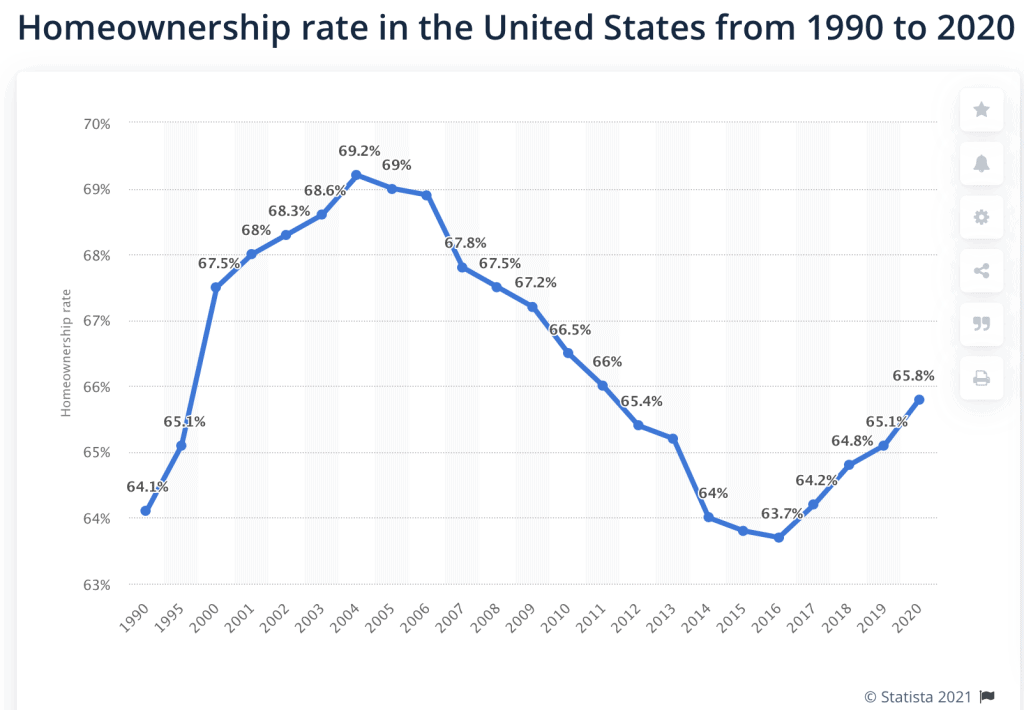

A foundational principle of the “American Dream” is home ownership. As of 2020, according to the chart below from Statista, 65.8 percent of Americans own a home. This is down from the 30-year high of 69.2 percent in 2005, and 2.1 percentage points above the 30 year low of 63.7 percent, seen in 2016.

Beyond the sense of pride and stability inherent in owning your own home, Americans have taken advantage of the fact that home ownership has been a major source of wealth accumulation.

But, interestingly, little research has been done on American’s attitudes towards home ownership as an investment vehicle, vis-à-vis other types of investments.

To this end, Liberty Street Economics (LSE), the research arm of the New York Federal Reserve, recently published findings from a year-long study in which they explored the question: do households view housing as a good investment in comparison to financial assets such as stocks.

INTERESTING RESEARCH METHODOLOGY

LSE took an interesting approach to gaining insights on this question. Instead of asking questions through a traditional survey, they set up an experiment. Specifically:

- Respondents were asked to consider this situation: neighborhood friends in their 30s just received a sizeable gift that would be a solid down payment on a new house. Respondents had to advise these friends as to whether they should stick with plans to invest in the house, or put the money into the stock market.

- There was a second scenario in the experiment: if the friends already owned a home, the respondents were asked to offer advice on either investing the gift in a down payment on a rental property or putting the money in the stock market.

The study was initially conducted in February, 2020, prior to the lockdown. But, when COVID hit, with its subsequent economic turmoil, the researchers decided to add several additional windows to the study, one in October, 2020 and then again in February, 2021.

WHAT THEY FOUND: BIG PICTURE

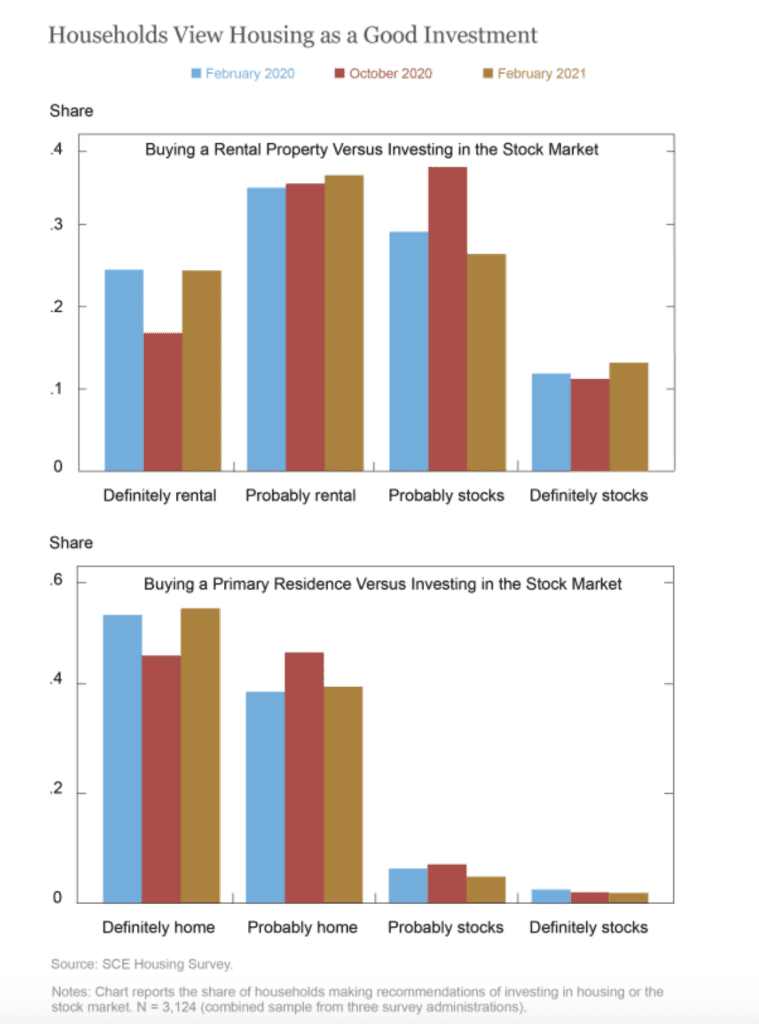

Looking at the chart below, we find:

- Overall, respondents considered housing a better investment option than stocks.

- When asked to choose between stocks and purchasing a home as a primary residence, more than 90% selected the home as a better investment. This speaks to the emotional and psychic benefits of home ownership, as much as its pure economic benefits.

- Investing in a rental property was seen as a slightly better strategy versus stocks, but the gap is clearly not as dramatic as it was for investing in real estate as a primary residence.

- Note the dip in October 2020 for both charts. With regard to rental properties, respondents (in a separate questionnaire not published with this report) were concerned a continuing pandemic could result in rental property vacancies. For those who believe in the value of home as a primary investment, the pandemic raised concerns about their ability to meet mortgage payments if there was a disruption in their job status.

GENDER AND EDUCATION

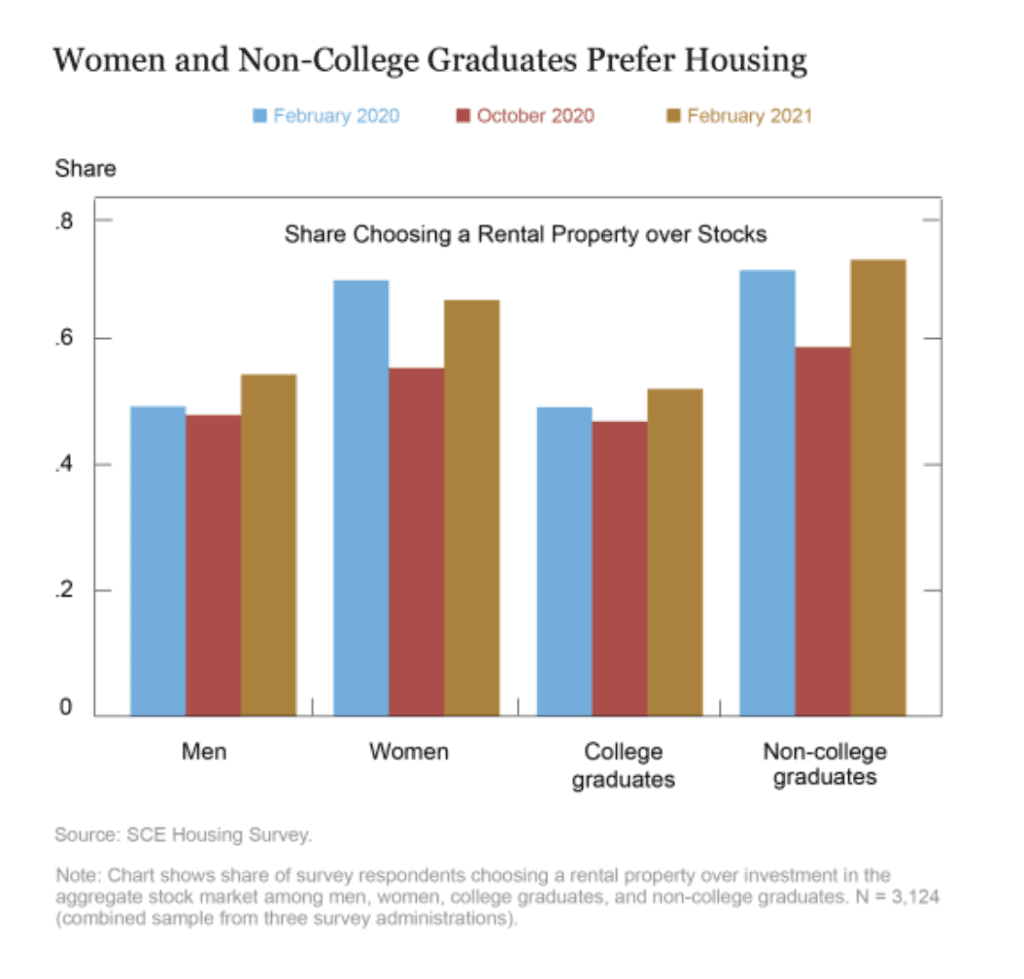

The researchers also considered how gender and education played into respondent’s attitudes toward housing or stocks as a better investment tool. Because, as we saw above, there was a clear bias towards the value of home ownership for primary residence, for this part of the study, LSE compared attitudes about stocks vs. rental properties as the better investment strategy.

Looking at the chart below, we see:

- Men are generally more inclined than women to prefer stocks over investing the gifted money in rental real estate. This might suggest that men have somewhat greater tolerance for risk and volatility.

- College graduates also see the stock market as a better investment than purchasing a rental property, when compared to non-graduates. In the unpublished, follow-up questionnaire, LSE learned that college graduates cited “time to manage investment properties” as the primary reason for preferring stocks.

REASONS FOR CHOOSING HOUSING

The researchers probed those who chose housing as a better investment as to their reasons why.

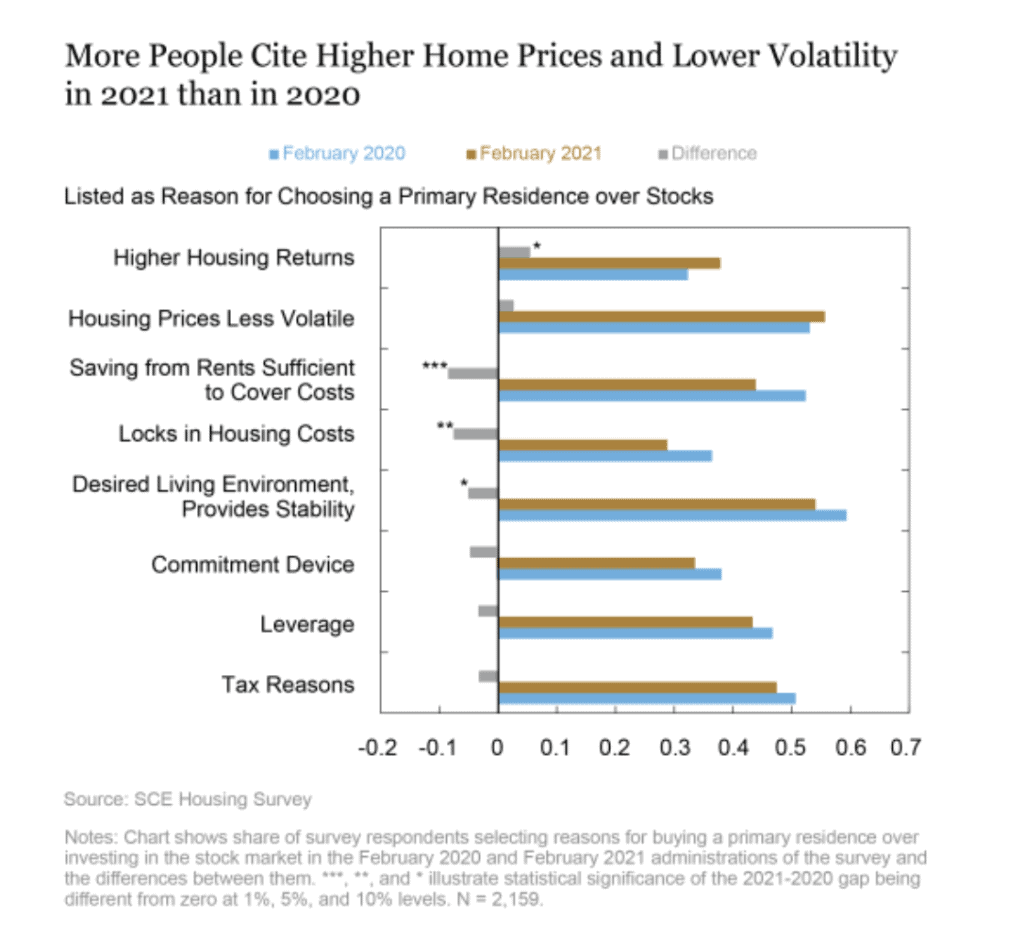

The chart below compares respondent attitudes between February, 2020 and February, 2021.

As we see, there are a number of reasons why respondents would invest in housing versus stock. The two most notable reasons, both of which reinforce our inherent belief in homes as a place of stability, are:

- Desired living environment provides stability

- Housing prices less volatile

Finally, we see that compared to February 2020, more respondents in 2021 chose “higher house prices” and “lower volatility” as their reasons for choosing housing as a better investment. This obviously reflects that fact that mortgage rates are still at record lows, and home prices continue to rise.

To learn more about trends in mortgage rates over the past five decades, check out our Mortgage Dashboard on the RDS Tableau Public page. HERE.

SOURCE

To learn more about Recovery Decision Science contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261