The Federal Reserve Bank will soon report the Consumer Loan Charge-off Rate (CLCOR) for the second quarter of 2021. As we’ve done for the past 20 quarters, the Recovery Decision Science Business Intelligence team has run the numbers to predict the charge-off rate.

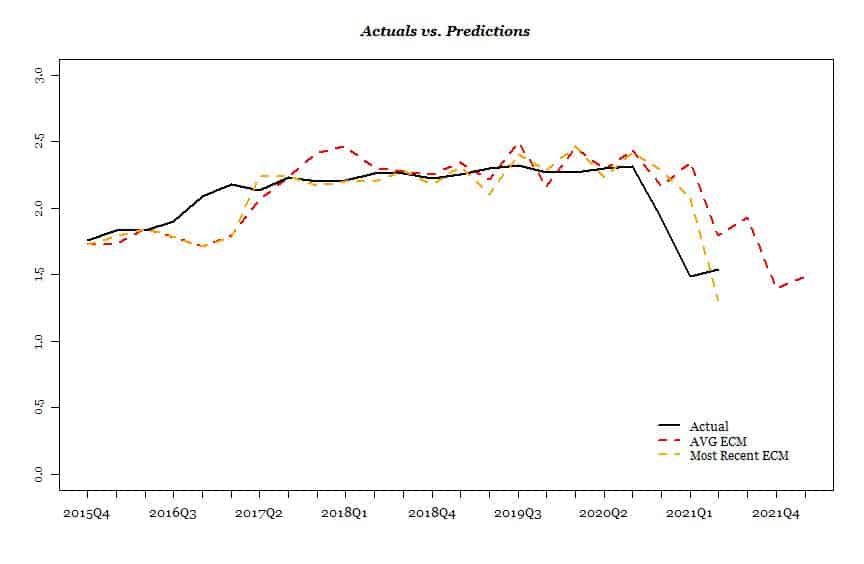

According to the data published on May 21st 2021, the total seasonally adjusted CLCOR figure for the 2021Q1 was 1.54%, slightly higher than 2020Q4 figure, 1.52%.

After the sharp break from 2.26% in 2020 Q2 to 1.92% in 2020Q3 at beginning of the pandemic, the rates have been just slightly above 1.5% which is significantly lower than the five-year average figure for the last five years before the pandemic, 2.11%.

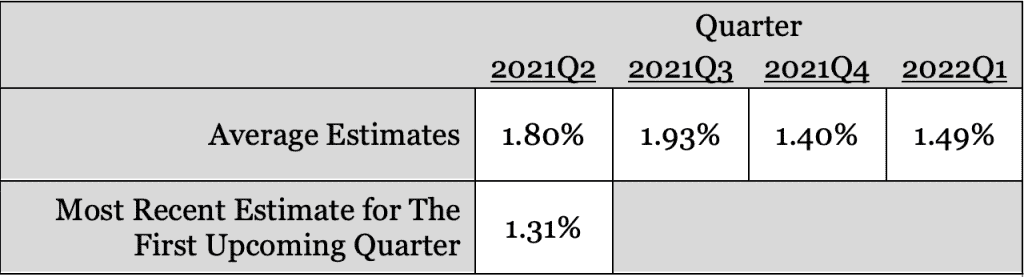

The current, most recent prediction for the upcoming report for 2021Q2 is 1.31%. We believe that it is more likely that the rate goes lower than higher compared to the previous published value. Our model also confirms that the rate will move in the same direction. Moreover, we’ve seen a decreasing trends for the delinquency rate.

However, the 1.31% estimate seems too low and that is because of the huge correction the model has to make because of the recent shift in the post-pandemic data. For perspective, 1986Q1 is the last time that CLCOR was around the 1.30% level at 1.35%. Thus, taking into account all variables, we expect the more likely estimate for 2021Q2 figure would be around 1.5% again.

Here are the predictions for the next four coming quarters:

In the chart below, you can see the performance of our predictions against the actual values since 2015Q4 that we started predicting CLCOR on a regular basis.

Here is a LINK to the updated viz on the RDS Tableau Public page

To learn more about Recovery Decision Science contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261

Error: Contact form not found.