One of the biggest challenges in the debt recovery industry is determining when and where it is most appropriate, and profitable, to sue for account collection.

Without adequate, and accurate, information, considerable time, energy and resources can be used pursuing accounts with little or no chance of paying. This challenge is compounded by the wide variation in legal costs from state to state. So, for example, many accounts with high, outstanding balances may be passed over for legal action in states with high legal costs, such as California and Texas.

In recent years, Recovery Decision Science has taken a leadership role in building game-changing, analytical solutions to guide collection decisions. These solutions include:

- Paymetrix AD/AD+: Sophisticated account-decisioning tools using RDS proprietary models built to accurately pinpoint the right accounts to litigate based on a number of variables.

- Paymetrix AI: Proprietary asset-searching model with a unique ability to identify previously undiscovered assets such as homes, bank accounts and job.

- Paymetrix PI: Value-based suit-decisioning tool that pinpoints the right accounts to litigate without the cost and time of the asset identification process.

Building on the success of these account-decisoning solutions, RDS recently expanded the Paymetrix suite to include a powerful new real estate scoring model called Paymetrix RE.

WHAT IS PAYMETRIX RE

All houses are not equal!

Intuitively we understand this precept, especially as relates to objective comparisons of homes based on something everyone understands: sales price.

But until now, there has never been a way to qualitatively compare one real estate property to another. That’s why Paymetrix RE is such a revolutionary advancement for the collections industry, where accurately estimating a home’s value can play such an outsized role in suit decisioning.

Paymetrix RE is a proprietary property-scoring algorithm that accurately determines the quality and value of a home based on actual images of the property and surrounding properties. Homes are scored on a 5-point scale, employing nationwide real estate data from more than 155 million U.S. properties.

As a reference point, the average U.S. home has a Paymetrix RE score of 1.6. Below, you’ll see a cross-section of homes covering the full-range of RE scores:

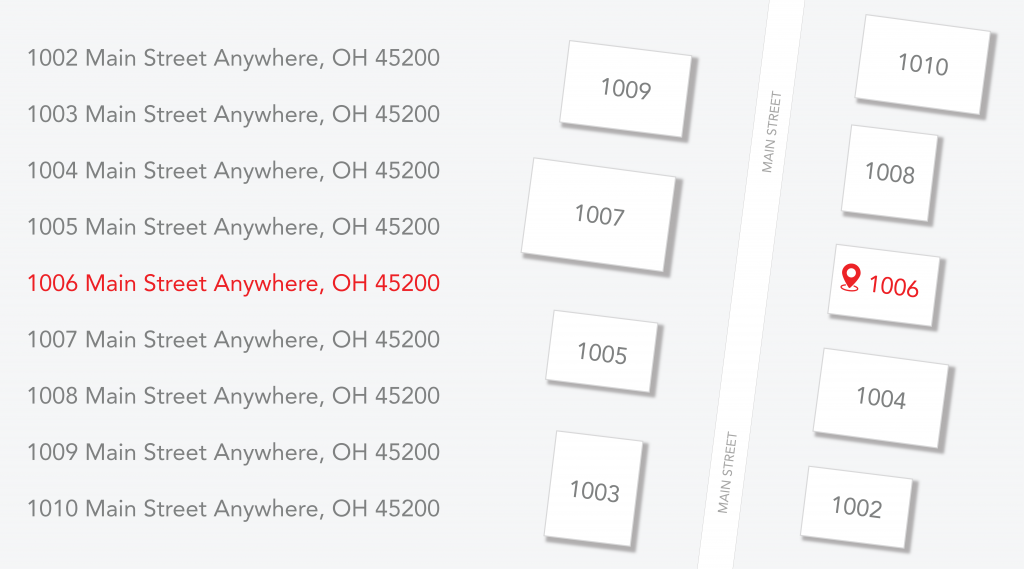

Machine-learning builds the RE algorithm beginning with actual images of the property of interest. The program then progresses by evaluating street-level images from all surrounding properties. Below is a schematic of an actual neighborhood from a recent analysis.

The power of the RE algorithm is that it puts the target property in a much broader context, i.e. an entire neighborhood. In other words, looking at the other properties in the neighborhood helps to validate our target home’s quality and value, thus creating a more accurate RE score for suit decisioning.

PUTTING IT TOGETHER

Below is an illustration from a case study using a sample of 50,000 previously-litigated accounts from a major, national creditor. The outcome from Paymetrix RE is compared to the expected results of a random-sample, where litigating 30% of the accounts would yield 30% of the profits:

As you can see, Paymetrix RE returns 42% of the profits compared to the benchmark, a lift of 12 points, or 40% more profit.

But let’s take a closer look to provide more context.

With the 50,000 accounts mentioned in the case study above, the FIRST PASS for RDS was to assign a “profitability index” using Paymetrix PI. Accounts with a high profitability index were recommended for legal collections. Notably, the bulk of these high PI accounts were in states with reasonable court costs, such as Maryland and Virginia.

RDS then laid in Paymetrix RE and was able to reveal high profit gems that PI alone could not identify. For example, an account in Texas had an outstanding balance of $40,000, and an extremely low profitability index of .9. So, suing to collect would not make sense because of the state’s high legal costs. But by running Paymetrix RE, RDS discovered the same account owned a property with an RE score of 3.2 (twice the national RE average of 1.6). Thus, RE dramatically changed the equation with regard to a suit decision on this account.

Paymetrix RE provides a fast and cost-efficient way to score the quality of homes. Because consumers living in higher quality homes are, on average, more likely to pay, RE allows banks and creditors to better prioritize their account decisions.

To learn more about Paymetrix RE, or the entire suite of Paymetrix products, contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261