Inflation Equitable?,” Federal Reserve Bank of New York Liberty Street Economics, June 30, 2022, https://libertystreeteconomics.newyorkfed.org/2022/06/was-the-2021-22-rise-in-inflation-equitable/.

To learn more about Recovery Decision Science

Kacey Rask : Vice-President, Portfolio Servicing

513.489.8877, ext. 261