The RDS Business Intelligence team just released its latest predictions for quarterly consumer loan charge-off rates. This is our 24th such set of predictions.

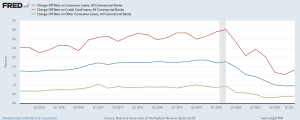

The Federal Reserve Bank will soon report the Consumer Loan Charge-off Rate (CLCOR) for the second quarter of 2022. According to the data published on May 20th, 2022, the total seasonally adjusted CLCOR figure for 2022Q1 was 0.95%, slightly above the 2021Q4 level at 0.94%. Moreover, the Charge-off Rate on Credit Card Loans, which was the only category that had maintained its downward trend since the onset of the pandemic, 2020Q2, finally in 2021Q4, hit the bottom at its lowest level ever at 1.57% and increased to 1.82% in 2022Q1.

https://fred.stlouisfed.org/graph/fredgraph.png?g=STMf

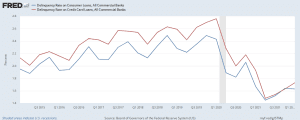

Also, the Delinquency Rate for Consumer Loans increased in 2022Q1, following the upward trend from its previous quarter.

https://fred.stlouisfed.org/graph/fredgraph.png?g=STMp

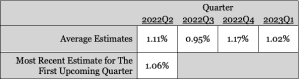

The current most recent prediction for the upcoming report for 2022Q2 is 1.06% which shows a slight upward movement of five basis points from the previous quarter. The overall trend for the next four quarters at this point suggests a consolidation period with the rate oscillating above 1% but not too far away from it.

Here are the predictions for the next four coming quarters:

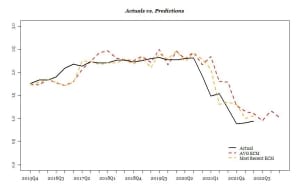

Below, you can see the performance of our predictions against the actual values since 2015Q4, when we started predicting CLCOR regularly.

CLICK HERE to see an interactive dashboard of our charge-off predictions on the RDS Tableau Public page.

To learn more about the RDS Business Intelligence team, contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected]/ 513.489.8877, ext. 261

Error: Contact form not found.