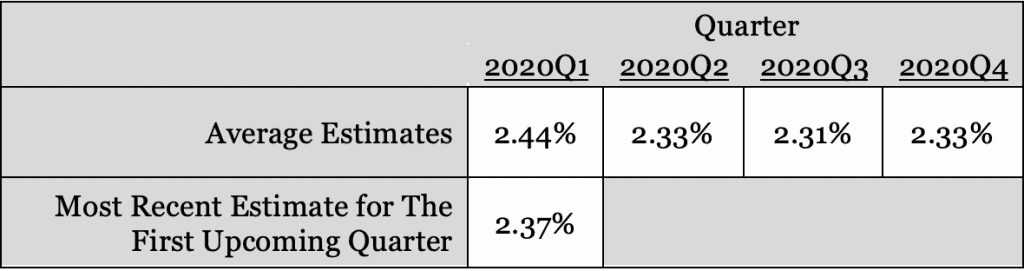

The Federal Reserve Bank will soon report the Consumer Loan Charge-off Rate (CLCOR) for the first quarter of 2020. According to the data published on Feb 18th 2020, the total seasonally adjusted CLCOR figure for the 2019Q4 was 2.27%. The most recent prediction for the upcoming report for 2020Q1 is 2.37%.

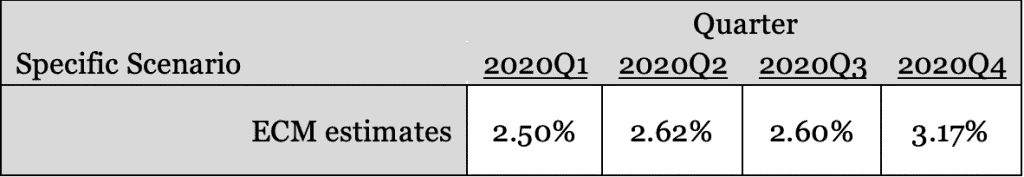

Here are the predictions for the next four coming quarters:

However, as we mentioned in our last post back in February, an external shock to the market because of domestic or global events (such as political feuds, epidemics, and armed conflicts….) could completely change the scene. Now in fact we are experiencing one those shocks because of COVID-19. Given the current conditions here are few points to consider regarding the CLCOR levels for the year 2020:

- The lockdown started in the 2nd half of March. Thus, we do not expect to see a huge change for the 2020Q1 prediction estimate.

- On the other hand, the US was on lockdown for most of the first half of 2020Q2. And the 2nd half of this quarter will be spent on slowly opening up the businesses. So, it is not farfetched to imagine a stronger change in our prediction estimates for 2020Q2 and the quarters after that.

- At the time of financial distress, unsecured obligations are first in the list to be neglected by consumers as they tend to keep the secured obligations as healthy as possible. So, one would neglect a credit card debt to make sure he makes dues towards the mortgage payment.

- On the other hand, staying home has decreased consumer spending in certain categories.

- Also, the data from a survey on how consumers spent their stimulus check money, show similar categories to typical purchases by a credit card.

- It is also yet unclear how soon the unemployment recover from the hit from the pandemic.

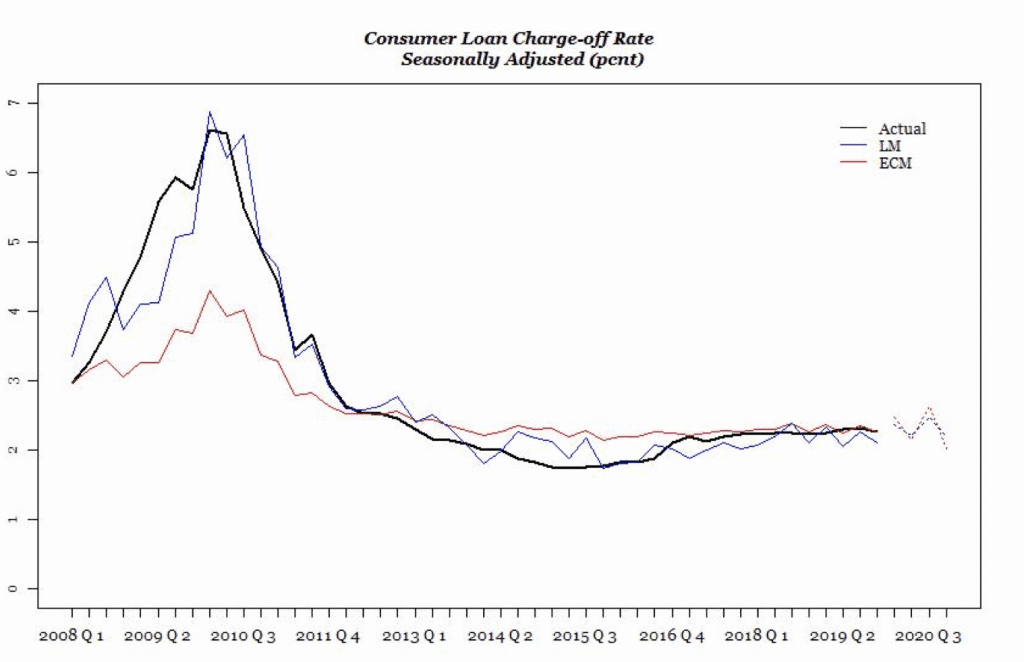

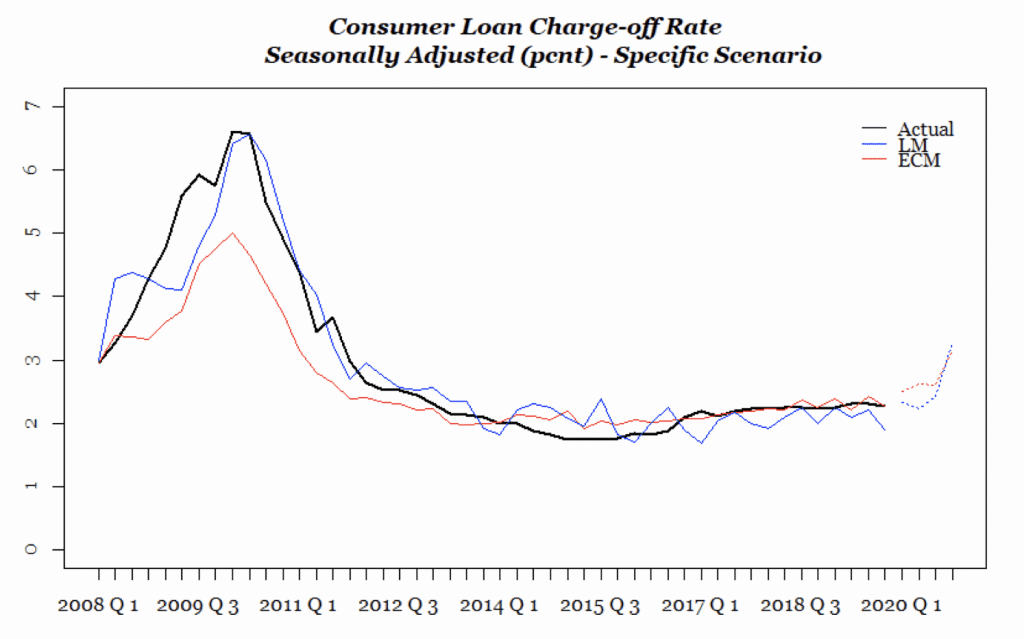

Given the point above, it would be hard to quantify the effect of COVID-19 on the levels of CLCOR for the year 2020. However, for our proxy predictor, we can simulate a scenario, similar to what happened in 2007Q4 forward till 2008Q3, for 2020Q1 to 2020Q4. The following figure shows the historical trend of CLCOR and the forecast values obtained from LM (Linear Model) and ECM (Error Correction Model) for the next four quarters. The ECM is our model of choice for this task. These results have not considered any COVID-19 effect because of the intrinsic lag in the nature of the effect.

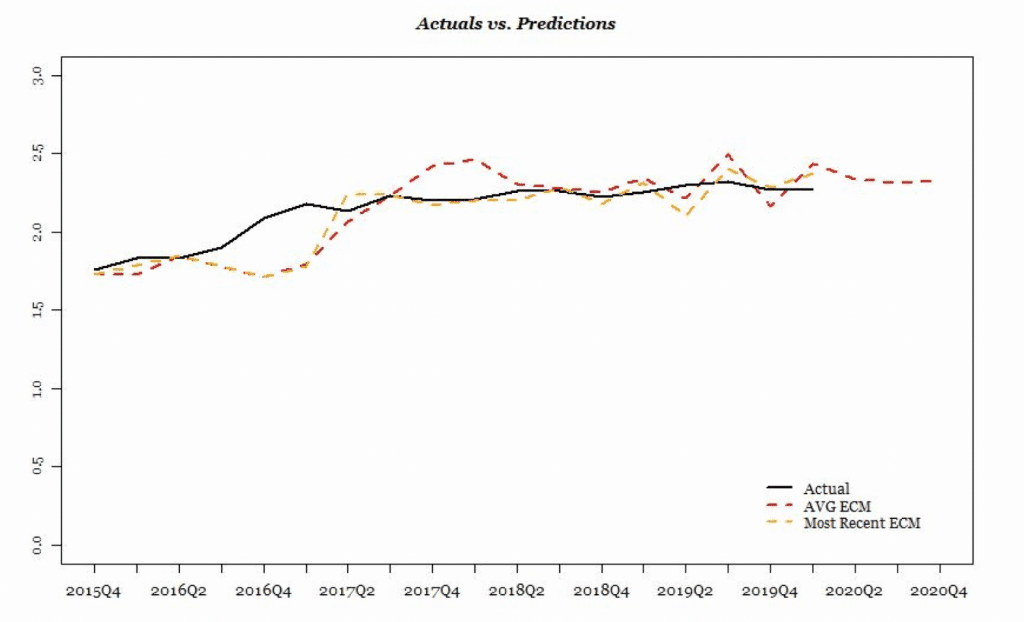

Below, you can see the performance of our predictions against the actual values since 2015Q4 that we started predicting CLCOR on a regular basis.

Now let’s apply the specific simulated scenario, and see how the results differ:

We can see that the results would be totally different. Without the COVID-19 effect our estimate for the end of 2020 was not going to be above 2.5%. But, now the simulated scenario shows 2020 ending above 3%.

More info about the performance is presented in a Tableau Visualization available here.

Error: Contact form not found.