If you are a financial institution that offers credit in any form, it’s likely that you face one or both of the following challenges:

- You do not have your own LEGAL NETWORK or are too small to maintain a legal network. Or, perhaps you have a legal network but are unhappy with their performance.

- You have DORMANT JUDGMENTS piling up, but do not have a strategy (or the necessary resources) to turn those judgments into paying accounts.

If you find yourself nodding in agreement to these challenges, it’s possible that you could benefit from working with a “master servicing specialist” such as Recovery Decision Science (RDS).

With nearly four decades of experience in the debt recovery industry, RDS offers customizable, full-service solutions to help creditors to manage, and maximize the return on their accounts receivable. RDS harnesses the power of data science to optimize recoveries on distressed portfolios by providing transparent servicing solutions from pre-charge off to post-judgment execution.

BUILT ON ANALYTICS

Applying machine learning to our analytics models has enabled RDS to build products that

“Pinpoint accounts with the highest propensity to pay and predict how much they will be able to pay.”

Our mix of analytical tools enables our clients to prioritize these accounts, saving them from wasting valuable resources by diverting time and money from unproductive accounts and refocusing those efforts on accounts with the highest potential yield. These tools provide solutions such as:

- Predictive analytics

- Account segmentation

- Suit-decisioning scores

- Leveraging real estate to prioritize decisions

- Risk mitigation

- (Previously undiscovered) Asset identification

ACCOUNT DECISIONING CASE STUDY

One of RDS’s proprietary analytics tools is Paymetrix AD/AD+. Paymetrix AD and AD+ are sophisticated account-decisioning tools using RDS proprietary models built to accurately pinpoint the right accounts to litigate based on a number of input variables.

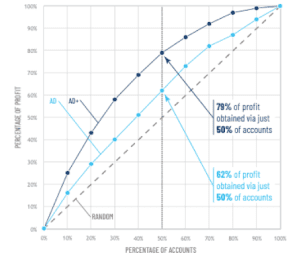

The illustration below utilized a sample of 50,000 previously-litigated accounts. The outcomes were compared to the expected results of a random sample where litigating 50% of the total accounts should yield 50% of the total profit. The comparison showed:

- Major lift in profitability compared to random selection with both models

- AD resulted in 62% of the profit via 50% of the accounts for a lift of 12%

- AD+ resulted in 79% of the profit via 50% of the accounts for a lift of 29%

THE RDS DIFFERENCE

RDS brings the next generation of account servicing. As a master servicer, we provide you with complete transparency through the entire life cycle of the account. Our end-to-end service offerings include:

- Customizable servicing solutions

- Turn-key national attorney and collection agency network

- Account segmentation

- Activation of dormant judgments

- Dispute and complaint management

- Bankruptcy and probate solutions

- Debt settlement solutions

- Live data updates through proprietary electronic data interchange

- Integrated reporting capabilities

- Consumer portal and payment process joint-venture partnerships.

To learn more about Recovery Decision Science’s Master Servicing capabilities, contact:

Kacey Rask : Vice-President, Portfolio Servicing

[email protected] / 513.489.8877, ext. 261

Error: Contact form not found.