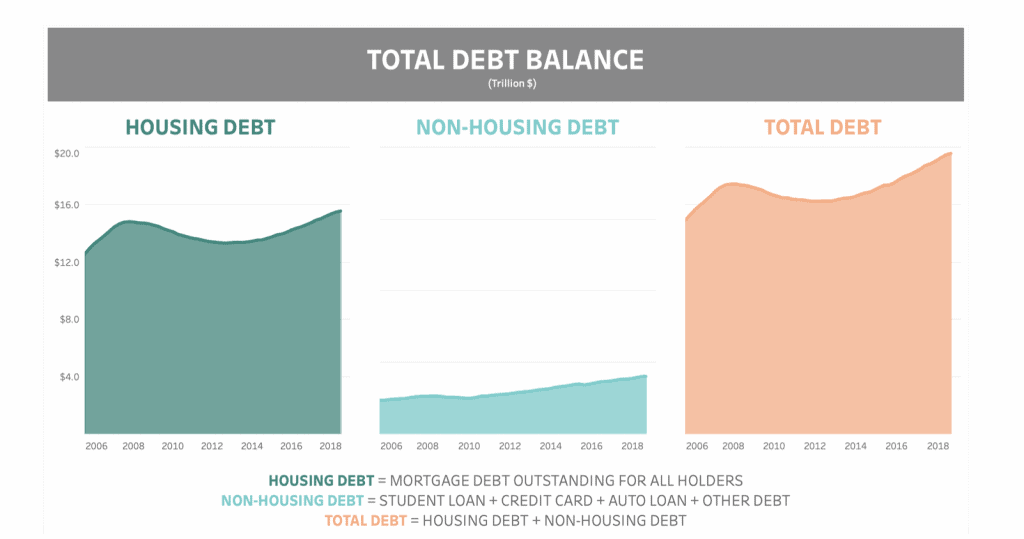

The latest report from the Board of Governors of the Federal Reserve System puts total U.S. household debt at $19.5 trillion in Q2 2019. This is up by $100 billion from the previous quarter.

HOUSING

The bulk of U.S. debt is housing debt, coming in at $15.5 trillion.

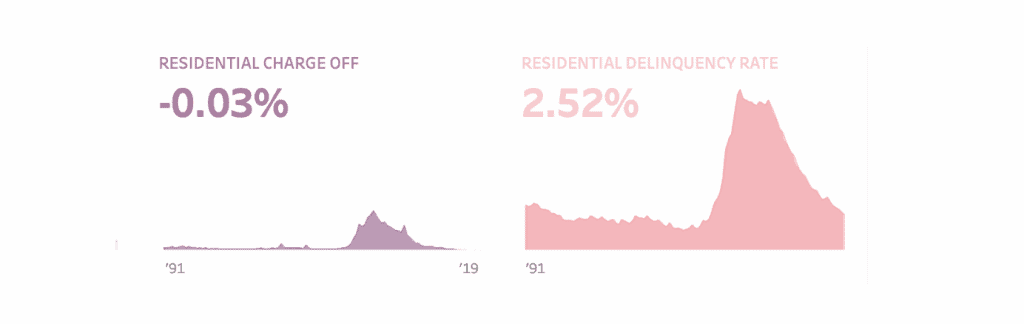

Residential mortgage delinquency rate between Q1 and Q2 dropped from 2.70% to 2.52% respectively. There was also a significant drop in the charge-off rate to -0.03% in Q2 from 0.01% in Q1.

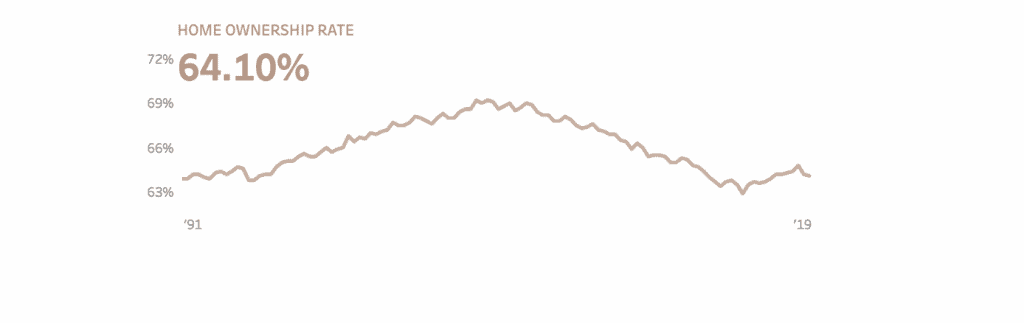

There was a slight, quarter-to-quarter decline in the home ownership rate, which now stands at 64.2%.

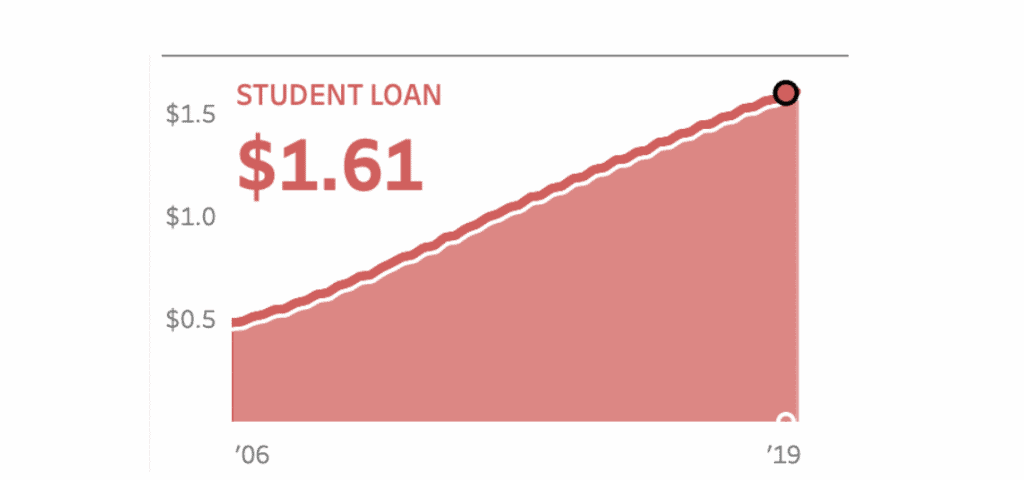

STUDENT LOANS

Student loan debt grew by $10 billion, from $1.60 to $1.61 trillion in Q2.

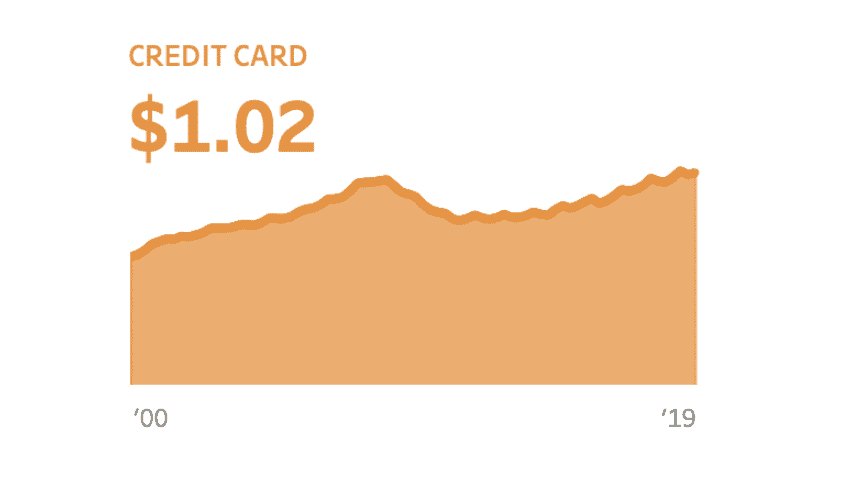

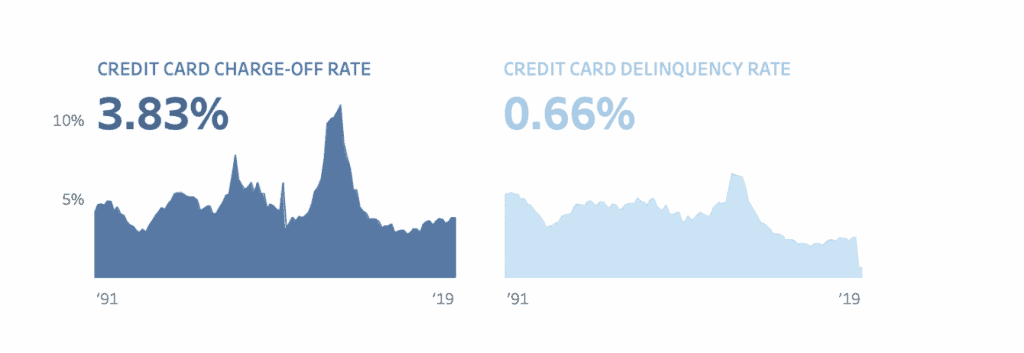

CREDIT CARDS

Credit card debt held steady at $1.02 trillion. The delinquency rate also dropped, moving from 0.72% in Q1 to 0.66% in Q2. The credit card charge-off rate held steady at 3.83% from quarter to quarter.

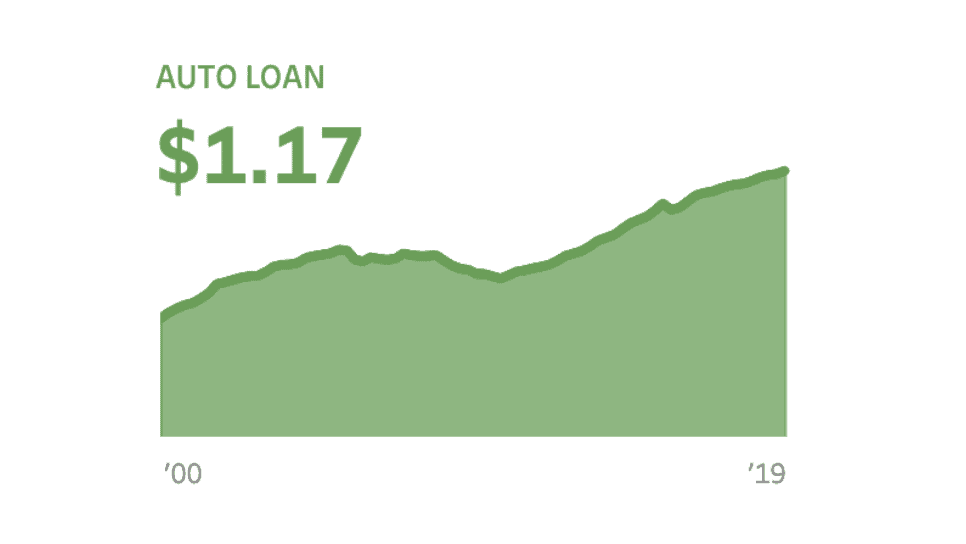

AUTO LOANS

Outstanding auto loans grew $10 billion in Q2 to $1.17 trillion.

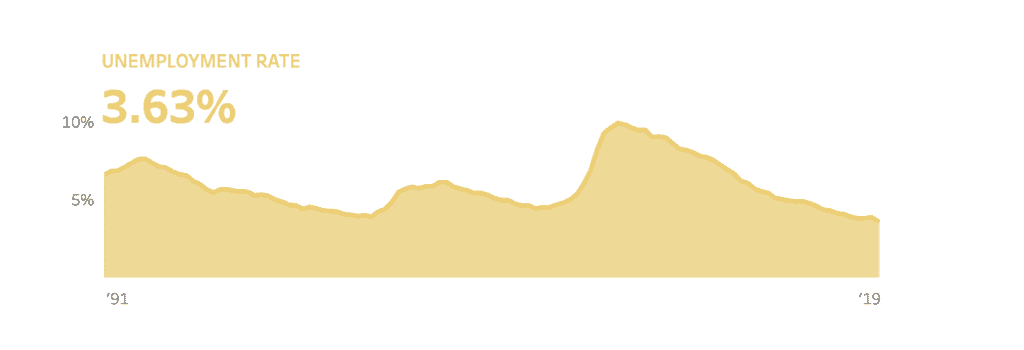

UNEMPLOYMENT

The nation’s unemployment rate stood at 3.63% in Q2, down from 3.87% the previous quarter.

Here is a link to the RDS Tableau page where you can find interactive versions of each of the above visualizations: https://tabsoft.co/2lGQ5nG

SOURCE

https://www.federalreserve.gov/data/mortoutstand/current.htm