SERIES INTRODUCTION

In this series, we will guide you through the life of managing a debt portfolio, using a mock portfolio of accounts. Our goal is to provide you insight into the process of evaluating, projecting returns for, and operating a debt portfolio. This series will have 5 posts in the following order:

- Portfolio Evaluation

- Account Level Treatment

- Account Placement and Tracking

- Judgment Maintenance

- Final Results

1. PORTFOLIO EVALUATION

Purpose of Evaluation

Evaluating the portfolio allows us to estimate its future value based on its characteristics. Specifically, it gives us the basis we need to measure success, whether looking at return on investment (ROI), internal rate of return (IRR), or another indicator. For purposes of this series, we will use ROI to measure the return on our portfolio. To do this we will need to answer some basic questions, such as:

- How many accounts do we estimate will pay?

- How many accounts qualify for litigation?

- How many accounts should be placed for non-litigation collection?

These questions help us to determine the ROI that we should expect on the portfolio.

Account Types

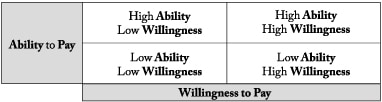

Each account can be categorized based on its consumer’s willingness and ability to pay, as follows:

Ideally, the consumer will begin to pay voluntarily once you make the next collection attempt, which saves you both the time and additional costs of pursuing further collection efforts. But most often when dealing with accounts for which previous agencies have made multiple collection efforts, consumers do not pay voluntarily and they stop responding to collection attempts. The more prior collection efforts that have been made, the lower the likelihood of a consumer paying voluntarily. Eventually, an account reaches a point where collection attempts have been exhausted and the last remaining avenue is litigation.

Suit-Decision Process

One difference between older, outdated approaches and newer, innovative approaches is how we choose which account to litigate. In the past, it was difficult for collectors to know which consumers had high versus low ability to pay, primarily due to insufficient technology and data. This situation left collectors guessing blindly as they targeted a percentage of the portfolio for litigation without knowing if those accounts selected were the best candidates for suit. This is commonly referred to as a “suit-rate” and is not an optimal solution. Every account that is litigated costs time and money. Court costs and attorney’s fees are costly and require an up-front investment with no guarantee of recovery. Spending valuable resources litigating the wrong account results in not only a loss of the related costs but also a missed opportunity to litigate another, more suitable account. It is crucial to choose the right accounts for litigation and to assign the rest to receive other, appropriate treatments

The Paymetrix AD Solution

Recovery Decision Science developed Paymetrix AD (Account Decisioning) by analyzing, testing, and transforming years of collection data into a decision-to-suit model. Our model uses 76 account variables to assign a Profitability Index to every account, which is the present value of cash inflow divided by the present value of cash outflow

Experienced analysts work with this information to separate the accounts into appropriate treatment tracks, primarily:

- Non-Litigation

- Litigation

- Other

Non-Litigation treatments are designed to handle accounts with a low Profitability Index. While these accounts might still be within the statute of limitations and otherwise appear on the surface to qualify for Litigation, Paymetrix AD tells us that Litigation is not predicted to be cost-effective. Knowing this information prior to Litigation saves you from wasting court costs and time that you could more profitably invest elsewhere. Instead, you can use those resources to pursue legal collections for those eligible accounts that have a high Profitability Index. Lastly, the Other treatments are designed to handle accounts that are ineligible for Litigation/Non-Litigation treatments. We will discuss different treatments more in our next blog post.

When evaluating a portfolio, we will make projections of ROI for each treatment track. However, for the purpose of this blog series we will focus on managing the Litigation track.

Portfolio Summary

Now that we have given a quick summary of the purpose of an evaluation, account types, account treatments and suit-decisioning using Paymetrix AD, we turn to the summary of the portfolio. Once our client has uploaded the file to our Secure FTP site, our team performs and summarizes the evaluation. In this example, we are using a portfolio with the following characteristics:

- Total Face Value: $100 M

- Total # of Accounts: 14,200

- Average Balance per Account: $7,042

- State Breakdown

- Top 10 States

Next, our experienced analysts apply Paymetrix AD to the portfolio data and determine the following projections with each treatment track for our sample portfolio:

- Non-Litigation: 65% of accounts predicted to return $3M

- Litigation: 30% of accounts predicted to return $8.3M

- Other: 5% of accounts predicted to return $100K

Projections from any forecasting model are not 100% accurate. We have found, however, that Paymetrix AD projections have proven very accurate over time and provide a successful placement guide to optimize recovery.

Now that we have analyzed the portfolio through evaluation, the next step is to identify Account Level Treatments using Paymetrix AI (Asset Identification). We will explore this topic in our next post. Stay tuned!