In general, the cost of higher education has outpaced inflation for more than two decades. Aggregate enrollment grew between 2000-2010, despite higher college costs. Enrollment since 2010 has leveled off and even dropped in recent years. Yet, costs have continued to rise.

With rising costs comes an increased dependence on student debt for college financing-most of which comes through Federal and private loans.

In this post, the 3rd in a 5-part series covering the Federal Reserves analysis of Heterogeneity in America, we take a deep dive into the heterogeneity of college-going, as well as its relationship to student debt and default experiences by college type across individuals living in majority Black, majority Hispanic and majority White zip codes.

The Fed report covered three areas, as summarized in the sections below:

COLLEGE ATTENDANCE

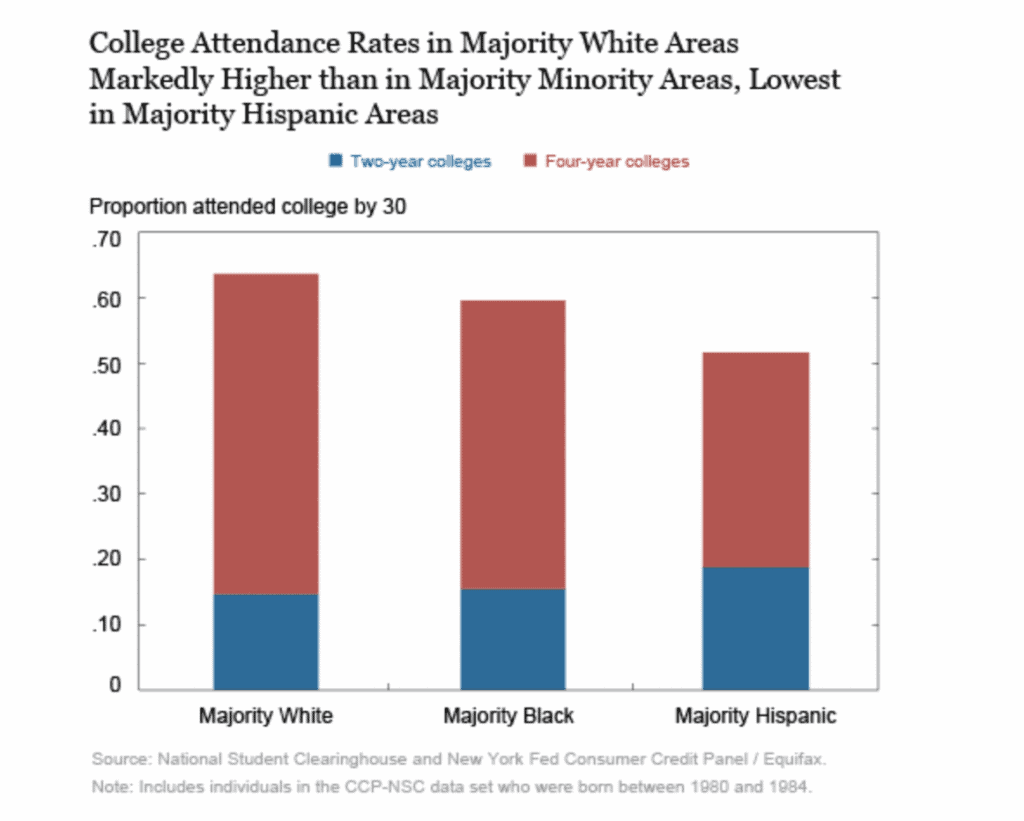

The study found dramatic differences in college attendance across the three demographic groups mentioned above.

- Individuals in majority White zip codes have the highest college attendance, followed by those in majority Black zips.

- Individuals in majority Hispanic zip codes have the lowest attendance rates among the three categories.

- In majority White areas, 64 percent of 30-year-olds with a credit report history had attended some sort of post-secondary education.

- Majority Black and majority Hispanic areas trailed majority White areas in four-year college attendance.

- Individuals in majority Hispanic zip code areas attended two-year colleges at a slightly higher rate.

- Individuals in majority Black areas are 15 percent more likely to attend a four-year college than those in majority Hispanic areas.

BORROWING

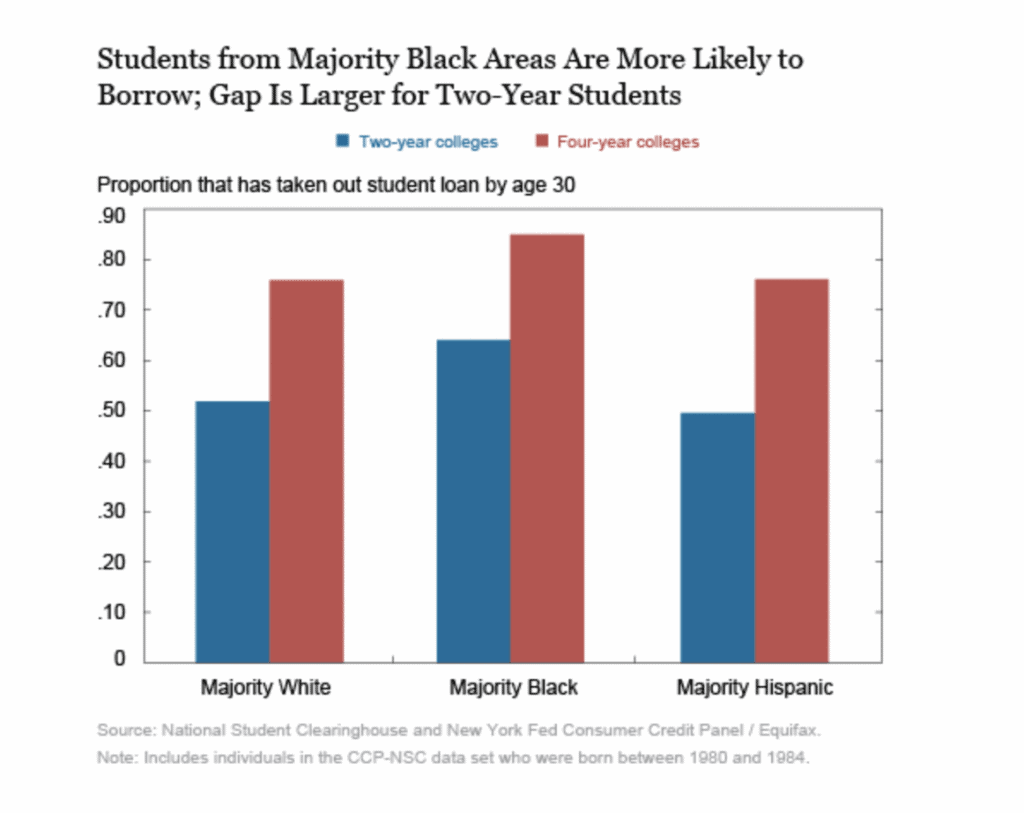

As detailed in the chart below, there is considerable variation in loan behavior by race and ethnicity:

- Individuals who attend college and live in majority Black neighborhoods are more likely to borrow than those in majority White or Hispanic areas.

- Four-year attendees in majority Black areas were 9 percent more likely to have a student loan than students in White or Hispanic areas.

- Majority White and Hispanic students share a propensity to hold student debt, with two-year attendees in majority Hispanic areas borrowing at a slightly lower rate.

STUDENT DEBT DEFAULTS

The final area of the Fed’s analysis centered on student loan defaults.

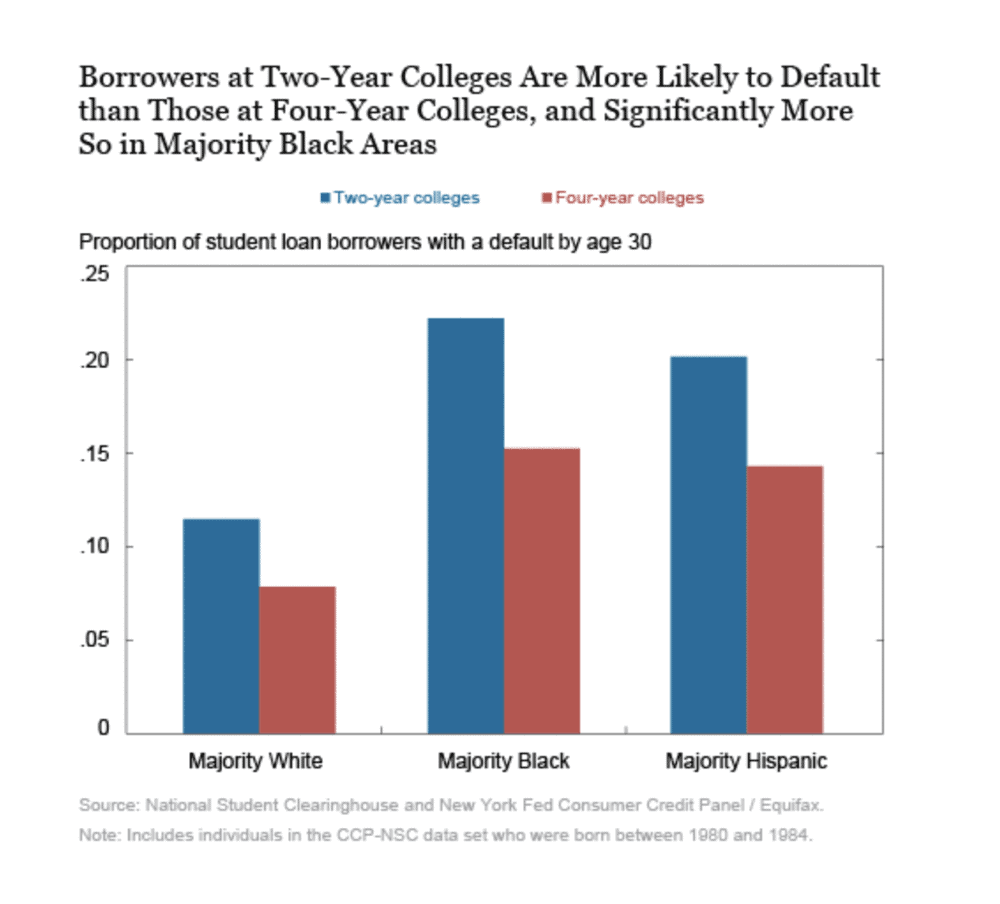

As we see from the chart below:

- Borrowers who attend two-year colleges have uniformly higher default rates by age 30.

- Two-year attendees are less likely to borrow, but the nature of loans to two-year students tends to be riskier.

- Borrowers who attended two-year schools are roughly 50 percent more likely to default than their four-year counterparts, regardless of race or ethnicity.

- Borrowers in majority Black or Hispanic areas are much more likely to default on student loans.

- The default rate for two-year attendees who are from majority Black or Hispanic areas are dramatically higher than their counterparts in majority White areas:

- Majority black zip codes: 1.9 times higher than majority white zips.

- Majority Hispanic zip codes: 1.7 times higher than majority white zips.

This study reveals the stark disparities by race and ethnicity when it comes to attending and paying for college. In next week’s post, we’ll continue the college theme, looking at the role tuition subsidies play in increasing spending and reducing debt.

SOURCE

Rajashri Chakrabarti, William Nober, and Wilbert van der Klaauw, “Measuring Racial Disparities in Higher Education and Student Debt Outcomes,” Federal Reserve Bank of New York Liberty Street Economics, July 8, 2020, https://libertystreeteconomics.newyorkfed.org/2020/07/measuring-racial-disparities-in-higher-education-and-student-debt-outcomes.html.