Each American generation has approached financial management differently, from the Depression-era, Greatest Generation'sfrugality and pensions stemming from long-term, stable jobs, to the boom-Boomerembrace of the stock market in the 1980s.

Now come the Millennials, a generation derided by many for fecklessness but one that, trends are showing, embracesnew technology and old-fashioned values like honesty and transparency in money management. Simple as it may sound, learning to manage expectations of a growing client basesuch as the Millenialsrequires understanding and finesse.

To be clear, Millennials are defined as individuals born after 1980 and reaching adulthood early in the 21stcentury. Most are still in prime earning years and are still in the process of creating wealth but,by next year, the global net worth of the Millenial generation is estimated to range from $19 to $24 trillion.

There's no better time to understand how they make decisions about money management.

TRANSPARENCY

The current generation has more in common with the Greatest Generation than may appear at face value: both came of age during eras of significant financial challenge – for the former, the Great Recession of the late aughts, and for the latter, the Great Depression.

Many Millennials entered the job market in 2008 and the subsequent crash of housing markets bred a distrust of financial systems. The ensuing [SA1] rise of education, college debt and housing costs make for a skeptical client base.

A 2016 study conducted by Deloitte, the international tax and financial advisory giant, showed about 75 percent of those defined as Millennials don't consider money a sole gauge of success, refuse to compromise personal or family values for the sole purpose of gaining wealth, and ascribe more value to brands they view as socially responsible.

This group's skepticism of financial advisors bred by theircoming of age in a crisis accounts for 72 percent of the Deloitte study respondent. They report that they plan to self-direct their fund management, although,not surprisingly, younger consumers have less financial knowledge than their elders.

Expect Millennials to cross-check advice from financial experts with outside sources and keep in mind that it's helpful to give these clients a 'peek behind the curtain' to earn their trust.Be forthright about your business' history and consumer initiatives and clear about fees. You can't overcommunicate.

TECHNOLOGY

Up-to-date technology alone won't create brand or firm loyalty but makes a good first step towards it. Deloitte estimates almost 90 percent of Millennials check their cell phones within 15 minutes of waking up, many checking in on social media platforms. And 57 percent say they would consider changing their banking relationship solely for one with a better technological platform.

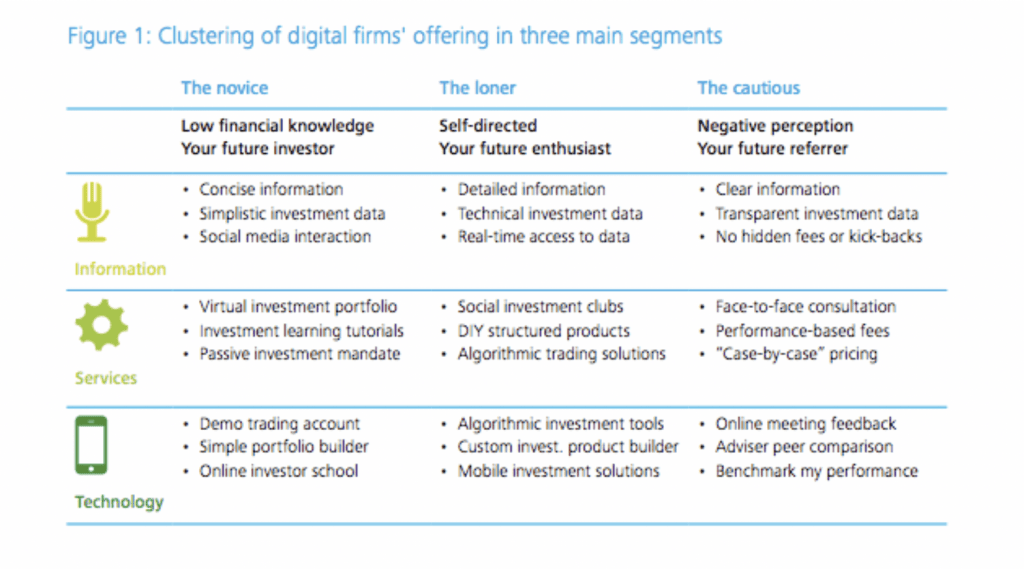

Thus, reaching younger consumers via digital platforms is a necessity and the chart below, provided by Deloitte, advises what type of service to provide to younger clients with differing investment mindsets.

Like any other generation, Millennials are diverse and not a monolithic population, but the bottom line is that outdated modes of communication about wealth management won't do. Design products with a focus on state-of-the-art technological platforms that transmit information at every stage of the investment cycle and support the clients' desire to make investment decisions themselves.

SOURCE

https://www.entrepreneur.com/article/314156

https://www.refinery29.com/en-us/2018/10/215609/millennials-talking-about-money