Despite some of the grimmest economic news since the Great Depression because of COVID-19, the one bright spot continues to be the U.S. real estate market.

Fueled by record-low mortgage rates, home sales continue to grow, albeit, not as fast as refinancing activity.

The RDS data analytics team recently updated its Econometrix Tableau real estate workbooks.

Here’s a summary of our real estate-related visualizations, along with links to the related, interactive Tableau workbooks:

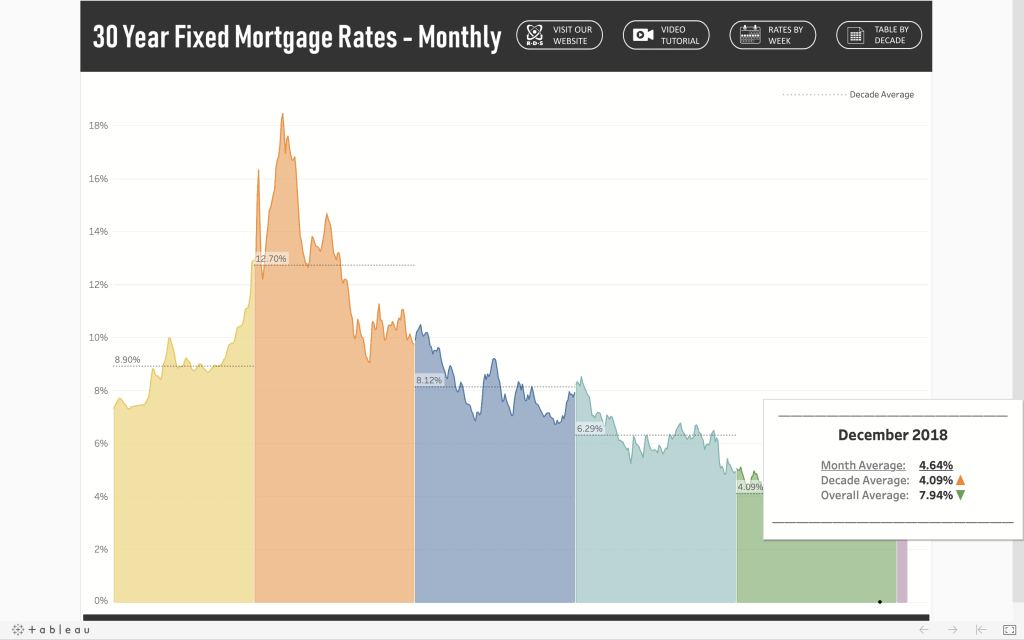

MORTGAGE RATES

As of August 6, the 30-year fixed mortgage rate was 2.88%. The current rate is 20% lower than the (still very low) rate of 3.75 for the same week a year ago.

Going back nearly 50 years, the previous low for the 30-year fixed mortgage was 3.42% in May of 2013.

Below is a snapshot of the mortgage rate viz dating back to the early 70s.

CLICK HERE to see the Mortgage Rate interactive viz on the RDS Public Tableau page

MORTGAGE APPLICATIONS

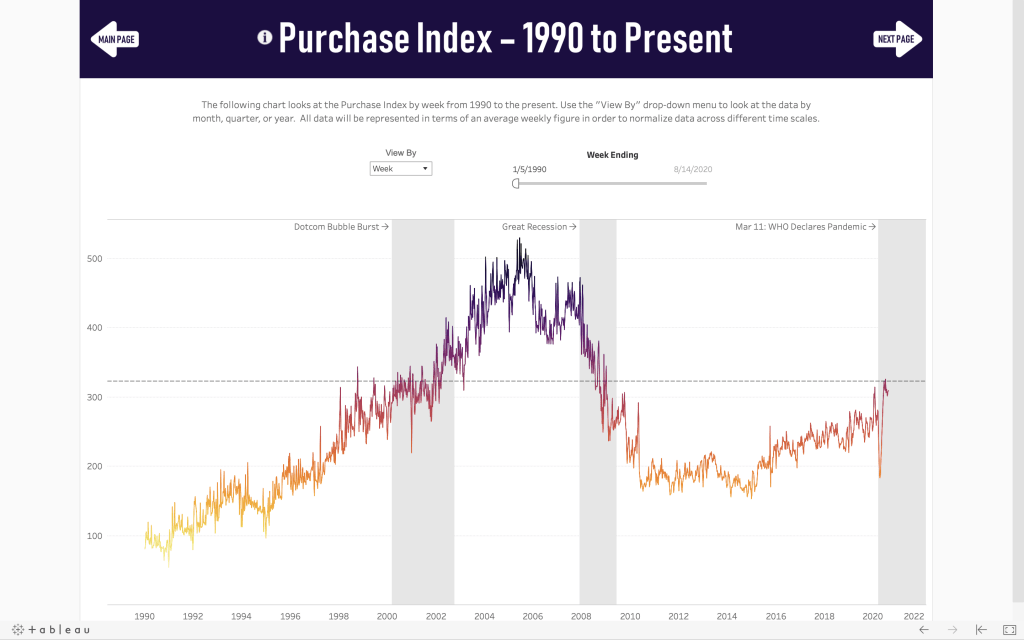

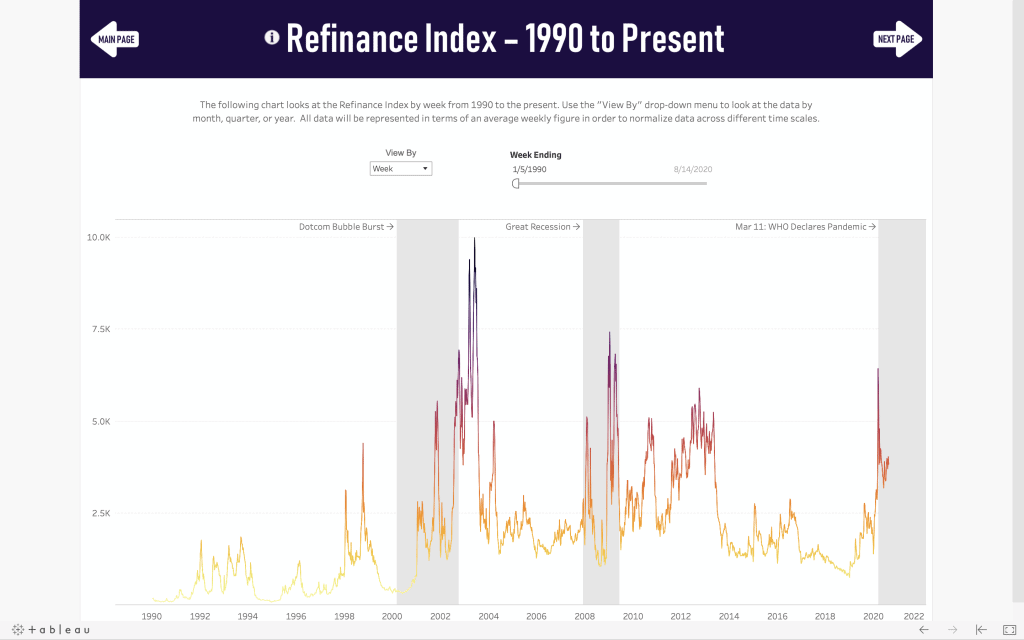

The Mortgage Bankers Association (MBA) reports weekly on two types of mortgage applications:

- MBA Purchase Index: The Purchase Index is a leading indicator of home sales by 4-6 weeks, meaning that it is a predictor of housing activity. Housing economists and home builders use the index to forecast new and existing home sales.

- MBA Refinance Index: The Refinance Index is a tool to predict mortgage activity. Homebuilders pay attention to the Refinance Index because it is a leading indicator of home sales. On the other hand, mortgage investors also take notice of the index as it is a leading indicator of mortgage pre-payment activity.

MBA Purchas Index

The year started strong, with the Purchase Index climbing past 300 (313.7) for the first time since October, 2009.

But as the reality of the pandemic started to take hold, the real estate market started to freeze up, and the Purchase Index plummeted 41%, hitting a 5-year low of 186.4 on April 17th. But, as the Fed continued to push interest rates lower, the market responded. In three months, the Purchase Index climbed 75% to hit an 11-year high of 325, on July 3. As of July 3, the Purchase Index sits at 300.7, up 19% versus a year ago.

CLICK HERE to see the Purchase Index interactive viz on the RDS Public Tableau page

MBA Refinance Index

Also, as a response to record-low interest rates, the refinance market has had a wild ride in the first seven months of 2020.

Refinance activity has been on an upward swing since the Refinance Index hit an 18-year low in 2018. The Index grew 71% in 2019 and is on pace to grow another 108% through 2020. But as you can see from the screenshot below, the Index has been on a wild ride since the first of the year, hitting an 11-year high of 6,419 on March 6th (a 479% increase versus the same date a year ago). The Index currently stands at 3,810, a 150% increase for the same date a year-ago.

The volatility of the Refinance Index is generally bad news for investors of mortgage-backed securities, because it means they are losing a significant number of mortgages at higher interest rates.

CLICK HERE to see the Refinance Index interactive viz on the RDS Public Tableau page

HOME SALES

After dipping to a 21-month low of 571,000 (seasonally-adjusted annual rate) in April, home sales have rebounded. As of June, sales stand at 776,000, a 36% increase versus the April low. The June level is the highest we’ve seen since July, 2007’s 776,000.

CLICK HERE to see the U.S. Home Sales interactive viz on the RDS Public Tableau page

Once we have new home sales for July, we will update this report accordingly.